EXHIBIT 10.12

CENTER 21 OFFICE LEASE

THIS OFFICE LEASE (this “Lease”) is made as of July 23, 2009 (the “Effective Date”), by and between Landlord and Tenant, upon the following terms and conditions:

SECTION 1: BASIC LEASE PROVISIONS.

These Basic Lease Provisions set forth the basic terms of this Lease. In the event of any inconsistency between the terms set forth in these Provisions and any other provision of this Lease, the Basic Lease Provisions shall prevail.

| 1.1 | Tenant: | Name: | PANDORA MEDIA, INC., a California corporation | |||||

| Address for Notices: | 2101 Webster Street Oakland, California 94612 | |||||||

| Attention:

Telephone Fax: |

Etienne Handman, Chief Operating Officer (510) 451-4100 x441 (510) 451-4286 | |||||||

| 1.2 | Landlord: | Name: | CIM/OAKLAND CENTER 21, LP, a Delaware limited partnership | |||||

| Address for Notices: | 6922 Hollywood Boulevard, Suite 900 Los Angeles, California 90028 | |||||||

| Attention: Telephone: Fax: |

Avi Shemesh (323) 860-4900 (323) 860-4901 | |||||||

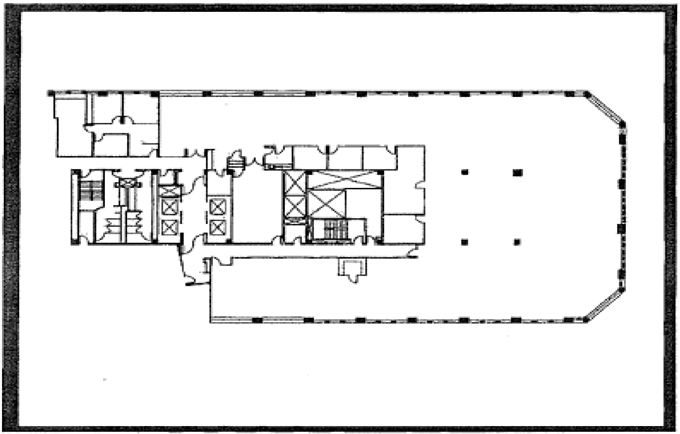

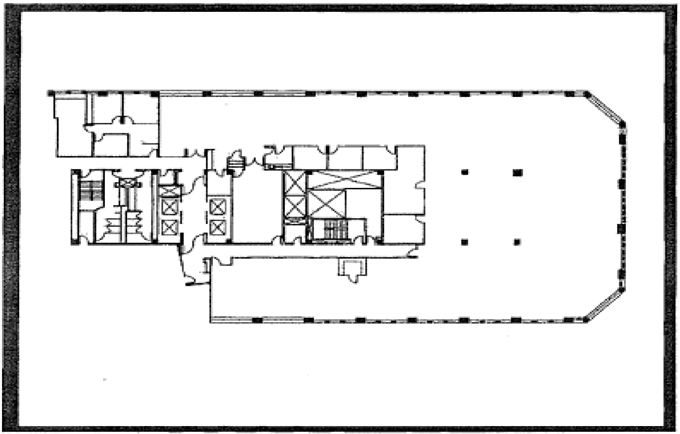

| 1.3 | Premises: | Suite 1650 on the sixteenth (16th) floor of the 2101 Webster Building, as shown on Exhibit “A” attached hereto (the “Premises”). The Premises contain 14,644 rentable square feet of area. | ||||||

| 1.4 | Project: | That certain office project in the City of Oakland, California known as “Center 21” and comprised of (i) a 20 story building located at 2101 Webster Street, Oakland California (the “2101 Webster Building”), and (ii) a nine story building located at 2100 Franklin Street (the “2100 Franklin Building”, and together with the 2101 Webster Building, collectively, the “Buildings”), (iii) a subterranean parking garage underneath the Buildings (the “Underground Parking Garage”) and (iv) a multi-story parking structure located at 2353 Webster Street (the “Parking Structure”). The Buildings are constructed such that they join each other along the north wall of the 2101 Webster Building and the south wall of the 2100 Franklin Building, and are capable of sharing floor plates across the span of both Buildings, although on some floors it is possible that a separate wall will remain in place between the Buildings if the floors in question will be occupied by multiple tenants. | ||||||

| 1.5 | Tenant’s Proportionate Share: |

The percentage that the rentable square footage of the Premises bears to the entire rentable square footage of the Project. | ||||||

| 1.6 | Term: | Five (5) Lease Years, measured from the Commencement Date.

Commencement Date: The earlier of: (i) Tenant’s commencement of business operations in the Premises; and (ii) October 1, 2009.

Expiration Date: The last day of the month in which the fifth (5th) anniversary of the Commencement Date occurs. | ||||||

| 1.7 | Base Rent: | Annual Rent | Monthly Rent | Monthly PSF Rent | ||||

| $465,679.20 | $38,806.60 | $2.65 | ||

| $474,465.60 | $39,538,80 | $2.70 | ||

| $485,009.28 | $40,417.44 | $2.76 | ||

| $493.795.68 | $41,149.64 | $2.81 | ||

| $507,853.92 | $42,321.16 | $2.89 |

| 1.8 | Security Deposit: | $317,500. See Section 3.4. | ||||||

| 1.9 | Base Year: | 2009. | ||||||

| 1.10 | Permitted Use: | General office use associated with the use as a streaming music radio service, in compliance with all Project rules and subject to applicable Laws. See Addendum Paragraph 1.10 | ||||||

| 1.11 | Brokers: | None. | ||||||

| 1.12 | Guarantors: | None. | ||||||

| 1.13 | Parking Passes: | Tenant shall have the right to rent 1 unreserved parking pass in the Underground Parking Garage and up to 15 unreserved parking passes in the Parking Facility, at the rates and subject to the terms of Addendum Section 1.13. | ||||||

| 1.13 | Definitions: | All capitalized terms used in this Lease shall have the meanings specified in this Section 1 or in Section 46 or in any Addendum to this Lease. | ||||||

| 1.14 | Exhibits: | The following Exhibits are attached to this Lease and incorporated herein by this reference: | ||||||

| Exhibit A Exhibit B Exhibit C Exhibit D Exhibit E Exhibit F |

- Floor Plan showing the location of the Premises - Statement of Commencement Date - Intentionally Omitted - Rules and Regulations for the Project - Form of Estoppel Certificate - Form of Letter of Credit | |||||||

| 1.15 | Addendum: | Attached: | X Yes; No. | |||||

2

SECTION 2: LEASE OF PREMISES.

2.1 Lease to Tenant. Landlord hereby leases the Premises to Tenant, and Tenant hereby leases the Premises from Landlord, for the Term, subject to the other provisions of this Lease. Landlord and Tenant agree on the area of the Premises and the Project set forth in the Basic Lease Provisions. The term “rentable square feet” as used in the Lease will be the area of the Premises as determined in accordance with the Building Owners and Management Association Method for Measuring Floor Area in Office Buildings, ANSI Z65.l-1996, as modified by Landlord for purposes of the Buildings (the “BOMA Standard”).

2.2 Common Areas. Tenant shall have the nonexclusive right to use the Common Areas, subject to Matters of Record and the Rules and Regulations. Tenant’s rights are subject to Landlord’s right to make changes to the Common Areas or the use of such Common Areas which Landlord deems reasonable, perform maintenance and repairs and otherwise use the Common Areas as Landlord may deem appropriate in its reasonable judgment. Landlord shall not be obligated to light the Common Areas outside the hours specified in the Rules and Regulations except as required by Law.

2.3 Title. Tenant’s leasehold estate in the Premises under this Lease is subject to: (a) the Matters of Record; and (b) the effect of all Laws applicable to the use and occupancy of the Premises. Any modifications to the Matters of Record shall not materially adversely impact Tenant’s use of the Premises.

2.4 Acceptance of Premises. Tenant accepts the Premises, the Common Areas and Project in their “as-is, where-is” condition, provided Landlord shall upgrade the lighting in the restrooms using Building standard materials. Tenant hereby agrees and warrants that it has investigated and inspected the condition of the Premises and the suitability of same for Tenant’s purposes, and Tenant does hereby waive and disclaim any objection to, cause of action based upon, or claim that its obligations hereunder should be reduced or limited because of the condition of the Premises or the Building or the suitability of same for Tenant’s purposes. Tenant acknowledges that neither Landlord nor any agent nor any employee of Landlord has made any representations or warranty with respect to the Premises or the Building or with respect to the suitability of either for the conduct of Tenant’s business and Tenant expressly warrants and represents that Tenant has relied solely on its own investigation and inspection of the Premises and the Project in its decision to enter into this Lease and let the Premises in the above-described condition except as to latent defects and subject to problems or conditions of which Tenant gives Landlord notice within thirty (30) days after the Commencement Date. Within thirty (30) days following the Commencement Date, Tenant shall complete, execute and return to Landlord a Statement of Commencement Date in the form of Exhibit “B” hereto. Acceptance of the Premises by Tenant in no way relieves Landlord its responsibilities to maintain and repair Systems, Equipment and the Common Area, as specified in Section 5.2 of this Lease.

2.5 Delivery of Possession.

2.5.1 Landlord shall deliver to Tenant possession of the Premises free and clear of all other tenants and occupancies. Landlord shall not be liable for any delay in delivery of possession of the Premises, provided that Tenant shall not be liable for any payments of Rent until and unless Landlord delivers the Premises in accordance with this

3

Lease. Landlord makes no representation or warranty with respect to the occupancy by any tenant or occupant (whether a major tenant or occupant. or a small shop tenant or occupant), as to the date on which any such tenant or occupant accepted or will accept occupancy of its space or the use to which any other tenant or occupant will put its leased space, except as expressly provided herein.

2.5.2 The projected delivery date is October 1, 2009. In the event that the Commencement Date has not occurred on or before December 31, 2009 (as extended by Force Majeure) (the “Cancellation Date”), then either Landlord or Tenant shall have the right to cancel this Lease by giving the other written notice within ten (l0) days after the Cancellation Date. If Landlord or Tenant timely gives such notice, Landlord shall repay Tenant any prepaid rent or security deposit, and the parties shall have no further rights or obligations to each other pursuant to this Lease. If neither party timely exercises such right, such right shall expire at the end of the tenth day after the Cancellation Date.

2.6 Quiet Possession. So long as Tenant is not in Default, Tenant shall be entitled to quietly have, hold, and enjoy the Premises during the Term, subject to Landlord’s rights under this Lease.

2.7 Use of Premises. Tenant and Tenant’s Employees shall use the Premises solely for the uses specified in the Basic Lease Provisions in a first-class, professional and businesslike manner consistent with reputable business standards and practices, and Tenant shall, at is sole cost and expense, faithfully observe and promptly comply with all Rules and Regulations, signage criteria and any Laws or Matters of Record now in force or which may hereafter be in force with respect to Tenant’s use, occupancy and possession of the Premises. Tenant shall at all times keep the Premises in a clean and wholesome condition, and shall further comply with all reasonable requirements of any board of fire underwriters or other similar body now or hereafter constituted. Tenant shall not do or permit anything to be done upon the Premises in any way materially disturbing, bothering or annoying any other tenant in the Project or constituting a nuisance. In no event shall Landlord be liable to Tenant for any damage or claims suffered or incurred as a result of the failure of Tenant, or any other Person (other than Landlord) to conform to the foregoing.

2.8 Changes to Project. Landlord reserves the right, in its sole discretion, at any time to make or allow permanent or temporary changes or replacements to the Project outside the Premises, including but not limited to the Common Areas. Without limiting the generality of the foregoing, such construction activities may include base building and/or tenant improvement work for future tenants. Landlord’s activities may require the temporary alteration of means of ingress and egress to the Project and the installation of scaffolding and other temporary structures while the work is in progress. Such work shall be performed in a manner reasonably designed to minimize interference with Tenant’s conduct of business from the Premises. None of the same shall be considered to be a constructive eviction of Tenant from the Premises, create any liability on the part of Landlord, or give Tenant any right to rent abatement or otherwise alter the rights or obligations (including Rent) of Tenant under this Lease.

2.9 Name of Project. Landlord may change the name and/or the address of the Project at its sole discretion.

4

2.10 Relocation of Premises. Landlord shall have the right at any time, upon at least sixty (60) days’ prior written notice to Tenant, to relocate Tenant at Landlord’s cost, including costs of replacement improvements, network, electrical, moving, startup and other costs which Tenant would otherwise not incur, to other comparable premises, as agreed by the parties in the Building (“Relocated Premises”). Tenant shall have right to terminate this Lease in the event proposed Relocated Premises are not agreed to be comparable upon ten (10) days prior written notice to Landlord.

SECTION 3: RENT.

3.1 Base Rent. From and after the Commencement Date, Tenant shall pay to Landlord the Base Rent specified in Section 1.7, in advance on or before the first day of each calendar month during the Term without demand, deduction or setoff, except as otherwise expressly set forth herein. If the Commencement Date shall be a day other than the first day of a month, then the first and last monthly installment of Tenant’s monthly installment of Base Rent shall be prorated on the basis of a thirty (30) day month. Tenant shall pay the first month’s Base Rent upon Lease execution, and thereafter on the first day of each month of the Term. Notwithstanding anything to the contrary contained herein, and provided that Tenant faithfully performs all of the terms and conditions of the Lease, Landlord hereby agrees to abate Tenant’s obligation to pay Monthly Base Rent for the first three (3) full months of each of the first three (3) years of the initial Term. During such abatement period, Tenant shall still be responsible for the payment of all of its other monetary obligations under the Lease.

3.2 Payment of Additional Rent. In addition to the Base Rent, Tenant shall pay as Additional Rent:

3.2.1 All personal property taxes assessed against and levied upon any Personal Property prior to delinquency.

3.2.2 Tenant’s Proportionate Share of increases of the Operating Costs incurred during the Term, payable in accordance with Section 3.3.

3.2.3 All additional charges for any services, goods or materials furnished by Landlord at Tenant’s request or relating to Tenant’s specific use of the Premises.

3.2.4 All Excess Consideration payable to Landlord pursuant to Section 7.6 hereof.

3.2.5 All other sums payable by Tenant hereunder.

3.3 Payment of Operating Costs. In addition to the Base Rent, commencing on the first day of January of the calendar year following the Base Year, and continuing on the first day of each subsequent calendar month during the Term, Tenant shall pay in monthly installments an amount equal to Tenant’s Proportionate Share of the excess of Operating Costs for such year over Operating Costs for the Base Year (the “Excess Expense”) in accordance with the following provisions:

3.3.1 Prior to the end of each calendar year (from and after the Base Year), Landlord shall endeavor to deliver to Tenant a good faith estimate of the Excess Expenses for the next calendar year (the “Excess Expense Estimate”). The Excess Expense Estimate shall

5

show the amount previously paid by Tenant for Excess Expenses for the previous calendar year. In addition to the Base Rent provided for in Section 3.1, above, on the first day of each calendar month during each calendar year, Tenant shall pay Tenant’s Proportionate Share of the Excess Expense Estimate for said calendar year.

3.3.2 Landlord may periodically revise the Excess Expense Estimate to reflect changed circumstances, and Tenant shall make subsequent Operating Cost payments based upon the revised Excess Expense Estimate.

3.3.3 Within ninety (90) days after each calendar year in the Term, Landlord shall deliver to Tenant a statement of the actual Excess Expenses (the “Annual Statement”). The Annual Statement shall state the amount by which Tenant has underpaid or overpaid Tenant’s Proportionate Share of the Excess Expenses. Tenant shall pay any deficiency to Landlord within thirty (30) days after receipt of the Annual Statement. The amount of any overpayment shall be refunded to Tenant or credited against Rent next coming due.

3.3.4 Tenant shall have ninety (90) days after delivery of the Annual Statement to object in writing to the accuracy of the Annual Statement. If Tenant does not make its written objection within that period, the Annual Statement shall be binding upon Tenant. Whether or not Tenant objects to the Annual Statement, Tenant shall pay any amount specified in the Annual Statement within the 30 day period following the delivery of the Annual Statement. See Addendum.

3.3.5 Intentionally deleted.

3.3.6 Even though the Term has expired or this Lease has been terminated and Tenant has vacated the Premises, when the final determination is made of Tenant’s Proportionate Share of Excess Expenses pursuant to this Section 3.3 for the year in which the Term expires or this Lease terminates, Tenant shall promptly pay any amount due over the estimated amount of the same previously paid by Tenant for such year, and conversely, any overpayment made shall be promptly refunded by Landlord to Tenant; provided, however, that all or any part of any such refund may be applied by Landlord in payment of any delinquent or past due sums, including Base Rent or any other amounts due from Tenant.

3.4 Security Deposit. Concurrently with the execution of this Lease, Tenant shall deposit with Landlord the Security Deposit. Landlord shall not be required to pay interest on the Security Deposit or keep the Security Deposit separate from its general funds. Upon any Default by Tenant, Landlord may use the Security Deposit to the extent necessary to make good any arrears of sums payable by Tenant under this Lease, or to compensate Landlord for any damage, injury, expense or liability caused by Tenant’s Default. If any portion of the Security Deposit is so used or applied, Tenant shall, within five (5) days after written demand therefor, deposit a certified or bank cashier’s check with Landlord in an amount sufficient to restore the Security Deposit to its amount immediately preceding such use or application of funds and Tenant’s failure to do so shall be a Default under this Lease. The balance of the Security Deposit remaining at the end of the Lease Term shall he returned after all of Tenant’s obligations (with the exception of those specified in Section 3.3.6 [final determination of Proportionate Share of Excess Expenses]) have been fulfilled. Tenant hereby waives any rights or benefits that may be available to Tenant by reason of California Civil Code Section 1950.7.

6

Alternatively, Tenant may deposit with Landlord, concurrently with this Lease, an unconditional, irrevocable sight draft and renewable letter of credit (“Letter of Credit”) naming Landlord as beneficiary, in favor of Landlord and in the form attached hereto as Exhibit “F”, or other form acceptable to Landlord in its sole discretion. The Letter of Credit shall be issued by a bank reasonably satisfactory to Landlord with a branch located in Oakland or San Francisco, California in the principal amount of $317,500.00 (hereinafter, the “Stated Amount”). The form and content of the Letter of Credit shall conform to International Standby Practices 1998 International Chamber of Commerce Publication No. 590. The Letter of Credit shall state that an authorized officer or other representative of Landlord may make demand on Landlord’s behalf for the Stated Amount of the Letter of Credit, or any portion thereof, and that the issuing bank must immediately honor such demand, without qualification or satisfaction of any conditions, except the proper identification of the party making such demand. In addition, the Letter of Credit shall indicate that it is freely transferable in its entirety by Landlord as beneficiary and that upon receiving written notice of transfer, and upon presentation to the issuing bank of the original Letter of Credit, the issuer or confirming bank will reissue the Letter of Credit naming such transferee as the beneficiary. Tenant acknowledges and agrees that it shall pay upon Landlord’s demand, as Additional Rent, all reasonable costs or fees charged in connection with the Letter of Credit that arise due to: (i) Landlord’s sale or transfer of all or a portion of the Project; or (ii) the addition, deletion, or modification of any beneficiaries under the Letter of Credit. The Letter of Credit may be re-issued or renewed provided that, except as expressly set forth herein, the Letter of Credit amount shall not be reduced below the Stated Amount at any time during the Lease Term. Each renewal or replacement Letter of Credit shall be in substantially the same form as the original Letter of Credit or such form as is otherwise reasonably acceptable to Landlord. In the event that Tenant fails to renew or re-issue the Letter of Credit at least ten (10) business days prior to the expiration of the then existing Letter of Credit, then Landlord shall be entitled to make demand for the Stated Amount of said Letter of Credit and, thereafter, to hold such funds as a cash security deposit in accordance with this Section 3.4. Upon any Default by Tenant beyond the applicable cure period, Landlord may (but shall not be required to) draw upon all or any portion of the Stated Amount of the Letter of Credit, and Landlord may then hold such proceeds as a cash security deposit and/or use, apply or retain all or any part of the proceeds for the payment of any sum which is in default, or for the payment of any other amount which Landlord may spend or become obligated to spend by reason of Tenant’s Default or to compensate Landlord for any loss or damage which Landlord may suffer by reason of Tenant’s Default. If any portion of the Letter of Credit proceeds are so used or applied, Tenant shall, within five (5) days after demand therefor, post an additional Letter of Credit in an amount to cause the aggregate amount of the unused proceeds and such new Letter of Credit to equal the Stated Amount required in this Section 3.4. Landlord shall not be required to keep any proceeds from the Letter of Credit separate from its general funds. Should Landlord sell its interest in the Premises during the Lease Term Landlord shall deposit with the purchaser thereof the Letter of Credit or any proceeds of the Letter of Credit, thereupon Landlord shall be discharged from any further liability with respect to the Letter of Credit and said proceeds. Any remaining proceeds of the Letter of Credit held by Landlord after expiration of the Lease Term, after any deductions described in this Section 3.4, shall be returned to Tenant or, at Landlord’s option, to the last assignee of Tenant’s interest hereunder, after all of Tenant’s obligations have been fulfilled.

Notwithstanding the foregoing, provided that Tenant is not then in Default (and Tenant has not been in Default under this Lease) beyond the applicable cure period, on the earlier of (i) the first day of the thirty-fifth (35th) month of the Term, or (ii) the date Tenant provides Landlord with sufficient evidence that Tenant has established two (2) consecutive

7

quarters of at least $2,000,000 of positive EBITDA (in accordance with GAAP), Landlord she return the Letter of Credit to Tenant. The rights granted herein are personal to the original Tenant and may not be transferred or assigned.

3.5 Late Charges. Tenant hereby acknowledges that late payment by Tenant to Landlord of rent or other sums due hereunder will cause Landlord to incur costs not contemplated by this Lease, the exact amount of which will be extremely difficult, if not impossible, to ascertain. Such costs include, but are not limited to, processing and accounting charges, and late charges which may be imposed upon Landlord by the terms of any mortgage or trust deed covering the Premises. Accordingly, if any installment of rent or any sum due from Tenant shall not be received by Landlord or Landlord’s designee within five (5) days after said amount is past due, then, in addition to an other remedies provided herein, Tenant shall pay to Landlord a late charge equal to ten percent (10%) of such overdue amount (but in no event greater than the maximum amount permitted by law), plus, in either event, all attorneys’ fees incurred by Landlord by reason of Tenant’s failure to pay rent and/or other charges when due hereunder. The parties hereby agree that such late charges represent a fair and reasonable estimate of the cost that Landlord will incur by reason of the late payment by Tenant, and that it does not constitute a forfeiture or penalty. Acceptance of such late charges by Landlord shall in no event constitute a waiver of Tenant’s default with respect to such overdue amount, nor prevent Landlord from exercising any of the other rights and remedies granted hereunder. Landlord may, at its option, deduct all late charges from the Security Deposit.

SECTION 4: ALTERATION AND IMPROVEMENTS.

4.1 Alterations by Tenant. At its sole cost and expense, Tenant shall have the right to make Tenant Alterations which have received Landlord’s prior written approval (which will not be unreasonably withheld), so long as each of the following conditions is met:

4.1.1 The proposed Tenant Alterations:

(a) are appropriate for Tenant’s use, including electrical and data connections to modular workstations and other computer and telephone equipment, and will not adversely affect the utility of the Premises for future tenants;

(b) will not alter the exterior appearance of the Project;

(c) are not of a structural nature and will not weaken or impair the structural strength of the Project; and

8

(d) will not unreasonably affect or increase demands on any of the mechanical, electrical, sanitary, or other Systems and Equipment;

(e) will not unreasonably interfere with the normal and customary business operations of other tenants in the Building or Project; and

(f) comply with all Laws.

4.1.2 Landlord shall have approved complete construction drawings and specifications for the proposed Tenant Alterations. Any change must be approved by Landlord.

4.1.3 Landlord shall have approved of Tenant’s contractor and subcontractors, such approval to be granted or withheld in Landlord’s reasonable discretion;

4.1.4 Landlord shall have been furnished with original certificates of insurance from a company approved by Landlord, showing Landlord as an additional insured on all public liability, property damage and worker’s compensation policies, with such limits as Landlord may reasonably require; and

4.1.5 Landlord shall have been furnished with copies of all building and/or other applicable permits or licenses required for the prosecution of the work.

4.2 Work Done by Tenant. Any Tenant Alterations shall comply with the following:

4.2.1 All work shall be in compliance with all Laws. Any work not acceptable to any governmental authority or agency having jurisdiction over such work or does not reasonably conform to plans agreed to by Landlord shall be promptly corrected by Tenant at Tenant’s expense.

4.2.2 Tenant and Tenant’s Employees shall not install plumbing, mechanical, electrical wiring or fixtures, ceilings, partitions, or other alterations which, in Landlord’s judgment, may adversely affect any of the Project systems or their performance (including, but not limited to, the heating, ventilating and air-conditioning systems).

4.2.3 All work by Tenant and Tenant’s Employees shall he performed diligently until completed and pursuant to any reasonable scheduling requirements imposed by Landlord.

4.3 No Liability of Landlord. Landlord shall have no liability for any faulty work or defect regardless of Landlord’s approval of Tenant Alterations or plans and specifications.

4.4 Reimbursement to Landlord. Tenant shall reimburse Landlord for any reasonable, actual, out-of-pocket expense incurred by Landlord in approving the plans and specifications for Tenant Alterations and in reviewing the progress of their construction, and any expense incurred by Landlord by reason of faulty work or inadequate cleanup.

9

4.5 Property of Landlord. All Tenant Alterations shall remain in the Premises at the expiration or earlier termination of the Term, and shall become the property of Landlord, without any compensation to Tenant, provided, however, at Landlord’s written election, Tenant shall remove any or all of such Tenant Alterations from the Premises. Landlord shall specify which Tenant Alterations shall be removed at the time such Tenant Alterations are approved by Landlord. Tenant shall repair any damage caused by the removal. Upon the expiration or earlier termination of the Term, Tenant shall remove its Personal Property from the Premises and Tenant shall repair any damage caused by such removal.

4.6 Notice of Work Commencement. Before commencing any work with respect to the Tenant Alterations, Tenant shall notify Landlord in writing not less than five (5), nor more than ten (10), business days prior to the date such work commences. Landlord shall have the right to post all appropriate notices of non-responsibility.

4.7 Mechanics’ Liens. Tenant shall pay for all labor and materials supplied to the Premises at Tenant’s request for Tenant. Tenant shall not permit any mechanics’ or similar liens to be filed against the Land or the Project, or against Tenant’s leasehold interest in the Premises. Tenant shall indemnify, defend and hold harmless Landlord, Landlord’s Employees, the REA Parties and their respective successors, assigns, partners, directors, officers, shareholders, employees, agents, lenders, ground lessors and attorneys, and the Project, from and against any and all Claims incurred by such indemnified persons, or any of them, as the result of any mechanics’ lien filed against the Land, Project or against Tenant’s leasehold interest in the Premises. If Tenant causes a lien on the Project, Tenant shall, at its sole cost and expense, either (i) remove such lien or (ii) provide a bond in accordance with California Civil Code Section 3143. No action to remove a lien, as provided herein, shall affect Tenant’s right to contest the legitimacy of the lien and seek appropriate legal remedies against the party placing such lien on the Project.

4.8 Completion Bond. Landlord may require Tenant, at Tenant’s sole cost, to obtain and provide to Landlord a lien and completion bond in a form and by a surety acceptable to Landlord, and in amount not less than one hundred fifty percent (150%) of the estimated cost of such Tenant Alterations but only if such Tenant Alterations exceed $150,000 in value.

SECTION 5: REPAIR AND MAINTENANCE.

5.1 Tenant’s Obligations. Tenant shall keep the Premises and all signs installed by Tenant in good condition and repair, whether or not the need for such repairs occurs as a result of Tenant’s use, any prior use, the elements or the age of such portion of the Premises. All damage to the Premises or the Project caused by Tenant or Tenant’s Employees, or the failure of Tenant or Tenant’s Employees to comply with this Lease and the Rules and Regulations, shall be repaired at Tenant’s expense, subject to Section 8.3. Landlord may make any repairs, which are not promptly made by Tenant and charge Tenant for the cost thereof, together with interest thereon at the Default Rate. Tenant waives all rights to make repairs to the Premises at the expense of Landlord, or to deduct the cost thereof from Rent. Upon the expiration or earlier termination of this Lease, Tenant shall surrender the Premises and all alterations, additions and improvements in the same condition as when received, ordinary wear and tear excepted.

10

5.2 Landlord’s Obligations. Landlord shall maintain and repair, or cause to be maintained and repaired, the Systems and Equipment, the Common Areas, and the structural elements of the Project, except that Landlord shall not be responsible to repair any damage or wear and tear which is the result of the negligence or willful misconduct of Tenant or Tenant’s Employees. In no event shall Landlord have any liability for interruption or interference in Tenant’s business, or for any other damages (whether direct or consequential), nor shall Rent be abated, on account of Landlord’s failure to make repairs or on account of Landlord’s performance of its maintenance and repair obligations under this Section 5.2, except as otherwise expressly provided in this Lease. Landlord’s obligations under this Section 5.2 shall not affect Landlord’s right to recover from Tenant the costs for any damage or repair to the Project for which Tenant is liable hereunder. Notwithstanding any statement to the contrary, Tenant shall retain its rights to abatement as specified in Paragraph 48 of the Addendum.

SECTION 6: BUILDING SERVICES.

6.1 Provision by Landlord. Landlord shall furnish the Premises with the following Basic Services, provided Landlord reserves the right to adopt such reasonable nondiscriminatory modifications and additions hereto as it deems appropriate.

6.1.1 Landlord shall, subject to limitations and provisions hereinafter set forth in this Section 6.1:

(a) Provide automatic elevator facilities on Monday through Friday from 7:00 a.m. to 6:00 p.m. (“Business Hours”), excepting Holidays, and have one automatic elevator available at all other times.

(b) Provide to the Premises, during the times specified in Section 6.1.1(a) hereof (and at other times for an additional charge to be fixed from time to time by Landlord, which charge is currently $65.00 per hour upon 24 business hours prior notice), heating, ventilation, and air conditioning (“HVAC”) as is necessary in Landlord’s judgment for the comfortable occupancy of Premises for general office purposes, including telephone, computer network and data storage systems installed with Landlord’s consent, subject to any energy conservation or other regulations which may be applicable from time to time. Landlord shall not be responsible for maintaining comfortable room temperatures if Tenant’s lighting and receptacle loads exceed those listed in Section 6.1.1(c) hereof, or if the Premises contain other heat generating equipment in excess of those normally found in space used for, or are used for other than, general office purposes.

(c) Furnish to the Premises electric current for routine lighting and the operation of general office machines such as personal computers, dictating equipment, and the like, which use standard electric power, which lighting shall not exceed the capacity of Building standard office lighting and receptacles. In no event shall the total electrical requirement for the Premises exceed 2.3 kilowatt-hours per month per RSF of the Premises, nor shall it exceed any limits imposed by any governmental or quasigovernmental authority. Tenant agrees, should its electrical installation or electrical consumption be in excess of the foregoing use or extend beyond the times specified in Section 6.1.1(a), to reimburse Landlord for the cost of such utilities. In such event, Landlord may install, at Tenant’s expense, any necessary meters for measuring Tenant’s utility consumption.

11

(d) Furnish water for drinking fountains, kitchen and restrooms provided by Landlord; but if Tenant requires, uses or consumes water for any purpose in addition to ordinary drinking, kitchen and restroom purposes, Landlord may, subject to the terms of Sections 6.1.2, install, at Tenant’s cost, a water meter and thereby measure Tenant’s water consumption for all purposes, and Tenant shall pay for such water usage at the actual cost for such service.

(e) Provide janitorial services to the Premises, Monday through Friday (except Holidays), such services to be consistent with janitorial services provided by landlords of similar high rise office buildings in the vicinity of the Project, provided that the Premises are used exclusively as offices and are kept reasonably in order by Tenant. Notwithstanding the foregoing, if the Premises are not used exclusively as offices, or if any Tenant Alterations require janitorial services in excess or such standard janitorial services as provided by Landlord, Tenant shall employ such persons as designated by Landlord to perform such additional janitorial services at Tenant’s expense and to the satisfaction of Landlord. In the alternative, and at Landlord’s sole option, Landlord may provide such additional janitorial services and Tenant shall promptly reimburse Landlord for the cost and expense of such additional janitorial services immediately upon receipt of any invoice for such services by Landlord. Tenant shall pay to Landlord the cost of removal of any of Tenant’s refuse and rubbish, to the extent that the same exceeds the refuse and rubbish usually attendant upon the use of the Premises for general office purposes.

6.1.2 With respect to any meter installed as contemplated in Sections 6.1.1(c) or (d) hereof, Tenant shall keep the meter and installation equipment in good working order and repair at Tenant’s own cost and expense, subject to the terms of Section 6.1.3. If Tenant is in Default, Landlord may cause the meter and equipment to be repaired and collect the Actual Cost thereof from Tenant. Tenant agrees to pay for utilities consumed as shown by the meter, as and when due according to billings therefor rendered, and in the event of Tenant’s default in making such payment, Landlord may, on five (5) days notice to Tenant, pay the charges and collect the same from Tenant as Additional Rent.

6.1.3 Except as part of the Tenant Improvements (which are subject to approval by Landlord pursuant to the terms of the Work Letter), no electrical equipment, air conditioning or heating units, or plumbing additions shall be installed, nor shall any changes to the Project’s HVAC, electrical or plumbing systems be made without prior written approval of Landlord, which consent shall be subject to Landlord’s reasonable discretion provided it will be reasonable for Landlord not to grant such consent if such changes would cause a material adverse effect on the Project’s Systems and Equipment or result in a material increase in costs to the Project. Landlord reserves the right to designate and/or approve the contractor to be used, provided such contractors designated by Landlord charge reasonable and comparable rates to other local contractors skilled in the same trade. Any permitted installations shall be made under Landlord’s supervision, Tenant shall pay any additional cost on account of any increased support to the floor load or additional equipment required for such installations, and such installations shall otherwise be made in accordance with Section 4 of the Lease.

6.1.4 Tenant will not, without prior written consent of Landlord, use any apparatus, machine or device in the Premises, including, without limitation, duplicating machines, computers, electronic data, processing machines, punch card machines, and machines using current in excess of 110 volts, which will in any way increase the amount of

12

electricity or water required to be furnished or supplied for use of the Premises .in excess of that which would be required for use of the Premises as general office space as of the date of the Lease, nor connect with electric current, except through existing electrical outlets in the Premises, any apparatus or device for the purpose of using electric current in excess of that now usually furnished or supplied for use of the Premises as general office space.

6.1.5 Landlord shall not provide reception outlets or television or radio antennas for television or radio broadcast reception, and Tenant shall not install any such equipment without prior written approval from Landlord, which approval may be withheld in Landlord’s sole discretion.

6.1.6 Tenant agrees to cooperate fully at all times with Landlord, and to abide by all regulations and requirements which Landlord may reasonably prescribe for the proper functioning and protection of the Project’s HVAC, electrical and plumbing systems. Tenant shall comply with all laws, statutes, ordinances and governmental rules, regulations and directives, whether or not having the force of law, now in force or which may hereafter be enacted or promulgated in connection with building services furnished to the Premises, including, without limitation, any governmental rule or regulation relating to the heating and cooling of the Project.

6.1.7 Landlord reserves the right to reduce, interrupt or cease services of the HVAC, elevator, plumbing, and electric systems, when necessary, by reason of accident, emergency or governmental regulations, or for repairs, additions, alterations or improvements to the Premises or the Project until the repairs, additions, alterations or improvements shall have been completed, and shall further have no responsibility or liability for failure to supply elevator facilities, plumbing, ventilating, air conditioning, or utility services, when prevented from so doing by strike, lockout or accident, or by any cause whatever beyond Landlord’s reasonable control, or by laws, rules, orders, ordinances, directions, regulations or requirement of any federal, state, county or municipal authority, labor trouble or any other cause whatsoever, or failure of gas, oil or other suitable fuel supply or inability by exercise of reasonable diligence to obtain gas, oil or other suitable fuel. It is expressly understood and agreed that any covenants, conditions, provisions or agreements in the Lease, or performance of any act or thing for the benefit of Tenant, shall not be deemed breached if Landlord is unable to furnish or perform the same by virtue of a strike, labor dispute, lockout, laws, rules, orders, ordinances, directions, regulations or requirements of any federal, state, county or municipal authority, accident, breakage, or repairs, or any other cause whatever beyond Landlord’s reasonable control, or where reasonable efforts are made to restore service, Tenant shall not be entitled to any abatement of rent or other compensation nor shall this Lease or any of Tenant’s obligations hereunder he affected by reason of such stoppage or interruption. Tenant is responsible for its own emergency power requirements.

6.1.8 Tenant shall not contract to obtain electricity from any provider other than the provider selected by Landlord without Landlord’s prior written consent, which may be withheld in Landlord’s sole discretion.

6.2 Additional Services. Should Tenant require, and should Landlord provide, Additional Services, Tenant agrees to pay on demand, as Additional Rent, the expense of all Additional Services, and Landlord shall be entitled to impose and collect charges for Additional Services. Prior to delivery of possession, or at any time during the Term that Tenant is consistently exceeding the Basic Services, Landlord may cause a switch and metering system to be installed at Tenant’s expense to measure the amount of

13

utility services consumed The cost of any such meters and their installation, maintenance, repair and replacement shall be paid by Tenant. All costs for such Additional Services shall be prorated among all tenants then requesting comparable Additional Services during such time periods.

6.3 Interruption. No interruption or malfunction of any Basic Services or Additional Services shall constitute an eviction or disturbance of Tenant’s use and possession of the Premises or a breach by Landlord of any of its obligations hereunder, nor render Landlord liable for damages or entitle Tenant to be relieved from any of its obligations under this Lease, specifically including, but not limited to, Tenant’s obligation to pay Rent, except as otherwise expressly provided in this Lease.

SECTION 7: ASSIGNMENT AND SUBLETTING.

7.1 Restriction on Assignment and Subletting. Tenant shall not,-directly or indirectly, by operation of law or otherwise, make any Transfer without obtaining Landlord’s written approval. Tenant shall provide Landlord with prior written notice (“Transfer Notice”) of the proposed Transfer, containing the items specified in Section 7.2 below. Landlord’s written approval of a Transfer shall not be reasonably withheld (except that Landlord shall have the right to exercise its sole, arbitrary and independent discretion, and not to act unreasonably, in respect of any request for consent to a lien, mortgage, deed of trust, encumbrance or hypothecation against the Premises, the Project or this Lease or Tenant’s interests hereunder). Within thirty (30) days after receipt of Tenant’s Transfer Notice and all the items specified in Section 7.2 below, Landlord shall notify Tenant of its election to (a) approve the requested Transfer; (b) disapprove the requested Transfer, or (c) exercise its recapture rights in accordance with Section 7.8. Any such attempted Transfer without the approval of the Landlord shall be null and void and of no effect. Tenant shall, on demand of Landlord, reimburse Landlord for all Landlord’s reasonable costs, including attorney fees, incurred by Landlord in obtaining advice, reviewing documents, and preparing documentation for each requested Transfer.

7.2 Documentation Required. The Transfer Notice shall be accompanied by each of the following:

(a) A copy of all proposed Transfer Documents.

(b) A statement setting forth the name, address and telephone number of the Transferee, and all principal owners of the Transferee.

(c) Current financial information regarding the proposed Transferee, including a statement of financial condition.

(d) For any sublease, a description of the portion of the Premises to be sublet.

(e) Any other information reasonably required by Landlord, which will enable Landlord to determine the financial responsibility, character, and reputation of the proposed Transferee, nature of such Transferee’s business and proposed use of the Premises or portion thereof.

7.3 Entity Tenant. If Tenant or any Guarantor is a corporation the stock of which is not actively publicly traded on a national securities exchange, or is a partnership,

14

limited liability company or unincorporated association, or other entity, the transfer, assignment or hypothecation of any stock or direct or indirect interest in such corporation, partnership limited liability company, association, or other entity or its assets in the aggregate in excess of twenty-five percent (25%) shall be deemed a Transfer within the meaning of this Section.

7.4 Permitted Transfers. Notwithstanding anything to the contrary contained in this Lease, neither (i) an assignment or transfer of this Lease as a result of a merger, a consolidation, public offering, and/or sale of all of Tenant’s capital stock and/or assets, nor (ii) an assignment of this Lease to an Affiliate of Tenant, shall require the prior consent of Landlord, provided, however, the same shall not be binding on Landlord until a fully executed copy of such assignment and/or assumption of this Lease by the assignee shall have been delivered to landlord; and further, provided, that: (a) Tenant shall not then be in Default under this Lease beyond expiration of any applicable notice, grace or cure period; (b) in each instance, the succeeding entity shall assume in writing all of the obligations of this Lease on the part of Tenant; (c) in the case of (i) above, such entity has a tangible net worth of not less than that of Tenant as of the date of the execution of this Lease; (d) in the case of (ii) above, any such assignee in possession of the Premises shall, during such possession, remain an Affiliate of Tenant; and (e) such assignment or transfer shall in no manner relieve Tenant of any of the obligations undertaken by it under this Lease. Tenant shall submit such information as Landlord may reasonably require concerning all of the foregoing for Landlord’s files.

7.5 Reasonable Disapproval. Landlord shall not be deemed to have unreasonably withheld approval a Transfer if consent to such Transfer is conditioned on any of the following grounds:

7.5.1 The business of the proposed Transferee and its use of the Premises shall not conflict with any exclusive use granted to any other tenant of the Project.

7.5.2 The proposed Transferee must be reputable and of good character.

7.5.3 The proposed Transferee shall have a net worth sufficiently large and liquid for the proposed Transferee to meet its obligations under this Lease.

7.5.4 The subtenant or assignee will be bound and subject to Tenant’s obligations (other than Base Rent) under the Lease relating to the portion of the Premises transferred.

7.5.5 The proposed Transferee shall not be a governmental entity or agency, provided such governmental entity or agency is not already a direct tenant in the Project, or any other type of institution, or agency that increases the traffic flow to, from or within the Project, or increases the use of the other facilities of the Project or imposes an extra burden upon Landlord with respect to furnishing the services referred to in this Lease.

7.5.6 There does not then exist any Default by Tenant under this Lease or any nonpayment or nonperformance by Tenant under this Lease which, with the passage of time and/or the giving of notice, would constitute a Default.

7.5.7 The proposed Transferee is not a tenant in the Project nor has it negotiated with Landlord for a lease of space within the Project for a period of six months.

15

7.6 Continuing Obligations.

7.6.1 Notwithstanding any Transfer, Tenant and each Guarantor shall remain fully liable for the performance of all obligations contained in this Lease. Any act or omission of a Transferee that violates any Lease obligations shall be a Default by Tenant.

7.6.2 Landlord shall have the right to approve the terms of each Transfer authorized by Landlord.

7.7 Transfer Premium. In the event of a Transfer, 50% of the Excess Consideration (as hereinafter defined) received by Tenant from or in respect of such Transfer shall be paid to Landlord (which amount is to be prorated where a part of the Premises is subleased) as Additional Rent. Tenant shall pay the Excess Consideration to Landlord at the end of each calendar year during which Tenant collects any Excess Consideration. Each payment shall be sent with a detailed statement showing: (i) the total consideration paid by the sublessee or assignee and/or received by Tenant; and (ii) any exclusions from the Excess Consideration permitted by this Paragraph. Landlord shall have the right to audit Tenant’s books and records to verify the amount of Excess Consideration due to Landlord and the accuracy of the statement required herein. The term “Excess Consideration” shall mean an all Rent or other payments (consideration) received by Tenant from an assignment or sublease that is in excess of the Rent than payable by Tenant under this Lease (on a per square foot basis if less than all of the Premises are transferred), after deducting reasonable leasing commissions paid by Tenant and other reasonable out-of-pocket expenses paid by Tenant directly related to obtaining a sublessee or assignee (including, without limitation, reasonable attorneys’ fees and the cost of reasonable and customary tenant improvements).

7.8 Landlord’s Right to Recapture. Notwithstanding anything to the contrary contained in this Section 7, Landlord may elect to terminate this Lease as to the portion of the Premises sought to be subject to the Transfer, except that this Lease shall terminate only for the term contemplated by the proposed Transfer if the Transfer would be for a period ending more than one year before the end of the Term. If Landlord exercises its right to terminate this Lease under this Section 7.8. Landlord shall be free to lease the Premises or any portion thereof (or of other premises within the Project) to any third party, including, without limitation, any third party identified by Tenant in its Transfer Notice, and Tenant shall not be entitled to any compensation, or to any portion of the rent or other consideration received by Landlord from such third party or otherwise, as a result thereof. Furthermore, Landlord’s exercise of its termination right shall not be constructed to impose any liability on Landlord with respect to any real estate brokerage, finders’, or other fee, commission or other compensation that Tenant may incur in connection with its proposed transaction.

7.9 Landlord’s Rights to Transfer. Landlord shall have the right to sell, transfer, hypothecate or assign any or all of its rights and obligations under this Lease. Upon the transfer of all of Landlord’s interest under this Lease, all liabilities and other obligations of the Landlord arising on or after the date of the transfer shall be the sole responsibility of the transferee. The transferor is hereby released from any claim with respect thereto upon the assumption of the obligations of Landlord hereunder by the transferee.

16

SECTION 8: INSURANCE/INDEMNITY.

8.1 Policies. All insurance required to be carried by Tenant hereunder shall be issued by insurance companies qualified to do business in the State of California and rated A:XII or better in the most current issue of “Best’s Key Rating Guide.” Current, original certificates evidencing the existence and amounts of such insurance shall be delivered to Landlord by Tenant at least 30 days prior to Tenant’s taking occupancy of the Premises, and the expiration of any policy required hereunder. No policy shall be subject to cancellation or modification except after not less than 30 days’ written notice to Landlord and any Lender.

8.2 Tenant’s Insurance. During the Term, Tenant shall, at Tenant’s sole expense, procure and maintain the following insurance:

8.2.1 “Special Form” (formerly known as “All Risk”) insurance, including fire, extended coverage, sprinkler leakage (including earthquake sprinkler leakage), vandalism and malicious mischief, covering all Tenant Improvements, Tenant Alterations, and any and all Personal Property, in an amount not less than 100% of their actual replacement cost. The proceeds of such insurance shall be used for the repair or replacement of the property insured, except that in the event of a loss occurring after the last 6 months of the Term, the proceeds attributable to the Tenant Improvements and Tenant Alterations shall be paid and belong to Landlord, and the proceeds attributable to the Personal Property shall be paid and belong to Tenant.

8.2.2 ISO “Occurrence Form” commercial general liability insurance for injury to or death of any person and damage to property in connection with the construction of improvements on the Premises and with Tenant’s use of and operations in the Premises. Such insurance shall have limits of not less than Two Million Dollars ($2,000,000) per incident, not less than Two Million Dollars ($2,000,000) per annual aggregate. Tenant’s policy of liability insurance shall include an endorsement naming Landlord, and any Lender designated by Landlord, as additional insureds under ISO endorsement CG 2011 “Additional Insured Managers or Lessors of Premises”.

8.2.3 Workers’ compensation insurance in the amount required by the state in which the Premises are located, and Employers’ liability with limits of $1,000,000 for each accident, each employee, and each illness pertaining to Tenant’s employees; and

8.2.4 Tenant shall carry and maintain during the Term (including any option periods, if applicable) increased amounts of the insurance required to be carried by Tenant pursuant to this Article 8 and such other reasonable types of insurance coverage and in such reasonable amounts covering the Premises and Tenant’s operations therein, as may be required by Landlord from time to time.

8.3 Waiver of Subrogation. So long as the same does not impair any insurance coverage required hereunder, Tenant and Landlord each hereby waive: any rights of recovery against the other and the officers, agents, and representatives of the other for injury or loss covered by insurance, including any deductible amounts under said insurance, to the extent of the injury or loss covered thereby, and on behalf of their respective insurance companies, any right of subrogation that either may have against the other. All policies of insurance which Tenant or Landlord actually carries and/or is required to carry pursuant to this Lease shall include a clause or endorsement denying the

17

insurer any right of subrogation against Landlord and/or Tenant, so long as the same can be obtained from an insurance company meeting the standards set forth in Section 8.1 above.

8.4 Tenant’s Failure to Insure. If Tenant fails to maintain any insurance required by this Lease, Tenant shall be liable for any loss or cost resulting from that failure. Landlord may, but shall not be obligated to, provide for such insurance at Tenant’s cost. This Section 8.5 shall not waive any of Landlord’s other rights and remedies under this Lease. Tenant shall not keep, use, sell or offer for sale in or upon the Premises any article, which may be prohibited by the standard form of any insurance policy required hereunder. Tenant agrees to pay for any increase in premiums for insurance referred to herein that may be charged during the Lease Term on the amount of such insurance which may be carried by Landlord on the Premises or the Project, resulting from any activity on or in connection with the Premises, whether or not Landlord has consented to the same.

8.5 Indemnity.

(a) Tenant’s Indemnity. Except to the extent arising from Landlord’s willful misconduct or gross negligence, Tenant hereby indemnifies Landlord and Landlord’s Employees, and shall forever save and hold Landlord and Landlord’s Employees harmless, from and against all obligations, liens, claims, liabilities, costs (including, but not limited, to all attorneys’ and other professional fees and expenses), actions and causes of action, threatened or actual, which Landlord may suffer or incur arising out of or in connection with Tenant’s and Tenant’s Employees actions and omissions relating to this Lease, including without limitation the use by Tenant and Tenant’s Employees of the Premises, the conduct of Tenant’s business, any activity, work or things done, permitted or suffered by Tenant in or about the Premises or the Project, Tenant’s or Tenant’s Employees’ failure to comply with any applicable Law, or any negligence or willful misconduct of Tenant or any of Tenant’s Employees. In case of any claim, demand, action or cause of action, threatened or actual, against Landlord, upon notice from Landlord, Tenant shall defend Landlord at Tenant’s expense by counsel reasonably satisfactory to Landlord. If Tenant does not provide such a defense against any and all claims, demands, actions or causes of action, threatened or actual, then Tenant shall, in addition to the above, pay Landlord the expenses and costs incurred by Landlord in providing and preparing such defense, and Tenant agrees to cooperate with Landlord in such defense, including, but not limited to, the providing of affidavits and testimony upon request of Landlord.

(b) Landlord’s Indemnity. Except to the extent arising from Tenant’s willful misconduct or negligence, Landlord hereby indemnifies Tenant and Tenant’s Employees, and shall forever save and hold Tenant and Tenant’s Employees harmless, from and against all obligations, liens, claims, liabilities, costs (including, but not limited, to all attorneys’ and other professional fees and expenses), actions and causes of action, threatened or actual, which Tenant may suffer or incur arising out of or in connection with any gross negligence or willful misconduct of Landlord or any of Landlord’s Employees in or about the Project, in each instance during the Term of this Lease. In case of any claim, demand, action or cause of action, threatened or actual, against Tenant to which the foregoing indemnity applies, upon notice from Tenant, Landlord shall defend Tenant at Landlord’s expense by counsel

18

reasonably satisfactory to Tenant. If Landlord does not provide such a defense against any and all claims, demands, actions or causes of action, threatened or actual, then Landlord shall, in addition to the above, pay Tenant the expenses and costs incurred by Tenant in providing and preparing such defense, and Landlord agrees to cooperate with Tenant in such defense, including, but not limited to, the providing of affidavits and testimony upon request of Tenant.

(c) Insurers Not Relieved. Tenant’s agreement to indemnify Landlord and Landlord’s agreement to indemnify Tenant are not intended to and shall not relieve any insurance carrier of its obligations under policies required to be carried pursuant to the provisions of this Lease, to the extent such policies cover, or if carried, would have covered the matters, subject to the parties’ respective indemnification obligations; nor shall they supersede any inconsistent agreement of the parties set forth in any other provision of this Lease.

8.6 Landlord’s Insurance. Landlord shall insure the Project during the Term against damage by fire, and standard extended coverage perils, and shall carry commercial general liability insurance insuring Landlord, all in such amounts and with such deductibles as Landlord may determine from time to time in its sole discretion. None of the insurance carried by Landlord shall name Tenant as an insured or otherwise be for the benefit of Tenant, as a third party beneficiary or otherwise.

8.7 Tenant’s Assumption of Risk. Except in the case of willful misconduct or gross negligence of Landlord, Tenant, as a material part of the consideration to Landlord, hereby assumes all risk of damage to property or injury to persons, in, upon or about the Premises from any cause, and Tenant hereby waives all related claims against Landlord. Without implying any obligation of Landlord or Landlord’s Employees to accept any of Tenant’s property for safekeeping, Landlord and Landlord’s Employees shall not be liable for any damages to property entrusted to Landlord or Landlord’s Employees, nor for loss of or damage to any property in or about the Premises by theft or otherwise, nor for any injury or damage to persons or property resulting from any cause whatsoever unless caused solely by the gross negligence of Landlord or Landlord’s Employees. Landlord and Landlord’s Employees shall not be liable for any latent defect in the Premises or in the Project. Tenant shall give prompt notice to Landlord in case of fire or accidents in the Premises or in the Project.

8.8 Exemption of Landlord. In the event that Landlord is prevented or delayed from making any repairs or furnishing any services or performing any other covenant or duty to be performed by Landlord hereunder by reason of any Force Majeure, Landlord shall not be liable to Tenant therefor, nor shall Tenant be entitled to any abatement of Rent, or to claim an actual or constructive, total or partial eviction from the Premises. Except as provided in Section 16.3, the parties hereby agree that neither party shall be liable to the other for any injury to the other’s business or any loss of income therefrom or for damage to the furniture, fixtures, equipment and other property of Tenant or Tenant’s Employees from any cause whatsoever. Landlord shall not be liable for any damage, destruction or loss of property or for any injury or death to any person arising from any act or neglect of any other tenant or other occupant or user of the Project, or any matter beyond the reasonable control of Landlord.

19

SECTION 9: DAMAGE OR DESTRUCTION.

9.1 Damage Generally. If any part of the Premises or the Project is damaged by fire or other casualty and the damage affects Tenant’s use or occupancy of the Premises, Tenant shall give prompt notice to Landlord. To the extent that Landlord has available insurance proceeds in connection with such casualty, Landlord shall repair such damage with reasonable diligence. If any substantial part of the Premises is rendered untenantable by reason of damage not caused by the willful misconduct of Tenant or any of Tenant’s Employees, then the Base Rent hereunder shall thereafter abate in proportion to the rentable area of the Premises rendered untenantable until the date when such part of the Premises shall have been delivered to Tenant with Landlord having completed its obligations hereunder, unless Landlord shall make available to Tenant during the period of such repair other space in the Project reasonably suitable for the temporary conduct of Tenant’s business. Landlord shall not be liable for any inconvenience or annoyance to Tenant or injury to the business of Tenant resulting from such damage or repair, construction or restoration. Tenant waives the provisions of California Civil Code Sections 1932(2) and 1933(4) and the provisions of any other Law allowing Tenant to make repairs and deduct the cost thereof from any Rent. Except as provided herein, Landlord shall restore or repair the Premises diligently and to their condition immediately prior to the damage. Landlord shall not be liable for delays in repair or restoration caused by Force Majeure.

9.2 Exceptions to Obligation to Rebuild. Despite Section 9.1, this Lease may be terminated by Landlord in any of the following situations:

(a) If substantial alteration or reconstruction of the Project shall, in the opinion of Landlord, be required as a result of damage by fire or other casualty; or

(b) If all available insurance proceeds are materially less than 100% of the cost of restoration;

(c) If the damage to the Project or Premises is caused by the willful misconduct of Tenant or any of Tenant’s Employees; or

(d) If existing laws do not permit the Premises to be restored to substantially the same condition as they were in immediately before the destruction.

Any such election to terminate this Lease shall be exercised by notice from Landlord to Tenant served within 60 days after the date of the damage. The notice shall specify the date of termination, which shall be at least thirty (30) days after notice is given. In the event Landlord gives such notice of termination, this Lease shall terminate as of the date specified, and all Base Rent (to the extent not otherwise abated) shall be prorated to of the later of the date of termination or Tenant’s vacation of the Premises.

9.3 Extent of Landlord’s Obligation to Repair. Subject to Landlord’s right to terminate as set forth above, Landlord shall make repairs to the structural elements and the shell of the Premises at Landlord’s expense. The repair and restoration of Tenant Alterations, Tenant Improvements and the Personal Property shall be the sole obligation of Tenant. Tenant shall commence such repair and restoration and the installation of its stock-in-trade, fixtures, furniture, furnishings and equipment prompt)y upon delivery to it

20

of possession of the Premises and shall diligently prosecute any such work and installation to completion. In no event shall Landlord have any obligation to make repairs or restoration to the extent all insurance proceeds actually received by Landlord are insufficient to pay for the same. However, at Landlord’s option, Landlord’s contractor shall perform all reconstruction work in the Premises at Tenant’s expense. In the event that Landlord does not elect to have Landlord’s contractor repair all of the damage or destruction, Tenant shall undertake the repair and restoration of Tenant Improvements and Tenant Alterations in a diligent, first class manner in accordance with the provisions Section 4 hereof.

9.4 Near End of Term. Notwithstanding anything to the contrary contained in this Section 9, Landlord shall not have any obligation of any nature to repair, reconstruct or restore the Premises when the damage resulting from any casualty occurs during the last twelve (12) months of the Term and Landlord reasonably determines that such damage will take more than six (6) months to repair. In such event, Landlord shall have the right to cancel this Lease within sixty (60) days after the occurrence of such damage or destruction. If Landlord does not cancel this Lease, Tenant shall be entitled to an abatement of Base Rent in accordance with Section 9.

9.5 Tenant’s Right to Terminate. If the Premises are rendered unusable for the conduct of Tenant’s business by reason of such damage, Landlord shall give Tenant a reasonable estimate of the time required for repair as soon as possible after the date of damage. If Landlord reasonably estimates that the time needed for repair will extend more than 240 days after the date of damage, or if Landlord fails to complete repairs within thirty (30) days of the estimated completion date, then Tenant shall have the right to cancel this Lease by giving written notice within fifteen (15) days after receipt of Landlord’s estimate, such cancellation effective ten (10) days after the date such notice of cancellation is given.

SECTION 10: CONDEMNATION AND OTHER TAKINGS.

10.1 Condemnation. If any part of the Project shall be taken for public or quasi-public use by the right of eminent domain, or if the same is transferred by agreement in connection with such public or quasi-public use or under threat of eminent domain (collectively, a “Taking”), Landlord shall have the option, exercisable within 30 days after the effective date of the Taking, to terminate this Lease as of the date possession is acquired by the condemning authority. Tenant may terminate this Lease by reason of a Taking if, and only if, there is a Taking of a portion of the Premises to such an extent to substantially impair Tenant’s use of the Premises. Tenant shall have no right to terminate this Lease following any Taking except as set forth in the preceding sentence. Tenant hereby waives the benefit of California Code of Civil Procedure Section 1265.130 and any successor statute or other statute of similar import, it being the intent of the parties hereto that the terms of this Lease shall govern in the event of any Taking.

10.2 Partial Taking. In the event of a Taking of a portion of the Premises which does not result in a termination of this Lease under Section 10.1 above, all Base Rent shall be equitably abated based on the square footage that is subject to the Taking.

10.3 Restoration. In the event of a Taking of a portion of the Premises which does not result in a termination of this Lease under Section 10.1 above, Landlord shall proceed to restore the remaining portion of the Premises (other than customary office

21

Tenant Alterations approved by Landlord or any of the Personal Property) as nearly as practicable to its condition prior to the Taking. However, Landlord shall be obligated to restore at its expense as provided herein only to the extent of condemnation proceeds awarded in connection with the Taking and allocated to restoration costs. Notwithstanding the foregoing, if the costs of restoration exceed the portion of the condemnation award allocated to restoration costs, Landlord may elect to terminate this Lease unless Tenant elects to pay such excess.

10.4 Award. In the event of any Taking of all or a part of the Project, Landlord shall be entitled to receive the entire award in the condemnation proceedings, and Tenant hereby assigns to Landlord, any and all right, title and interest of Tenant in or to any such award, and Tenant shall be entitled to receive no part of such award. Despite the foregoing, Tenant shall not be precluded from claiming from the condemning authority any compensation to which Tenant may otherwise lawfully be entitled in respect of Tenant’s tangible Personal Property, or for relocating to new space, or for the unamortized portion of any tenant improvements installed in the Premises to the extent they were paid for by Tenant.

SECTION 11: DEFAULT BY TENANT.

The occurrence of any one or more of the following shall be deemed a “Default” by Tenant and a material breach, of this Lease:

11.1 Abandonment. Vacation or abandonment of the Premises by Tenant for a continuous period in excess of 5 consecutive business days, or failure or refusal to accept tender of possession of the Premises. coupled in each instance with a failure to pay Rent.

11.2 Nonpayment of Rent. Tenant’s failure to pay any Rent due or to make any other monetary payment imposed under the terms of this Lease, for a period of three (3) business days after written notice from Landlord.

11.3 Non-delivery of Documents. Tenant’s failure to execute and deliver any documents required by this Lease within the time periods expressly specified, where such failure continues three (3) business days after delivery by Landlord of written notice of failure to Tenant.

11.4 Other Obligations. Tenant’s failure to perform any other obligation under this Lease (including the Rules and Regulations) for thirty (30) days after written notice from Landlord; however, if more than thirty (30) days are reasonably required for cure, Tenant shall not be in default hereunder if Tenant shall promptly (and in any event within five (5) days after receipt of Landlord’s notice) commence the cure of the default and diligently prosecute the same to completion, so long as cure is completed within ninety (90) days after receipt of Landlord’s notice.

11.5 General Assignment. A general assignment by Tenant or any Guarantor for the benefit of creditors.

11.6 Bankruptcy. The filing of any voluntary petition in bankruptcy by Tenant or any Guarantor, or the filing of an involuntary petition by Tenant’s creditors or the creditors of any Guarantor, which involuntary petition remains undischarged for a

22

period of sixty (60) days. In the event that under any Law the trustee in bankruptcy or Tenant has the right to affirm this Lease and continue to perform the obligations of Tenant hereunder, such trustee or Tenant shall, in such time period as may be permitted by the bankruptcy court having jurisdiction, cure all Defaults of Tenant outstanding as of the date of the affirmance of this Lease and provide to Landlord such adequate assurances as may be necessary to ensure Landlord of the continued performance of Tenant’s obligation under this Lease.

11.7 Receivership. The employment of a receiver to take possession of substantially all of the assets and business of Tenant or any Guarantor or the Premises, if such receivership remains undissolved for a period of thirty (30) days after creation thereof.

11.8 Attachment. The attachment, execution or other judicial seizure of all or substantially all of the assets of Tenant or any Guarantor or the Premises, if such attachment or other seizure remains undismissed or undischarged for a period of thirty (30) days after the levy thereof.

11.9 Insolvency. The admission by Tenant or any Guarantor in writing of its inability to pay its debts as they become due, the filing by Tenant or any Guarantor of a petition seeking any reorganization, arrangement, composition, readjustment, liquidation, dissolution or similar relief under any present or future Law providing for debtor relief, the filing by Tenant or any Guarantor of an answer admitting or failing timely to contest a material allegation of a petition filed against Tenant or any Guarantor in any such proceeding or, if within thirty (30) days after the commencement of any proceeding against Tenant or any Guarantor seeking any reorganization, or arrangement, composition, readjustment, liquidation, dissolution or similar relief under any present or future Law, such proceeding shall not have been dismissed.

11.10 Guarantor. The default under or termination or cancellation of any guaranty of this Lease by any Guarantor, or the written assertion by any Guarantor that it is not bound by the terms of its guaranty of this Lease.

11.11 Misrepresentation. Any material misrepresentation herein by Tenant, or any material misrepresentation or omission in any financial statements or other materials provided to Landlord by or on behalf of Tenant or any Guarantor in connection with negotiating or entering into this Lease, or provided by or on behalf of Tenant, or a Guarantor, or by any Transferee in connection with any Transfer.

Any notice given pursuant to this Section 11 is in lieu of any written notice required by statute or law, including any notice required under Sections 1161 and 1161.1 of the California Code of Civil Procedure (or any similar or successor law), and Tenant waives (to the fullest extent permitted by law) the giving of any notice other than that provided for in this Section 11. To the extent the foregoing is not permitted by law, any notice under this Section 11 shall run concurrently with, and not in addition to, any similar time periods prescribed by applicable law.

SECTION 12: LANDLORD’S REMEDIES UPON DEFAULT.

12.1 Termination. In the event of a Default, Landlord shall have the right to terminate this Lease. The election to terminate may be stated in any notice served upon

23

Tenant with respect to the Default. After the termination, Landlord may, pursuant to applicable law, enter the Premises and remove Tenant, any other person occupying the same, and any or all Personal Property. Any such repossession shall be without prejudice to any of the remedies that Landlord may have under this Lease, or at law or in equity, by reason of the Default or the termination.

12.2 Continuation After Default. In the event of the occurrence of a Default, this Lease shall continue in effect for so long as Landlord does not terminate Tenant’s right to possession under Section 12.1, and Landlord may enforce all its rights and remedies under this Lease, including (but without limitation) the right to recover Rent as it becomes due. Landlord has the remedy described in California Civil Code Section 1951.4 (lessor may continue to lease in effect after lessee’s breach and abandonment and recover rent as it becomes due, if lessee has right to sublet or assign, subject only to reasonable limitations). Landlord shall further have all remedies under any other applicable code section. Acts of maintenance, preservation or efforts to lease the Premises, or the appointment of receiver upon application of Landlord to protect Landlord’s interest under this Lease, shall not constitute an election to terminate Tenant’s right to possession in the absence of written notice to the contrary.