UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

FORM 10-K/A (Amendment No. 1) |

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-35198

|

|

Pandora Media, Inc. (Exact name of registrant as specified in its charter) |

|

| |

Delaware | 94-3352630 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

2101 Webster Street, Suite 1650 Oakland, CA | 94612 |

(Address of principal executive offices) | (Zip Code) |

|

|

(510) 451-4100 (Registrant’s telephone number, including area code) |

Securities registered pursuant to section 12(g) of the Act:

|

| |

Title of each class | Name of each exchange on which registered |

Common stock, $0.0001 par value | The New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by a check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one): |

| |

Large accelerated filer x | Accelerated filer o |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

| Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the voting common stock held by non-affiliates of the registrant as of June 30, 2016 (the last business day of the registrant's most recently completed second quarter), based on the closing price of such stock on The New York Stock Exchange on such date was approximately $2,088 million. This calculation excludes the shares of common stock held by executive officers, directors and stockholders whose ownership exceeds 5% outstanding at June 30, 2016. This calculation does not reflect a determination that such persons are affiliates for any other purposes.

On April 24, 2017, the registrant had 240,342,380 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents (or parts thereof) are incorporated by reference into the following parts of this Form 10-K: None.

EXPLANATORY NOTE

This Amendment No. 1 to Form 10-K (this "Amendment") amends the Annual Report on Form 10-K for the fiscal year ended December 31, 2016 originally filed with the Securities and Exchange Commission (the "SEC") on February 16, 2017 (the "Original Filing") by Pandora Media, Inc., a Delaware corporation. As used herein, "Pandora," the "Company," "we," "our," and similar terms refer to Pandora Media, Inc. and, where appropriate, its wholly owned subsidiaries, unless the context indicates otherwise. We are filing this Amendment to present the information required by Part III of Form 10-K because we will not file our definitive proxy statement within 120 days of the end of our fiscal year ended December 31, 2016. In particular, this Amendment amends the cover page, Items 10 through 14 of Part III and the Exhibit Index of the Original Filing and includes certifications as required by Section 302 of the Sarbanes-Oxley Act of 2002, as amended, as exhibits in accordance with Rule 13a-14(a) under the Securities Exchange Act of 1934, as amended.

Except as described above, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and we have not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the filing of the Original Filing. Accordingly, this Amendment should be read in conjunction with the Original Filing and our other filings with the SEC.

Pandora Media, Inc.

Form 10-K

Table of Contents

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

DIRECTORS

Set forth below is each director’s name and age and his or her principal occupation, business history and public company directorships held during the past five years.

Roger Faxon, age 68, has served on our board of directors since June 2015. Since 2012, Mr. Faxon has been owner and chief executive of A&R Investments, an investment and consulting firm focused on the media and communications industries. Mr. Faxon also currently serves on the board of ITV plc, where he is a member of its nomination committee. Previously, from 1994 to 2012, Mr. Faxon held various positions at the EMI Group, a music recording and publishing company, including chief executive officer of the music publishing division and most recently as chief executive officer. From 1991 to 1994 he served as the managing director of Sotheby’s Europe, the art auction house. Mr. Faxon holds a Bachelor of Arts degree from The Johns Hopkins University, where he currently serves on its board of directors. We believe Mr. Faxon is qualified to serve on the board of directors due to his operational experience in the music industry.

James M. P. Feuille, age 59, has served on our board of directors since October 2005. Mr. Feuille currently serves as a general partner with Crosslink Capital, an investment and venture capital management company, where he focuses on investments in digital media, internet services, and software and business services. Mr. Feuille has been affiliated with Crosslink Capital since November 2002 and has been a general partner since January 2005. Prior to joining Crosslink Capital, Mr. Feuille served as the global head of technology investment banking at UBS Warburg, a business group of a global financial services firm, chief operating officer at Volpe Brown Whelan & Company, and head of technology investment banking at Robertson Stephens & Company. Mr. Feuille currently serves on the boards of directors of a number of privately-held companies. Mr. Feuille holds a Bachelor of Arts degree in Chemistry from Dartmouth College and a Juris Doctor degree and a Master of Business Administration degree from Stanford University. We believe that Mr. Feuille is qualified to serve on our board of directors due to his experience with the venture capital industry and a wide variety of internet and technology companies, as well as the perspective he brings as an affiliate of one of our major stockholders.

Peter Gotcher, age 57, has served on our board of directors since September 2005. Mr. Gotcher is an independent private investor focusing on investments in digital media technology companies. Mr. Gotcher was a venture partner with Redpoint Ventures, a private investment firm from September 1999 to June 2002. Prior to that, Mr. Gotcher was a venture partner with Institutional Venture Partners, a private investment firm, from 1997 to September 1999. Mr. Gotcher founded Digidesign, a manufacturer of digital audio workstations, and served as its president, chief executive officer and chairman of the board of directors of from 1984 to 1995. Digidesign was acquired by Avid Technology, a media software company, in 1995 and Mr. Gotcher served as the general manager of Digidesign and executive vice president of Avid Technology from January 1995 to May 1996. Mr. Gotcher currently serves as chairman of the board of directors of Dolby Laboratories and serves on the board of directors of GoPro, Inc. Mr. Gotcher holds a Bachelor of Arts degree in English Literature from the University of California, Berkeley. We believe that Mr. Gotcher should serve on our board of directors due to his broad understanding of the operational, financial and strategic issues facing public companies and his background providing guidance and counsel to companies in the digital media industry.

Timothy Leiweke, age 60, has served on our board of directors since April 2015. Mr. Leiweke currently serves as the chief executive officer of Oak View Group, a Los Angeles-based entertainment advisory, development and investment company. From 2013 to 2015, Mr. Leiweke served as the president and chief executive officer of Maple Leaf Sports & Entertainment, a professional sports and commercial real estate company, which is the parent company of the Toronto Maple Leafs, Toronto Raptors, Toronto FC and the Toronto Marlies. From 1996 to 2013, he was the president and chief executive officer of Anschutz Entertainment Group (AEG), a sporting and music entertainment presenter. From 1995 to 1996, he served as president and CEO for U.S. Skiing, the nation governing body for Olympic skiing. Prior to that, he served as president of the Denver Nuggets, a professional basketball team, from 1991 to 1995. Mr. Leiweke holds an honorary doctorate from California State University. We believe Mr. Leiweke is qualified to serve on our board of directors due to his vast experience and background in the entertainment and events industry.

Elizabeth A. Nelson, age 56, has served on our board of directors since July 2013. Ms. Nelson currently serves on the board of Nokia Corporation, a global networking company, Zendesk Inc., a leading software platform for customer service, and various private companies. Ms. Nelson currently serves as lead independent director at Zendesk, and chairs the audit committees at Nokia and Zendesk. From 1996 through 2006, Ms. Nelson served as the executive vice president and chief financial officer at Macromedia, Inc., where she also served as a director from January to December 2005. Prior to joining Macromedia, Ms. Nelson held various roles in finance and corporate development at Hewlett-Packard Company, an information technology company. Ms. Nelson’s prior public company board service includes serving as a director of Ancestry.com, an online family history company, from 2009 to 2012, of Autodesk, Inc., a design software company, from 2007 to 2010, of Brightcove, Inc., a cloud-based video company, from 2011 to 2014, of CNET Networks, Inc., an Internet media company, from 2003 to 2008, and of SuccessFactors, Inc., a provider of human resources solutions, from 2007 to 2012. Ms. Nelson holds a Master of Business Administration degree in Finance with distinction from the Wharton School at the University of Pennsylvania and a Bachelor of Science degree from Georgetown University. We believe that Ms. Nelson is qualified to serve on our board of directors due to her broad operating and management experience in the technology industry, and her service on the boards of directors of a range of technology, internet and mobile companies.

Mickie Rosen, age 49, has served on our board of directors since September 2015. Since October 2013, Ms. Rosen has been advising Fortune 100 companies and growth and early stage startups regarding strategy and operations. From 2011 to 2013, Ms. Rosen held various positions at Yahoo!, most recently as SVP of global media & commerce, where she led the media division globally, overseeing product, design, engineering, editorial, business development, partnerships, and marketing solutions. From 2008 to 2011, Ms. Rosen was a partner with digital media venture capital firm, Fuse Capital, where she also co-founded and incubated Tecca, a service helping consumers navigate personal technologies. From 2006 to 2008, she was the SVP and GM of Entertainment for Fox Interactive Media and from 2002 to 2006, Ms. Rosen was the head of product development, marketing, and PR for Fandango. Ms. Rosen has also held executive roles with Quisic, an e-learning start-up, and The Walt Disney Company's Corporate Alliances group and, prior to those roles, was a consultant for McKinsey & Company. Ms. Rosen holds a Bachelors of Arts degree in Economics from the University of California at San Diego and a Master in Business Administration degree from Harvard Business School. We believe that Ms. Rosen is qualified to serve on our board of directors due to her strategic and operational expertise in the fields of media and consumer technology.

Anthony Vinciquerra, age 62, has served on our board of directors since March 2016. Mr. Vinciquerra is senior advisor to Texas Pacific Group (TPG) in the technology, media and telecom sectors and advises TPG on acquisitions and operations across its investing arenas. Mr. Vinciquerra also currently serves on the board of Qualcomm, Inc., where he is a member of its audit committee. Mr. Vinciquerra was the chairman of Fox Networks Group, a media and broadcast television company, from 2008 to 2011 and previous served as its president and chief executive officer from 2002 to 2008. While at Fox, Mr. Vinciquerra managed all operations and strategy matters for a number of broadcast and internet properties, including Fox Television Network, Fox Cable Networks, Fox Sports and Fox International Channels. Mr. Vinciquerra also oversaw concert venues, large scale arenas and professional baseball, basketball and hockey teams in which News Corporation, the parent of Fox Networks Group, held an ownership interest. Prior to working at Fox, Mr. Vinciquerra served as the executive vice president and chief operating officer at Hearst-Argyle Television, a position he held since 1998. Mr. Vinciquerra has also held positions at CBS, KYW-TV in Philadelphia and WBZ-TV in Boston. Mr. Vinciquerra served on the boards of DIRECTV from 2013 until 2015, Motorola Mobility Holdings, Inc. from 2011 to 2012, and Motorola, Inc. from 2007 to 2011. Mr. Vinciquerra holds a Bachelor of Arts degree in Marketing from the State University of New York. We believe that Mr. Vinciquerra is qualified to serve on our board of directors due to his extensive management and operational experience, as well as his knowledge of the media and technology sectors.

Tim Westergren, age 51, is one of our founders and has served as our chief executive officer since March 2016. Mr. Westergren previously served as our chief creative officer and treasurer from February 2000 to May 2002, as our chief executive officer and president from May 2002 to July 2004, and as our chief strategy officer from July 2004 to February 2014. He has served as a member of our board of directors from the company’s inception. Prior to founding Pandora, Mr. Westergren worked as an independent musician, composer and record producer and has over 20 years of experience in the music industry. Mr. Westergren holds a Bachelor of Arts degree from Stanford University, where he studied computer acoustics and recording technology. We believe that Mr. Westergren is qualified to serve on our board of directors based on his historic knowledge of our company as one of our founders and our chief executive officer, the continuity he provides on our board of directors, his strategic vision for Pandora and his background in technology and music.

EXECUTIVE OFFICERS

Our executive officers and their ages and positions are as follows:

|

| | | | |

Name | | Age | | Position |

| | | | |

Tim Westergren | | 51 | | Chief Executive Officer and Director |

Nicholas Bartle | | 49 | | Chief Marketing Officer |

Stephen Bené | | 53 | | General Counsel and Corporate Secretary |

Naveen Chopra | | 43 | | Chief Financial Officer |

David Gerbitz | | 46 | | Executive Vice President, Revenue Operations |

Michael Herring | | 48 | | President and Chief Financial Officer |

Christopher Martin | | 44 | | Chief Technology Officer |

Christopher Phillips | | 42 | | Chief Product Officer |

Kristen Robinson | | 54 | | Chief Human Resources Officer |

John Trimble | | 53 | | Chief Revenue Officer |

Tim Westergren. See "Directors", above.

Nicholas Bartle has served as our chief marketing officer since October 2016. Mr. Bartle served as vice president of member marketing and communications at LinkedIn Corporation from September 2015 to September 2016. Prior to that, Mr. Bartle served as senior director of marketing communications for Apple Inc. from January 2011 to June 2015. Earlier in his career, Mr. Bartle held senior roles at BBDO, a worldwide advertising agency network, and Goodby, Silverstein & Partners, an advertising agency.

Stephen Bené has served as our general counsel and corporate secretary since October 2014. Mr. Bené served as senior vice president, general counsel and corporate secretary at Electronic Arts Inc., a video game developer and publisher, from October 2004 to June 2014. Prior to that, Mr. Bené was a staff attorney at Electronic Arts and an associate at the law firm of Fenwick & West LLP. Mr. Bené currently serves on the board of directors of menuMe, Inc., a restaurant menu application and website. Mr. Bené holds a Juris Doctor from Stanford Law School and a Bachelor of Science degree in Mechanical Engineering from Rice University.

Naveen Chopra has served as our chief financial officer since February 2017. Mr. Chopra served as the interim chief executive officer and chief financial officer at TiVo, Inc., the company that invented the digital video recorder, from January 2016 until TiVo was acquired by Rovi Corporation in September 2016. From 2012 to 2016, Mr. Chopra served as chief financial officer and senior vice president, corporate development and strategy at TiVo, where he was responsible for overseeing TiVo’s accounting and financial reporting, planning, tax, treasury, mergers and acquisitions, business development, and strategy functions. Mr. Chopra joined TiVo in 2003 as director, business development, and later served as vice president, business development, before being promoted to senior vice president, corporate development and strategy. Since July 2014, Mr. Chopra has served on the board of directors of Vonage Holdings Corp., where he is a member of its audit committee and compensation committee. He holds bachelor degrees in computer science and economics from Stanford University and an M.B.A. from the Stanford Graduate School of Business.

David Gerbitz has served as our executive vice president, revenue operations since July 2014 and became an executive officer in January 2016. From 2013 to 2014, Mr. Gerbitz was the vice president of global mid-market and small medium business sales at Yahoo!, a digital media and advertising company. Prior to that, Mr. Gerbitz served as vice president of client service operations and account management in North America at Yahoo! from 2011 to 2013. Mr. Gerbitz has also held a variety of leadership positions at Microsoft and Amazon.com. Mr. Gerbitz holds a Bachelor of Arts degree in Organization Communications from the University of Minnesota.

Michael Herring has served as our president since March 2016. He previously served as our chief financial officer from February 2013 to February 2017. Prior to joining Pandora, Mr. Herring served as the vice president of operations at Adobe Systems Incorporated, a provider of digital marketing and digital media solutions, from 2009 to 2013. Mr. Herring served as the chief financial officer and executive vice president of Omniture, Inc., a provider of online business optimization software, from 2004 to 2009. Prior to Omniture, Mr. Herring served as the chief financial officer of MyFamily.com (now Ancestry.com), having joined the company through the acquisition of Third Age Media in 2000. At Third Age Media, Mr. Herring served as vice president of finance. Prior to Third Age Media, he served as controller of Anergen Inc. Mr. Herring currently serves on the board of Fluid, Inc., a software company. Mr. Herring holds a Bachelor of Arts degree in Economics and Political Science from the University of California at Los Angeles.

Christopher Martin has served as our chief technology officer since March 2014 and became an executive officer in January 2016. Mr. Martin joined Pandora in late 2004 just before the company began to transition the business into redefining radio. From 2009 to 2014, Mr. Martin served as VP of engineering. From 2004 to 2009, he held the position of director of software engineering. Prior to joining Pandora, Mr. Martin worked in various engineering capacities at multiple enterprise software companies, including Quintus, Kenamea and QRS/Inovis. Mr. Martin holds a Bachelor degree in Mathematics from the University of California, Berkeley.

Christopher Phillips has served as our chief product officer since October 2014. Prior to that, from January 2012 to October 2014, Mr. Phillips was director of product management and user experience for Amazon Digital Music at Amazon. From April 2004 to December 2011, Mr. Phillips served as director of Apple QuickBooks product management, marketing and user experience for Intuit. Mr. Phillips holds a Bachelor of Science, Business Administration degree from The Ohio State University, Max M. Fisher College of Business.

Kristen Robinson has served as our chief human resources officer since March 2014 and became an executive officer in January 2016. From 2010 to 2013, Ms. Robinson was the SVP global human resources at Yahoo!, where she led the company's global HR centers of excellence and international HR teams. Prior to that, Ms. Robinson held various positions at Hewlett-Packard, Agilent Technologies, and served as the chief HR officer of Verigy. Ms. Robinson holds an MBA from Northwestern University's Kellogg School of Management and a Bachelor of Science degree in Accounting from Boston College.

John Trimble has served as our chief revenue officer since March 2009. Prior to joining us, Mr. Trimble was the executive vice president of sales at Glam Media, a media company, from 2007 to 2009. From 2002 to 2007, Mr. Trimble served as senior vice president of advertising sales for Fox Interactive Media, a provider of internet media management and content broadcasting services. Prior to that, Mr. Trimble also served as director of sales for the Sports Illustrated website, SI.com, and as vice president of sales for Phase2 Media, a men’s vertical advertising network. Mr. Trimble holds a Bachelor of Arts degree in Political Science from St. Lawrence University.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") requires our executive officers and directors and persons who beneficially own more than ten percent of our common stock to file with the SEC initial reports of beneficial ownership and reports of changes in beneficial ownership of common stock. Executive officers, directors and ten percent stockholders are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. As a matter of practice, we generally assist our executive officers and certain directors in preparing initial ownership reports and reporting ownership changes and we typically file these reports on their behalf. Based solely on our review of copies of any Section 16(a) forms received by us or written representations that no other reports were required, we determined that no executive officers, director or beneficial owner of more than ten percent of our common stock failed to file a report on a timely basis during the year ended December 31, 2016, except for a late Form 4 filed by James Feuille to report an award of RSUs dated June 6, 2016.

Code of Business Conduct and Ethics

Our board of directors has adopted a Code of Business Conduct and Ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. The Code of Business Conduct and Ethics is available on our Investor Relations website (http://investor.pandora.com) in the "Corporate Governance" section. We expect that any amendments to the code, or any waivers of its requirements, will be disclosed on our website.

Audit Committee

Our board of directors currently has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. Under our corporate governance guidelines, audit committee members are appointed by the board of directors based on the recommendation of the nominating and corporate governance committee. The audit committee currently consists of Mr. Faxon, Mr. Feuille and Ms. Nelson with Ms. Nelson serving as the committee’s chairperson. Our board of directors has determined that each member of the committee is "independent" as defined under the NYSE listing standards, Rule 10A-3(b)(1) of the Exchange Act and our corporate governance guidelines, and that each member of the audit committee meets the requirements for financial literacy under the applicable rules and regulations of the SEC and the NYSE. Our board of directors has determined that each member of the committee is an audit committee "financial expert," as that term is defined by the applicable rules of the SEC. The audit committee held five meetings during the year ended December 31, 2016. A detailed list of the audit committee’s functions is included in its charter which is available on our Investor Relations website (http://investor.pandora.com) in the "Corporate Governance" section.

ITEM 11. EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis provides information about our compensation philosophy, the processes that the compensation committee of the board of directors (the "Committee") uses to set executive compensation, and the significant components of our executive compensation packages for each of our CEO, CFO and other "named executive officers" or "NEOs". Our 2016 NEOs are:

|

| | |

Name | | 2016 Title |

| | |

Tim Westergren | | Chief Executive Officer |

Michael Herring | | President and Chief Financial Officer |

David Gerbitz | | Executive Vice President, Revenue Operations |

Chris Phillips | | Chief Product Officer |

John Trimble | | Chief Revenue Officer |

Brian McAndrews | | Former Chief Executive Officer |

Sara Clemens | | Former Chief Operating Officer |

On March 25, 2016, Mr. McAndrews stepped down as chief executive officer and our board of directors named Tim Westergren as his successor. Also on March 25, 2016, Ms. Clemens was promoted from chief strategy officer to chief operating officer and Mr. Herring, our chief financial officer, took on the additional role of president.

On December 16, 2016, Ms. Clemens resigned as chief operating officer, but remained employed by the Company for a transition period that ended on February 1, 2017. On February 28, 2017, Mr. Herring stepped down as chief financial officer upon the hiring of his successor and continues to serve as president. He served as our principal financial officer for all of 2016.

Section 1 – Summary and Highlights

Business Summary and Financial Highlights

In 2016, we launched Pandora Plus, unveiled Pandora Premium, and continued to grow our ad-supported business. We currently provide the Pandora service through three models:

| |

• | Ad-Supported Service. Our ad-supported Pandora service allows listeners to access our music and comedy catalogs and personalized playlist generating system for free across all of our delivery platforms. Listeners can obtain more features, such as skips and the ability to replay tracks, by watching an advertisement. |

| |

• | Subscription Service—Pandora Plus. Pandora Plus is a paid, ad-free subscription version of the Pandora service that includes replays, additional skipping, offline listening, higher quality audio on supported devices and longer timeout-free listening. |

| |

• | Subscription Service—Pandora Premium. Our on-demand subscription service, Pandora Premium, launched to select listeners on March 15, 2017, with general availability in the United States on April 18, 2017. Pandora Premium is a paid, ad-free version of the Pandora service that offers a unique, on-demand experience, providing users with the ability to search, play and collect songs and albums, build playlists on their own or with the tap of a button and automatically generates playlists based on the user’s listening activity. The features of Pandora Plus are also included in Pandora Premium. |

A few of our 2016 financial highlights include:

| |

• | For 2016, total revenue was $1.38 billion, a 19% year-over-year increase on a GAAP basis; |

| |

• | Advertising revenue was $1.07 billion, a 15% year-over-year increase; and |

| |

• | Total listener hours grew 4% to 21.96 billion for the full year. |

We also executed on important strategic business initiatives, including:

| |

• | The signing of direct license agreements with major and independent labels, publishers and composers that allow us to provide the new and improved products described above. |

| |

• | The integration of personalized concert notifications within Pandora's apps for iOS and Android, along with easy access to ticket purchasing. |

| |

• | The launch of the next generation of our Artist Marketing Platform, a powerful evolution of Pandora’s unique suite of marketing tools that includes Artist Audio Messages, Featured Tracks and AMPcast. The redesigned platform makes it easier and faster for artists to grow an audience, track progress and connect with fans on Pandora. |

| |

• | The partnership with Questlove to premiere Questlove Supreme, a three-hour show curated and produced by the four-time Grammy winner. The show is a weekly ride through the global musical landscape featuring adventurous music selections, compelling conversations and revealing interviews with music lovers from the entertainment industry and beyond. |

Compensation Program Highlights and Philosophy

Pandora is the world's most powerful music discovery platform, offering a personalized experience for each of our listeners wherever and whenever they want to listen to music—whether through earbuds, car speakers or live on stage. Our vision is to be the definitive source of music discovery and enjoyment for billions. In order to execute on this ambitious vision, we must hire people who are smart, self-motivated and passionate about the work they do at Pandora. As a technology and media company headquartered in the San Francisco Bay Area, with offices across the U.S. in markets such as New York, Chicago, Dallas and Los Angeles, we compete in vibrant and extremely competitive talent markets for the best talent with large, established companies, and with high-potential start-ups. While this challenging talent market continues to be a factor that influences our compensation-related decisions, it is only one of many factors that our Committee considers.

Our Committee follows a philosophy and process in making its compensation decisions. The Committee has designed our compensation program for all Pandora employees, including our NEOs, to support three main goals:

| |

• | Attract highly sought-after talent in competitive markets; |

| |

• | Pay for performance; and |

| |

• | Align employee and stockholder interests. |

These are foundational elements of how we think about compensation at Pandora. We put the pay-for-performance philosophy into practice by tying a portion of compensation for Pandora employees at all levels to company performance. With our most senior executives, more than a half of their overall target pay is variable and tied to performance—both operational and stock price performance—reflecting their heightened ability to directly impact performance in the near- and long-term.

The compensation program for our executives is made up of three primary components: base salary, variable cash incentives based on annual performance goals, and long-term equity incentives. The details of these components of pay are explained below in "Section 3—Elements of Pay".

Key 2016 Compensation Decisions

Our Committee made important compensation decisions in 2016 to further our commitment to our pay-for-performance strategy and to build long-term stockholder value:

| |

• | In an effort to further link pay and performance, we increased the percentage of performance-based equity granted to our NEOs from 40% of total equity granted in 2015 to 50% of total equity granted during 2016, and created a new kind of Performance Award linked to a $20 stock price target. We also increased the value of the equity grants we made to our NEOs in 2016 relative to 2015 in order to encourage executive stability during our CEO transition. |

| |

◦ | In 2016, our equity grants to NEOs include Performance Awards consisting of stock-settled performance-based RSUs ("PSUs") that vest based on Pandora’s stock price performance during a four-year performance period. Specifically, the PSUs only vest when the 90-day trailing average of Pandora’s |

stock price equals or exceeds $20 on a given vesting date. Our current CEO and our other NEOs (excluding our former CEO) received equity grants with a 1:1 ratio of PSUs to time-based RSUs. The details of these PSUs are explained below in "Section 3—Elements of Pay—Long-term Equity Incentives".

| |

◦ | The first potential vesting date for the 2016 Performance Awards occurred on February 15, 2017. The 90-day trailing average of Pandora’s stock price was below $20 as of such date, which resulted in our NEOs receiving no shares under the 2016 Performance Award at this vesting date. |

| |

• | Our Committee modified our equity granting practices by setting an overall equity budget that takes into account our growth and expansion efforts. |

| |

◦ | Based on extensive data-gathering and analysis, the Committee revised the equity guidelines (both new-hire and annual grant guidelines) for all employees to refine its approach to considering stock price fluctuations, expected usage and compensation practices. |

2016 Target and Realizable Compensation

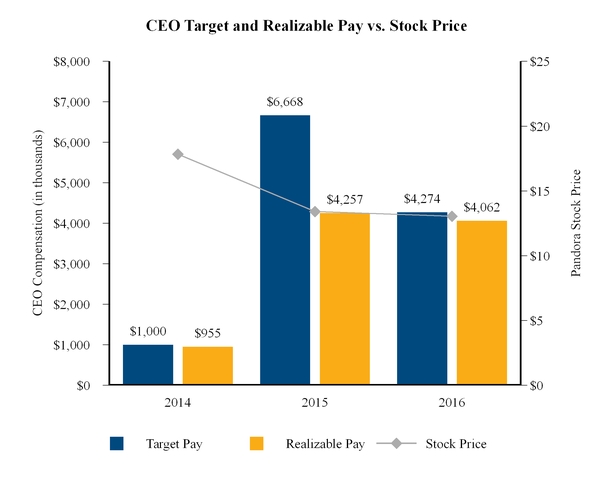

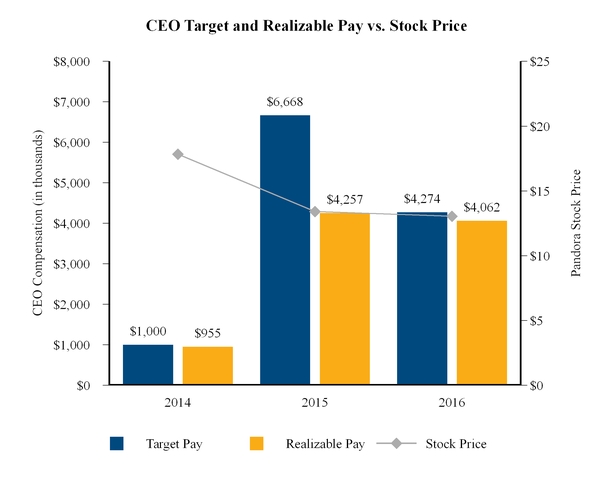

The amount of realizable compensation for our NEOs varies significantly based on overall Pandora performance. As of December 31, 2016, our CEO’s aggregate 2014, 2015 and 2016 "Realizable Pay" is approximately 78% of the reported "Target Pay". For each of 2014 and 2015, the chart below refers to the full-year compensation of our former CEO, Brian McAndrews. For 2016, the full-year compensation is that of our current CEO, Tim Westergren.

Target Pay – consists of base salary, target cash bonus amount and the "fair value" at grant of equity awards (i.e., Black-Scholes for stock options, the closing price of our common stock on the date of the grant for RSUs, or a Monte Carlo simulation model for 2015 MSUs and 2016 Performance Awards), excluding other compensation paid.

Realizable Pay – consists of base salary, actual bonus paid and the "in-the-money" value of all outstanding equity awards granted during the year using the closing price of our common stock on December 31, 2016 ($13.04), excluding other compensation paid. Realizable Pay includes the value of both the vested and unvested portions of all outstanding equity awards. Unvested 2015 MSUs are valued as if all performance periods concluded on December 31, 2016, with our relative TSR performance measured as of such date. Because the relative TSR performance was 0% for the period, no value was assigned to the 2015 MSUs. Unvested 2016 Performance Awards are valued as if all performance periods concluded on December 31, 2016, with the 90-day trailing average of Pandora’s stock price measured as of such date. Because the 90-day trailing average did not equal or exceed $20, no value was assigned to the 2016 Performance Awards.

Stock Price – reflects the change in the value of Pandora common stock from December 31, 2014 ($17.83) to December 31, 2016 ($13.04).

Components of Target Pay and Realizable Pay

This table outlines key details of each incentive compensation component that contributed to the CEO’s Target Pay and Realizable Pay for 2014, 2015 and 2016. For 2014 and 2015, the table below shows the compensation of our former CEO, Brian McAndrews. For 2016, the compensation is that of our current CEO, Tim Westergren.

|

| | | | | | | | | | | | | | | | | | | | | |

Year | | Base Salary

($) | | Target Bonus

($) | | Restricted Stock Units

($) | | 2015 Market Stock Units

($) | | 2016 Performance Awards

($) | | Stock Options

($) | | Total

($) |

2014 Target | | 500,000 |

| | 500,000 |

| (1) | — |

| | — |

| | — |

| | — |

| | 1,000,000 |

|

2014 Realizable | | 500,000 |

| | 455,000 |

| | — |

| | — |

| | — |

| | — |

| | 955,000 |

|

2015 Target | | 545,833 |

| | 550,000 |

| (1) | 4,034,100 |

| | 1,538,519 |

| | — |

| | — |

| | 6,668,452 |

|

2015 Realizable | | 545,833 |

| | 385,550 |

| | 3,325,200 |

| | — |

| (2) | — |

| | — |

| | 4,256,583 |

|

2016 Target | | 486,875 |

| (3) | 375,000 |

| (1) | 2,155,000 |

| | — |

| | 1,257,500 |

| | — |

| | 4,274,375 |

|

2016 Realizable | | 486,875 |

| (3) | 315,000 |

| | 3,260,000 |

| | — |

| | — |

| (4) | — |

| | 4,061,875 |

|

___________________________________________________

| |

(1) | Salary increases for our NEOs are effective as of February 1 each year. Target bonuses for the year are based on a percentage of the new base salary, if any, multiplied by the target bonus percentage. As a result, the base salary amounts presented above differ from the annualized base salaries presented in Section 3—Elements of Pay—Base Salary, and the target bonus amounts may exceed 100% of the base salary amounts presented above. See "Section 3 – Elements of Pay—Variable Cash Incentives" for additional information. |

| |

(2) | The 255,000 MSUs granted to Mr. McAndrews are valued as if all performance periods concluded on December 31, 2016, with our relative TSR performance measured as of such date. The 2015 MSUs had no realizable value as of December 31, 2016 because our relative TSR for the period resulted in a payout at 0% of target. See "Section 3 – Elements of Pay—Long-term Equity Incentives—2015 Market Stock Units" for additional information. |

| |

(3) | The 2016 compensation shown above is the full-year compensation for Mr. Westergren, who became our chief executive officer on March 25, 2016. Mr. McAndrews stepped down effective March 25, 2016, and his prorated compensation for 2016 is shown below in the 2016 Summary Compensation Table. |

| |

(4) | The 250,000 PSUs granted to Mr. Westergren under the 2016 Performance Award are valued as if all performance periods concluded on December 31, 2016, with the 90-day trailing average of Pandora’s stock price measured as of such date. The 2016 Performance Award had no realizable value as of December 31, 2016 because the 90-day trailing average did not equal or exceed $20. Therefore, no value was assigned to the 2016 Performance Awards. |

Base Salary – Intended to compensate our CEO for performing day-to-day responsibilities and to provide a baseline level of market competitiveness.

Target Bonus – Motivates our CEO to achieve corporate financial and non-financial performance objectives during the year. Payouts for 2016 could range from 0% to 200% of target depending on achievement of these objectives, and the actual payout for 2016 was 84% of target.

Equity Awards – During 2016, we granted our current CEO RSUs and Performance Awards, as compared to the mix of RSUs and MSUs granted to our former CEO in 2015. In light of our former CEO's new hire equity awards received in 2013, our former CEO did not receive an equity grant in 2014. Our equity awards vest over multiple years based on continued service or, in the case of Performance Awards and MSUs, continued service and performance, providing an at-risk variable pay opportunity. Because the ultimate value of these awards is directly related to the value of Pandora’s common stock, these rewards help align the long-term financial interests of our CEO with those of our stockholders.

Governance Practices

The Company has adopted corporate governance practices and policies that our board believes help advance our compensation goals, including:

|

| | | | |

WHAT WE DO | | WHAT WE DON'T DO |

| | | | |

| Maintain a completely independent compensation committee. Our Committee consists solely of independent directors who establish our compensation practices. | | | Guarantee salary increases or bonuses. None of our NEOs are guaranteed salary increases or bonuses. Salary increases are evaluated annually and bonuses are based on achievement of revenue and profit targets and other performance metrics that are set by the Committee at the beginning of each fiscal year. |

| | | | |

| Use a pay-for-performance model. Our executive compensation program focuses on corporate results and aligns with stockholder interests by creating highly leveraged plans with a focus on long-term financial and stock-price performance. | | | Permit hedging or short sales. All of our employees, including our board members and our executives, are prohibited from engaging in short sales or transactions in derivative securities, including hedging transactions, without prior approval from the board of directors. |

| | | | |

| Retain an independent compensation consultant. Our Committee retains Compensia, Inc. as its advisor to provide analysis, advice and guidance on executive compensation—independent of management. | | | Permit pledging. All of our employees, including our board members and our executives, are prohibited from pledging their equity as collateral for loans without prior approval from the board of directors. |

| | | | |

| Use performance-based equity aligned with stockholder return. Beginning in 2015, the Committee introduced performance-based equity awards as a component of our annual grants to all of our NEOs. | | | Allow tax gross-ups. We do not provide tax "gross-ups" in our executive severance or change in control policy or as part of any annual compensation practice, other than in connection with standard relocation and parking allowance practices. |

| | | | |

| Maintain a claw-back policy. Our claw-back policy prevents employees from benefiting from erroneously-paid cash incentives that result from their misconduct. It has been in place since 2014. | | | Provide special perquisites. We do not provide special perquisites to our NEOs, other than benefits that are generally available to all of our employees, such as our employee stock purchase plan, 401(k) plan, group health insurance, and short- and long-term disability insurance. See Section 5—Other Compensation for a discussion of security services provided to our CEO, which we do not consider to be a perquisite. |

| | | | |

| Maintain equity ownership guidelines for executives and directors. Since 2014, we have maintained the following stock ownership guidelines for our executives:

• CEO: 300% of annual base salary • All other executives: 100% of annual base salary Since 2013, we have maintained equity ownership guidelines for our board members equal to 300% of their annual retainer. | | | Allow re-pricing of options without stockholder approval. Our commitment to stockholder alignment means that our board is not able to re-price options that may be "under water" without obtaining and receiving stockholder approval. |

Section 2 – Compensation Setting Process

Role of the Compensation Committee

Setting Compensation for Executives other than the CEO

Our Committee has overall responsibility for administering our executive compensation programs. In fulfilling this responsibility, our Committee sets the target total direct compensation opportunities, as well as each individual compensation component, for our executives, including our NEOs (other than the CEO). In making compensation-related decisions, our Committee reviews compensation data for comparable businesses and a select group of "peer" companies, and assesses both our historical performance and forward prospects compared to those companies. As part of its decision-making process, our Committee takes into account our annual and long-term financial and operational performance, our long-term strategic and operational initiatives, the past performance and expected future contributions of our executives, and their individual expertise, skills and experience. Our Committee also solicits the CEO’s views as to the individual performance and potential of the executives that report to him, and his views on the appropriate compensation of those executives. With this information, and the advice of its independent compensation consultant, our Committee uses its own business judgment and experience to set the compensation elements and amounts for all executives, other than the CEO.

Setting Compensation for the CEO

For the CEO, the Committee engages in all of the data gathering and analysis described above, and, as needed, also solicits the views of the senior executive team and members of the board of directors as to the performance and potential of the CEO. With the advice of its independent compensation consultant, the Committee then approves or makes recommendations to the full board as to CEO compensation decisions.

Role of the Independent Compensation Consultant

Our Committee has engaged Compensia, Inc. ("Compensia") as its independent outside compensation consultant. Compensia provides a wide range of compensation advisory services to the Committee including: an annual review of our executive compensation philosophy and peer group; an annual competitive assessment of executive and board of director compensation levels; guidance in considering and implementing new compensation policies and practices; and input on this Compensation Discussion and Analysis.

Compensia works at the direction of, and reports directly to, our Committee. The Committee may replace Compensia or hire additional advisors at any time. A representative of Compensia attends Committee meetings when requested by the Committee. Compensia does not perform any other services for the Company, unless requested by the Committee. Our Committee has reviewed the independence of Compensia and determined that there are no conflicts of interest.

Role of the Chief Executive Officer

As noted above, our CEO provides the Committee with his assessment of the individual performance and potential for each of the executives that report to him. The CEO also makes general recommendations to our Committee regarding base salaries, target annual cash incentive opportunities and long-term incentive compensation for those same executives. While our CEO attends board and Committee meetings where executive compensation practices and philosophies are discussed, he does not participate in any session in which his own compensation is determined.

Competitive Positioning and Our Peer Group

In making compensation decisions in 2016, our Committee reviewed compensation data from 15 comparable companies. The Committee chose this peer group in December 2015 based on an analysis performed by Compensia, using the following selection criteria:

| |

• | Industry: internet, software-as-a service, content-oriented technology companies with an ad-based revenue model; |

| |

• | Revenue range: generally 0.5 to 2 times our revenue; |

| |

• | Market capitalization range: generally 0.25 to 4 times our market capitalization; and |

| |

• | Other growth and business factors, such as: revenue growth, valuation (e.g., market capitalization as a multiple of |

sales), profitability, number of employees, or business model.

Based on these selection criteria, our Committee selected the following companies as our 2016 peer group:

|

| | | | |

ACI Worldwide | | j2 Global | | TripAdvisor |

CoStar Group | | NetSuite | | VeriSign |

Endurance International | | Rackspace Hosting | | Web.com Group |

GoDaddy | | ServiceNow | | WebMD Health |

HomeAway | | Shutterfly | | Yelp |

The Committee believes that these 15 companies provide valuable comparisons, based on the selection criteria, to assist in determining the appropriate compensation for our executives. The Committee analyzes compensation data from these peer group companies on a role-by-role basis for the CEO and each of the executives that report to him and uses that analysis as an input into its compensation setting process.

Section 3 – Elements of Pay

The three primary elements of Pandora’s executive compensation program are base salary, variable cash incentives and long-term equity incentives, as described below:

|

| | | | | | |

Compensation Element | | What the Element Rewards | | Purpose and Key Features | | 2016 Decisions |

| | | | | | |

Base salary | | Recognizes individual performance, level of experience, expected future performance and contributions to Pandora. | | Designed to provide a competitive level of fixed compensation determined by the market value of the position using peer data, and the individual facts and circumstances of each executive’s role. | | Five of our NEOs received salary increases ranging from 8.1% to 15.4% to bring their salaries more in line with the comparable officers at our peer group, and to compensate them for new responsibilities associated with our management reorganization that took place in March 2016. See "Base Salary," below. |

| | | | | | |

Variable cash incentive | | | | | | |

- under our Corporate Incentive Plan | | Achievement of corporate and business-level performance objectives (for 2016, revenue, adjusted EBITDA excluding content costs, and listener hours). | | Motivates participants to achieve corporate financial performance objectives during the year. Payouts for 2016 could range from 0% to 200% of target depending on achievement of these objectives. | | Upward adjustments in target bonus levels for two of our NEOs compared to 2015. Based on performance, the CIP plan paid out at 84% of the target opportunity. |

| | | | | | |

- under a standalone sales compensation plan (CRO only) | | Achievement of business-level performance objectives (for 2016, U.S. ad revenue and advertising RPM). | | Motivates the chief revenue officer to achieve sales performance objectives during the year. Payouts for 2016 could range from 0% to 200% of target depending on achievement of these objectives. | | Adjusted weightings compared to 2015 to more heavily incentivize U.S. ad revenue growth. Reduced maximum payout from 250% to 200%. Based on performance, the plan paid out at 74% of the target opportunity. |

| | | | | | |

Long-term equity incentives | | Alignment with long-term interests of shareholders and achievement of performance objectives designed to enhance long-term stockholder interests and attract, motivate and reward employees over extended periods of time. Multi-year vesting requirements also promote retention. | | We award our NEOs annual grants of RSUs that vest over multiple years and provide an at-risk variable pay opportunity, and annual grants of Performance Awards that only vest if the 90-day trailing average of Pandora’s stock price equals or exceeds $20 on each vesting date. Because the ultimate value of these grants is directly related to the value of Pandora’s common stock, these rewards help align the financial interests of executives with those of stockholders. | | Our CEO and our NEOs (other than our former CEO) each received equity grants with a 1:1 ratio of Performance Awards to time-based RSUs. We increased the value of the equity grants we made to our NEOs in 2016 relative to 2015 in order to encourage executive stability during our CEO transition. The grants are described below in "Long-term Equity Incentives." |

Base Salary

We use base salaries to attract and retain qualified executives. Our Committee sets base salaries for our NEOs based on the scope of responsibilities, skill set, market trends, past performance, experience and a range of competitive data from our peer group on a role-by-role basis. Our Committee reviews base salaries at least annually, to see if any changes are warranted.

| |

• | In 2016, the Committee set the base salary for our new CEO, Mr. Westergren, at $500,000, or 9% lower than the salary for our former CEO and in line with other CEOs in our peer group. |

| |

• | In 2016, the Committee increased the base salary of our CFO, Mr. Herring, by 15% to $450,000 to bring his salary more in line with the CFOs and other executives in our peer group. Part of the increase is attributable to Mr. Herring taking on the additional role of president effective March 25, 2016. |

| |

• | In 2016, the Committee increased the base salaries of our other named executive officers between 8.1% and 14.3%, as shown in the table below, to bring their salaries more in line with the comparable officers at the companies in our peer group. In each of these cases, our Committee independently determined that this amount was appropriate for each candidate considering the scope of responsibilities, experience level and relevant peer group data. |

| |

• | Our former CEO stepped down in March 2016 and did not receive a salary increase in 2016. |

The following table sets forth the base salaries for our NEOs for 2016:

|

| | | | | | | | | |

Name and 2016 Title | | Annual Base Salary for 2015(1)

($) | | Annual Base Salary for 2016(1)

($) | | YOY %

Increase |

Tim Westergren

Chief Executive Officer(2) | | — |

| | 500,000 |

| | — |

|

Michael Herring

President and Chief Financial Officer(3) | | 390,000 |

| | 450,000 |

| | 15.4 | % |

David Gerbitz

Executive Vice President, Revenue Operations | | 335,000 |

| | 375,000 |

| | 11.9 | % |

Chris Phillips

Chief Product Officer | | 350,000 |

| | 400,000 |

| | 14.3 | % |

John Trimble

Chief Revenue Officer | | 400,000 |

| | 450,000 |

| | 12.5 | % |

Brian McAndrews

Former Chief Executive Officer(4) | | 550,000 |

| | 550,000 |

| | — | % |

Sara Clemens

Former Chief Operating Officer(5) | | 370,000 |

| | 400,000 |

| | 8.1 | % |

_________________________________________________________

| |

(1) | Salary increases for our NEOs are effective as of February 1 each year. As a result, the salaries presented in this table may vary from the base salaries presented in the 2016 Summary Compensation Table. |

| |

(2) | Mr. Westergren assumed the role of Chief Executive Officer on March 25, 2016. His reported 2016 base salary represents his annualized base salary and is not prorated for his start date. Under applicable SEC rules, we have excluded Mr. Westergren's compensation for 2015 because he was not a named executive officer or our chief executive officer in 2015 or any prior year. |

| |

(3) | Mr. Herring served as our chief financial officer in 2015 and 2016. Effective March 25, 2016, he took on the additional role of president. On February 28, 2017, Mr. Herring stepped down as chief financial officer upon the hiring of his successor and continues to serve as president. |

| |

(4) | Mr. McAndrews stepped down effective March 25, 2016. His reported 2016 base salary represents his annualized base salary and is not prorated for his termination date. His prorated compensation for 2016 is shown below in the 2016 Summary Compensation Table. |

| |

(5) | Ms. Clemens served as our chief strategy officer in 2015 and until March 25, 2016, when she was promoted to chief operating officer. On December 16, 2016, Ms. Clemens resigned her role as chief operating officer, and remained employed by the Company for a transition period that ended on February 1, 2017. |

Variable Cash Incentives

Corporate Incentive Plan

In 2016, many of our employees, including all of our NEOs, were eligible to participate in Pandora’s 2016 Corporate Incentive Plan ("CIP"), which provided a cash bonus opportunity based on Pandora’s 2016 financial performance. Consistent with past years, our Committee’s objective in implementing the CIP was to reward team success and to focus all participants on Pandora’s corporate financial goals, rather than on individual achievements.

The table below shows the target bonus levels, as a percentage of salary, for our NEOs for 2015 and 2016:

|

| | | | |

Name and 2016 Title | | Target Bonus under CIP

(as a % of salary (2015)) | | Target Bonus under CIP

(as a % of salary (2016)) |

Tim Westergren

Chief Executive Officer(1) | | — | | 75% |

Michael Herring

President and Chief Financial Officer | | 60% | | 60% |

David Gerbitz

Executive Vice President, Revenue Operations | | 50% | | 50% |

Chris Phillips

Chief Product Officer | | 50% | | 60% |

John Trimble

Chief Revenue Officer(2) | | 30% | | 30% |

Brian McAndrews

Former Chief Executive Officer(3) | | 100% | | 100% |

Sara Clemens

Former Chief Operating Officer(4) | | 50% | | 60% |

_____________________________________________

| |

(1) | Mr. Westergren became our chief executive officer on March 25, 2016. Under applicable SEC rules, we have excluded Mr. Westergren's compensation for 2015 because he was not a named executive officer or our chief executive officer in 2015 or any prior year. |

| |

(2) | The target bonus level for Mr. Trimble was set at 30% of base salary because he also participates in a separate sales compensation plan, which our Committee believes focuses Mr. Trimble on the Company's overall financial performance as well as the performance of the sales organization for which he is responsible. |

| |

(3) | Mr. McAndrews stepped down effective March 25, 2016. Under the terms of his Separation and Release Agreement, he remained eligible for a pro-rated CIP bonus for 2016 with the payment not to exceed his target CIP bonus, calculated using a base salary of $600,000. |

| |

(4) | Ms. Clemens stepped down as chief operating officer on December 16, 2016. Under the terms of her Separation and Release Agreement, she remained eligible for a full-year CIP bonus for 2016, calculated using a base salary of $400,000. |

At the outset of 2016, the Committee determined that the CIP financial metrics for the year would be a combination of annual corporate GAAP revenue, non-GAAP adjusted EBITDA excluding content costs1 and listener hours, weighted as follows:

| |

• | Sixty percent (60%) of the bonus payout to be determined by comparing our actual revenue for 2016 to our revenue target in our board-approved 2016 financial plan; |

| |

• | Twenty percent (20%) of the bonus payout to be determined by comparing our actual non-GAAP adjusted EBITDA excluding content costs for 2016 to the target in our 2016 financial plan; and |

| |

• | Twenty percent (20%) of the bonus payout to be determined by comparing our actual listener hours for 2016 to our listener hours target in our 2016 financial plan. |

Our Committee believed that this 60/20/20 split would encourage all participants to focus primarily on top-line revenue, while the inclusion of adjusted EBITDA excluding content costs provided an incentive to contain manageable operating expenses, and the inclusion of listener hours provided an incentive to grow listener engagement.

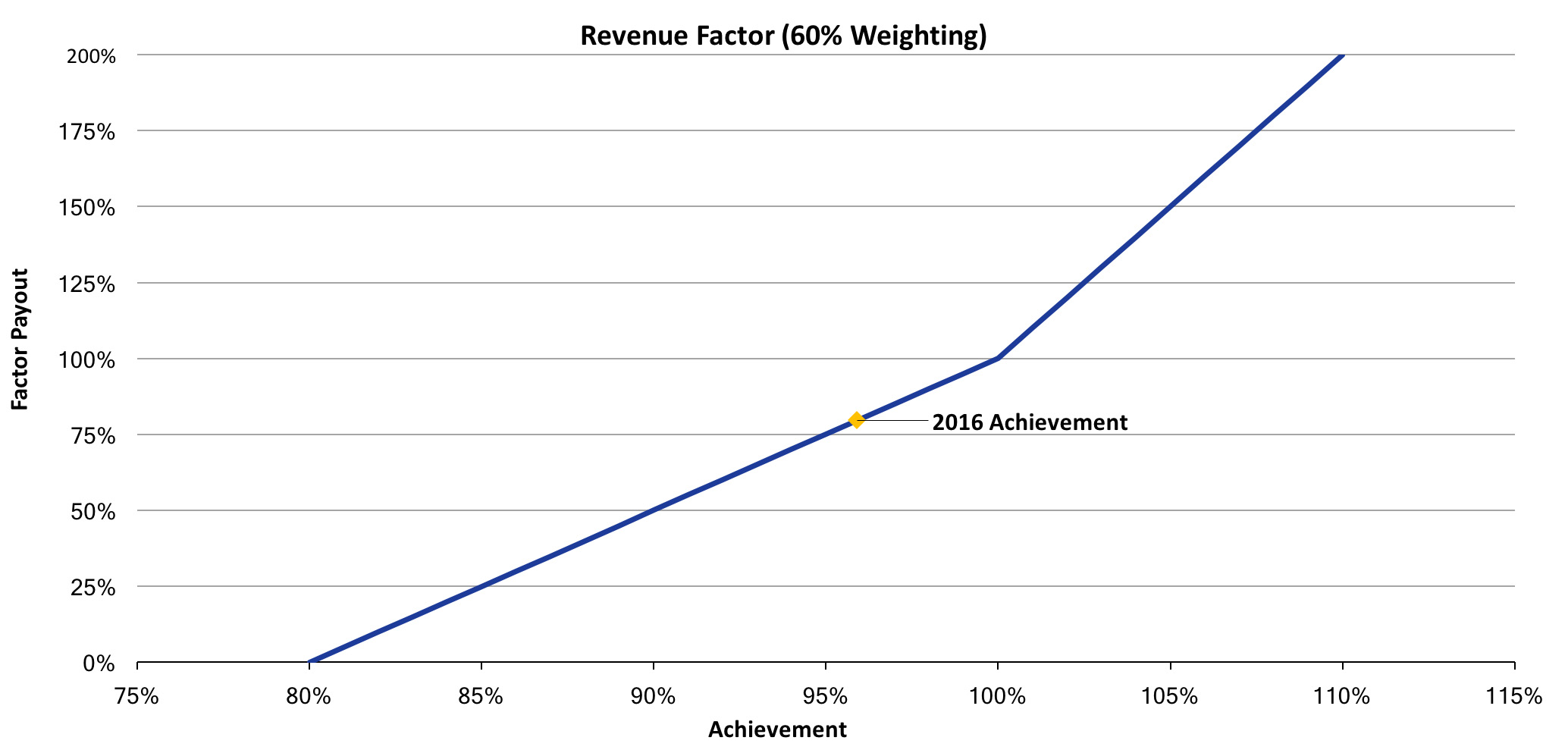

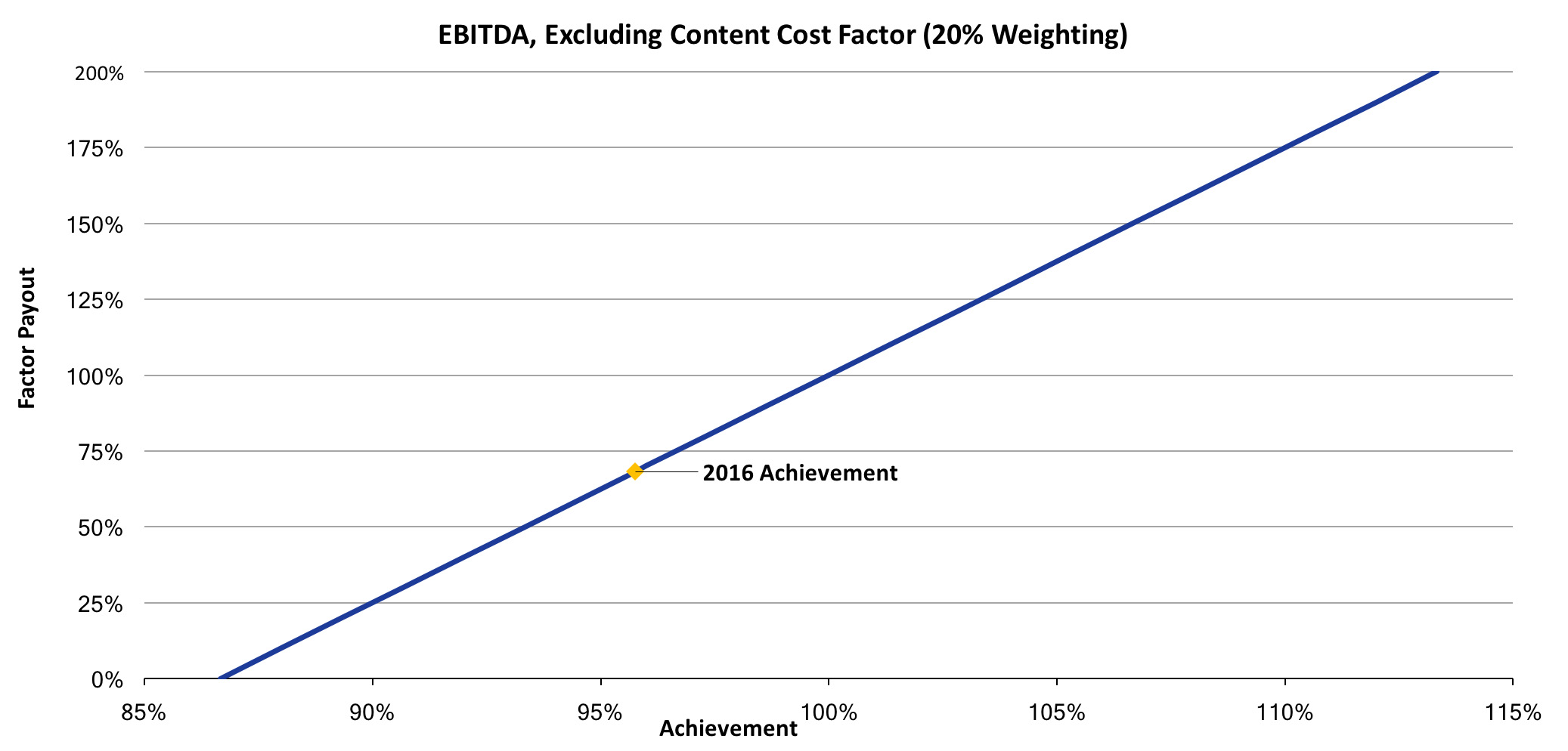

Below are the curves our Committee designed to determine the payments at various achievement levels under our CIP, as well as the Committee's philosophies behind the curve design.

_____________________________________________

1 Adjusted EBITDA excludes stock-based compensation expense, benefit from (provision for) income taxes, depreciation and intangible amortization expense, amortization of non-recoupable ticketing contract advances, other income (expense), transaction costs from acquisitions and one-time cumulative charges to cost of revenue - content acquisition costs that are not directly reflective of our core business or operating results for the present period.

Revenue CIP Factor – Motivates reaching or exceeding target with a steep penalty for missing target, but significant upside potential if target is exceeded. In 2016, we achieved 96% of our revenue factor, resulting in a payout at 80% for this factor.

Adjusted EBITDA Excluding Content Costs CIP Factor – Motivates management to manage profitability during the year. In 2016, we revised our adjusted EBITDA factor to exclude content costs because an increase in listener hours also increases content costs and negatively affects adjusted EBTIDA. In 2016, we achieved 96% of our adjusted EBITDA excluding content costs factor, resulting in a payout at 68% for this factor.

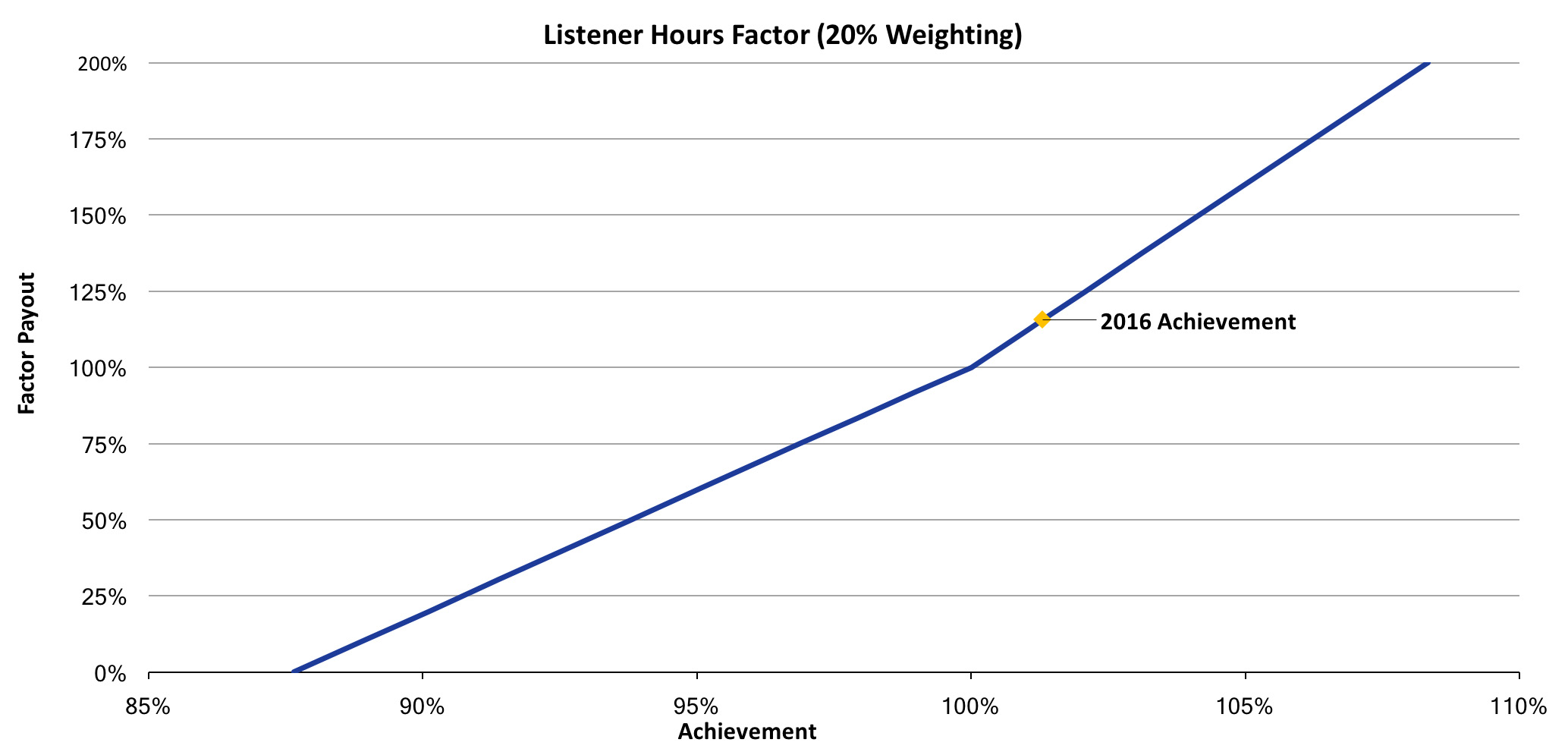

Listener Hours CIP Factor – Listener hours is a key indicator of the growth of our business and the engagement of our listeners, and an important focus area for 2016. In 2016, we achieved 101% of our listener hours factor, resulting in a payout at 116% for this factor.

The following table shows our 2016 performance across each CIP metric and the resulting CIP achievement:

|

| | | | | | | | | | | | | | | | | | | | |

| | CIP Weighting | | 2016 Target | | 2016 Actual | | Percentage Achievement | | CIP Factor Payout | | Percent of Goal (Weighted)(1) |

Revenue (in billions) | | 60 | % | | $ | 1.444 |

| | $ | 1.385 |

| | 96 | % | | 80 | % | | 48 | % |

Adjusted EBITDA excluding content costs (in millions) | | 20 | % | | $ | 642 |

| | $ | 615 |

| | 96 | % | | 68 | % | | 14 | % |

Listener Hours (in billions) | | 20 | % | | 21.70 |

| | 21.96 |

| | 101 | % | | 116 | % | | 23 | % |

_____________________________________________

| |

(1) | Calculated by multiplying the CIP Factor Payout by the CIP Weighting for each factor. The total blended payout of the CIP was 84% of target. The sum of the "Percent of Goal (Weighted)" column differs from the total blended CIP payout due to rounding. |

While our Committee generally retains discretion in its determination of CIP payments at the end of the year, it nevertheless strictly applied the plan structure in determining the payouts for 2016. Based on our revenue, adjusted EBITDA excluding content costs and total listener hour performance, each of our NEOs received 84% of his or her target bonus under our 2016 CIP, as set forth below:

|

| | | |

Name and 2016 Title | | Pay-out under the 2016 CIP ($) |

Tim Westergren

Chief Executive Officer | | 315,000 |

|

Michael Herring

President and Chief Financial Officer | | 226,800 |

|

David Gerbitz

Executive Vice President, Revenue Operations | | 157,500 |

|

Chris Phillips

Chief Product Officer | | 201,600 |

|

John Trimble

Chief Revenue Officer(1) | | 113,400 |

|

Brian McAndrews

Former Chief Executive Officer(2) | | 117,370 |

|

Sara Clemens

Former Chief Operating Officer(3) | | 201,600 |

|

_________________________________________________________

| |

(1) | The target bonus level for Mr. Trimble was set at 30% of base salary because he also participates in a separate sales compensation plan, which our Committee believes focuses Mr. Trimble on the Company's overall financial performance as well as the performance of the sales organization for which he is responsible. |

| |

(2) | Mr. McAndrews stepped down as chief executive officer on March 25, 2016. Under the terms of his Separation and Release Agreement, he remained eligible for a pro-rated CIP bonus for 2016 with the payment not to exceed his target CIP bonus, calculated using a base salary of $600,000. |

| |

(3) | Ms. Clemens stepped down as chief operating officer on December 16, 2016 and remained employed by the Company for a transition period that ended on February 1, 2017. She remained eligible for a full-year 2016 CIP bonus under the terms of the 2016 CIP Plan. |

Chief Revenue Officer Compensation Plan

Our chief revenue officer, John Trimble, is our only executive who participates in both our CIP and an additional sales compensation plan. Seventy percent of Mr. Trimble's target variable compensation was tied to his additional sales compensation plan, which the Committee approved at the beginning of 2016. Mr. Trimble's plan is based on the actual quarterly achievement against budgeted U.S. advertising revenue performance and target revenue per thousand listener hours ("RPMs"), with those metrics weighted at 75% and 25%, respectively. Mr. Trimble's cash incentive for 2016 under this plan could range from 0% to 200% of a target cash incentive of $306,250 depending on achievement of these objectives. Performance for RPMs did not exceed the target in 2016, and performance for ad sales exceeded the target in one of four quarters, resulting in a realized 2016 cash incentive for Mr. Trimble under this plan of $226,822, or 74% of target.

The following table shows our 2016 performance across each sales compensation plan metric and the resulting achievement:

|

| | | | | | | | | | | | | | |

| | Weighting | | 2016 Target(1) | | 2016 Actual | | Percentage Achievement(1) |

U.S. Ad Revenue (in millions) | | 75 | % | | $ | 1,115 |

| | $ | 1,058 |

| | 95 | % |

RPM | | 25 | % | | $ | 59.92 |

| | $ | 56.33 |

| | 94 | % |

_____________________________________________

| |

(1) | Bonus paid based on quarterly achievement against target, but presented here as the aggregate achievement for the year. The total blended payout for 2016 was 74% of target. |

Long-term Equity Incentives

Long-term equity incentives comprise the largest component of our executive compensation program as our Committee believes that our executives have a significant impact on our business success over time and, therefore, the creation of long-term stockholder value. To align our NEOs’ interests with those of our stockholders, provide long-term incentive opportunities, and drive retention, we use a variable mix of equity awards, including stock options, RSUs, stock-settled performance-based RSUs ("PSUs") and stock-performance-based market stock units ("MSUs"). While stock options and MSUs remain valuable compensation tools for us, in 2016 our Committee used PSUs and RSUs for our annual equity grants in order to further increase the pay-for-performance connection, stockholder alignment and retention incentives of our long-term incentive program.

Equity grants in 2016

In April 2016, our current CEO received an equity grant of RSUs representing 250,000 shares of our common stock, which vests over 4 years, and a Performance Award consisting of PSUs representing 250,000 shares of our common stock, which vests as explained below. As a result of these grants, our CEO received the majority of his 2016 compensation through long-term equity grants in a 1:1 ratio between time-based RSUs and PSUs, which we believe aligns his interests with those of our stockholders. Also in April 2016, our CFO and our other NEOs (other than our former CEO) received equity grants with a 1:1 ratio between time-based RSUs and PSUs. This represents an increase in the ratio of performance-based equity awards from 2015, when our CFO and other NEOs received 40% of the number of units granted to them as MSUs.

We increased the value of the equity grants we made to our NEOs in 2016 relative to 2015 in order to encourage executive stability during our CEO transition. The heavier weighting of performance-based equity awards was intended to further our commitment to our pay-for-performance philosophy.

The equity awards made to each of our NEOs in 2016 are set forth below:

|

| | | | | | |

| | 2016 Equity Grant |

Name and 2016 Title | | Restricted Stock

Units

(# of Units) | | Performance Awards

(# of Units) |

Tim Westergren

Chief Executive Officer | | 250,000 |

| | 250,000 |

|

Michael Herring

President and Chief Financial Officer | | 225,000 |

| | 225,000 |

|

David Gerbitz

Executive Vice President, Revenue Operations | | 175,000 |

| | 175,000 |

|

Chris Phillips

Chief Product Officer | | 200,000 |

| | 200,000 |

|

John Trimble

Chief Revenue Officer | | 200,000 |

| | 200,000 |

|

Brian McAndrews

Former Chief Executive Officer | | — |

| | — |

|

Sara Clemens

Former Chief Operating Officer | | 200,000 |

| | 200,000 |

|

2016 Performance Awards

The 2016 Performance Awards consist of stock-settled performance-based RSUs ("PSUs") that vest based on Pandora’s stock price performance during a four-year performance period. Specifically, the PSUs only vest when the 90-day trailing average of Pandora’s stock price equals or exceeds $20 on a given vesting date. On April 15, 2016, the grant date of the PSUs awarded to our NEOs, Pandora’s stock price was $8.62. Twenty-five percent of the PSUs were eligible to vest on February 15, 2017, and vest thereafter in quarterly installments of 6.25% of the total number of shares granted. If the 90-day trailing average of Pandora’s common stock price does not equal or exceed $20 on a given vesting date, then the shares scheduled to vest as of such date will remain unvested until the next successive vesting date on which the $20 target has been met. Any shares that remain unearned at the final vesting date will be canceled.

The 90-day trailing average of Pandora’s stock price was below $20 as of the first vesting date, which resulted in our NEOs receiving no shares under the 2016 Performance Award at this vesting.

We believe the design of the 2016 Performance Awards, as well as the increase in the ratio of performance-based equity awards to time-based RSUs continues to align our realizable executive compensation with our stock price performance.

2015 Market Stock Units

In 2015 we granted our NEOs stock-performance-based market stock units, or MSUs, that vest according to Pandora’s relative stock price performance. Specifically, MSUs measure Pandora’s total stockholder return ("TSR") performance against that of the Russell 2000 Index during three performance periods. Pandora’s relative TSR is calculated using the average adjusted closing stock price of Pandora stock, and the Russell 2000 Index, for ninety calendar days prior to the beginning of each performance period and the last ninety calendar days of the performance period. The target MSUs are divided across three performance periods as follows:

| |

• | Up to one-third of the target MSUs are eligible to be earned for a performance period that is the first calendar year of the MSU grant (the "One-Year Performance Period"); |

| |

• | Up to one-third of the target MSUs are eligible to be earned for a performance period that is the first two calendar years of the MSU grant (the "Two-Year Performance Period"); and |

| |

• | Any remaining portion of the total potential MSUs are eligible to be earned for a performance period that is the entire three calendar years of the MSU grant (the "Three-Year Performance Period"). |

For each performance period, a "performance multiplier" is calculated by comparing Pandora’s relative TSR for the period to the Russell 2000 Index TSR for the same period. The target number of shares will vest if the Pandora TSR is equal to the Russell 2000 Index TSR for the period. For each percentage point that the Pandora TSR falls below the Russell 2000 Index TSR for the period, the performance multiplier is decreased by three percentage points. For each percentage point that the Pandora TSR exceeds the Russell 2000 Index TSR for the Three-Year Performance Period, the performance multiplier is increased by two percentage points. The performance multiplier is capped at 100% for the One-Year and Two-Year Performance Periods. However, the full award is eligible for a payout of up to 200% of target with all upside tied to the Three-Year Performance Period.

In February 2016, the Committee certified the results of the One-Year Performance Period for the 2015 MSU grant to our NEOs, which concluded on December 31, 2015. During the period, our relative TSR declined 26 percentage points relative to the Russell 2000 Index TSR for the period, which resulted in the vesting of the One-Year Performance Period at 22% of the one-third vesting opportunity for the period.

In January 2017, the Committee certified the results of the Two-Year Performance Period for the 2015 MSU grant to our NEOs, which concluded on December 31, 2016. During the period, our relative TSR declined 48 percentage points relative to the Russell 2000 Index TSR for the period, which resulted in the vesting of the Two-Year Performance Period at 0% of the one-third vesting opportunity for the period.

We believe that this vesting level demonstrates the ability of MSUs to align our realizable executive compensation with our TSR performance.

Section 4 – Say-on-Pay Vote

At our 2012 annual meeting, more than 75% of stockholders recommended a triennial say-on-pay vote, and so our board of directors adopted the triennial approach. At our 2015 annual meeting, stockholders expressed a high level of support (98% of the votes cast) for the compensation of our NEOs. The Committee did not make any changes to the executive compensation setting process or program as a result of the 2015 say-on-pay vote.

Our next say-on-pay vote will occur at our 2018 annual meeting, at which our stockholders will also have an opportunity to cast a non-binding advisory vote on the frequency of future stockholder advisory votes on the compensation of our NEOs.

Section 5 – Other Compensation

Transportation and Security Measures for our CEO

The personal safety and security of our employees, including our executives, is of great importance to us and our stockholders. In 2016, based on the recommendation of an independent, third-party security study, we implemented a security program under which we require our CEO, Mr. Westergren (as well as his spouse and dependent children when they accompany him), to use, as much as practicable, Company-provided secure automobile transportation for all business and personal travel. In 2016, prior to the implementation of this security program, we allowed, but did not require, our CEO to use Company-provided automobile transportation for business travel, as well as for commutation and travel to certain non-business events.

The services provided by the Company for our CEO also include personal security during business-related and personal travel, and threat assessment and management. The Committee believes the amounts paid by the company for these services are reasonable, necessary, and for our company’s benefit.

Although we view the transportation and security services provided for our CEO as a necessary and appropriate business expense, because they may be viewed as conveying a personal benefit to him, we have reported the aggregate incremental costs to the Company of these services in the "All Other Compensation" column of the 2016 Summary Compensation Table.

The Committee periodically reviews and approves the security budget and the specific security concerns justifying the security services for our CEO.

Change in Control Plan

We believe a combination of severance and change in control arrangements will help our executives maintain continued focus and dedication to their responsibilities in the event of a change in control of the Company, and thus help maximize stockholder value in that event. Rather than having individual severance negotiations with each of our executives at the time of hire, or at the time a change in control event occurs, our Committee has previously adopted a program to provide uniform severance arrangements for our NEOs other than our CEO, and a slightly enhanced severance arrangement for our CEO. These severance arrangements are coupled with "double trigger" change in control payout conditions, in order to promote retention while minimizing the chance of undeserved payouts. Our severance and change in control arrangements are described in detail below under "Executive Compensation—Potential Payments on Termination and Change in Control".

Former Executive Officer Separation Arrangements