Exhibit 99.1

©2024 Sirius XM Holdings Inc. INVESTOR PRESENTATION SEPTEMBER 2024

2 ©2024 Sirius XM Holdings Inc. CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS This presentation contains "forward - looking statements" within the meaning of the Private Securities Litigation Reform Act of 19 95. Such statements include, but are not limited to, statements about future financial and operating results, our plans, objectiv es, expectations and intentions with respect to future operations, products and services; and other statements identified by word s s uch as "will likely result," "are expected to," "will continue," "is anticipated," "estimated," "believe," "intend," "plan," "pro jec tion," "outlook" or words of similar meaning. Such forward - looking statements are based upon the current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally beyond our control. Actual results and the timing of events may differ materiall y f rom the results anticipated in these forward - looking statements. The factors that could cause our results to differ materially from those described in the forward - looking statements can be foun d in Sirius XM Holdings Inc.'s Annual Report on Form 10 - K for the year ended December 31, 2023, which is filed with the Securities an d Exchange Commission (the "SEC") and available at the SEC's Internet site (http://www.sec.gov). The information set forth here in speaks only as of the date hereof, and we disclaim any intention or obligation to update any forward looking statements as a res ult of developments occurring after the date of this communication.

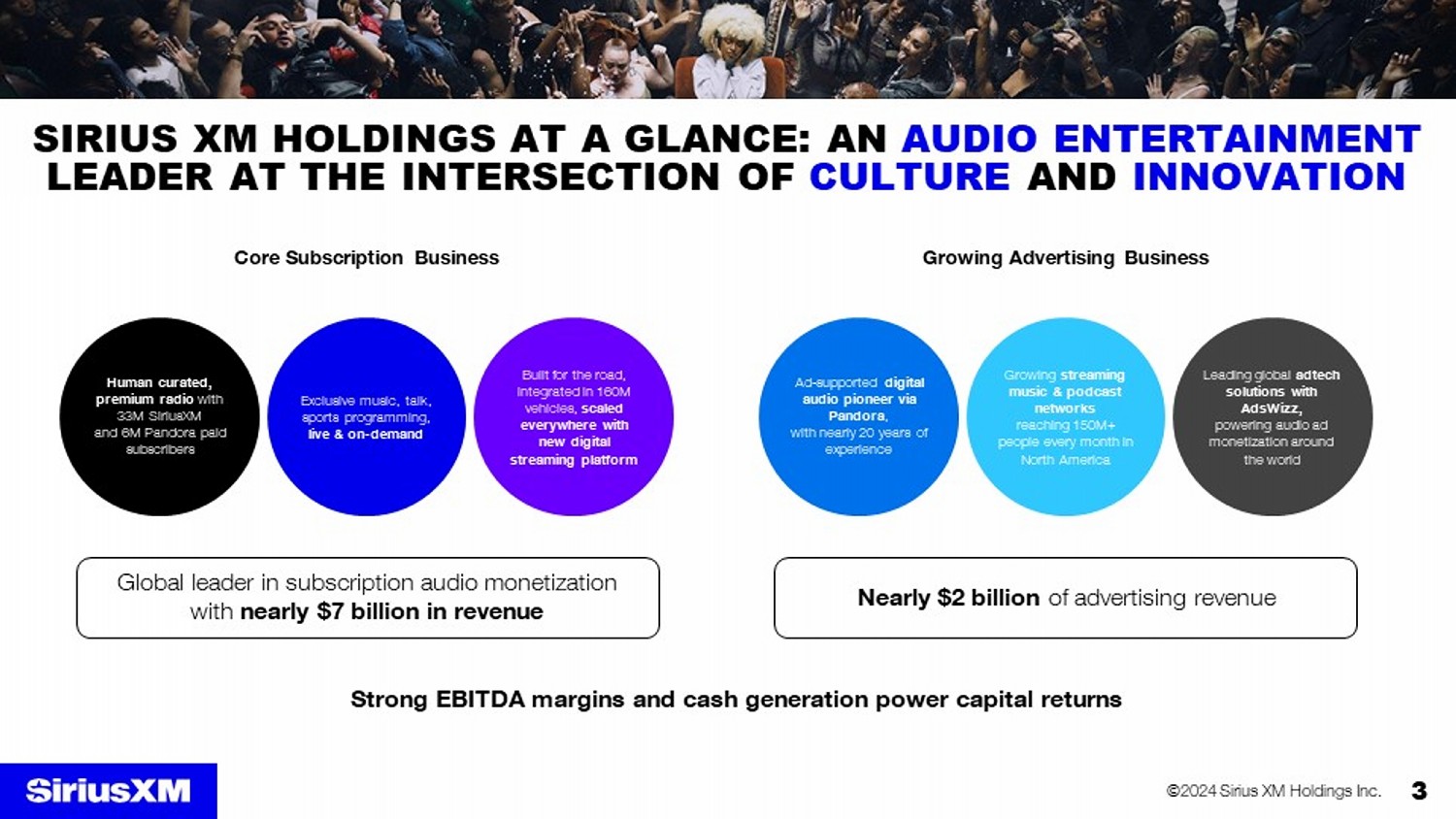

3 ©2024 Sirius XM Holdings Inc. SIRIUS XM HOLDINGS AT A GLANCE: AN AUDIO ENTERTAINMENT LEADER AT THE INTERSECTION OF CULTURE AND INNOVATION Core Subscription Business Strong EBITDA margins and cash generation power capital returns Global leader in subscription audio monetization with nearly $7 billion in revenue Growing Advertising Business Nearly $2 billion of advertising revenue Human curated, premium radio with 33M SiriusXM and 6M Pandora paid subscribers Exclusive music, talk, sports programming, live & on - demand Built for the road, integrated in 160M vehicles, scaled everywhere with new digital streaming platform Ad - supported digital audio pioneer via Pandora , with nearly 20 years of experience Growing streaming music & podcast networks reaching 150M+ people every month in North America Leading global adtech solutions with AdsWizz, powering audio ad monetization around the world

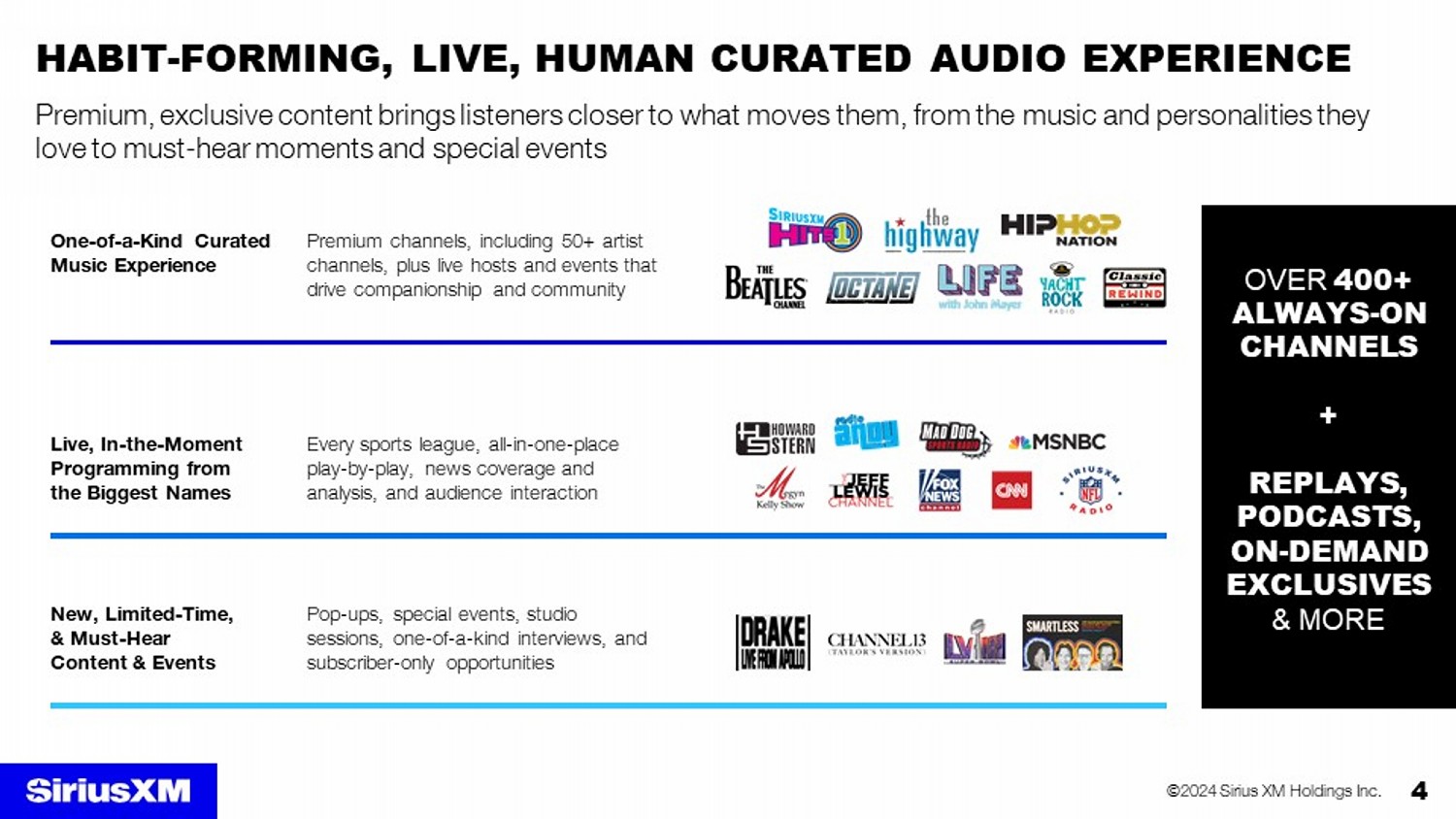

4 ©2024 Sirius XM Holdings Inc. Every sports league, all - in - one - place play - by - play, news coverage and analysis, and audience interaction Live, In - the - Moment Programming from the Biggest Names Pop - ups, special events, studio sessions, one - of - a - kind interviews, and subscriber - only opportunities New, Limited - Time, & Must - Hear Content & Events OVER 400+ ALWAYS - ON CHANNELS + REPLAYS, PODCASTS, ON - DEMAND EXCLUSIVES & MORE Premium channels, including 50+ artist channels, plus live hosts and events that drive companionship and community One - of - a - Kind Curated Music Experience HABIT - FORMING, LIVE, HUMAN CURATED AUDIO EXPERIENCE Premium, exclusive content brings listeners closer to what moves them, from the music and personalities they love to must - hear moments and special events

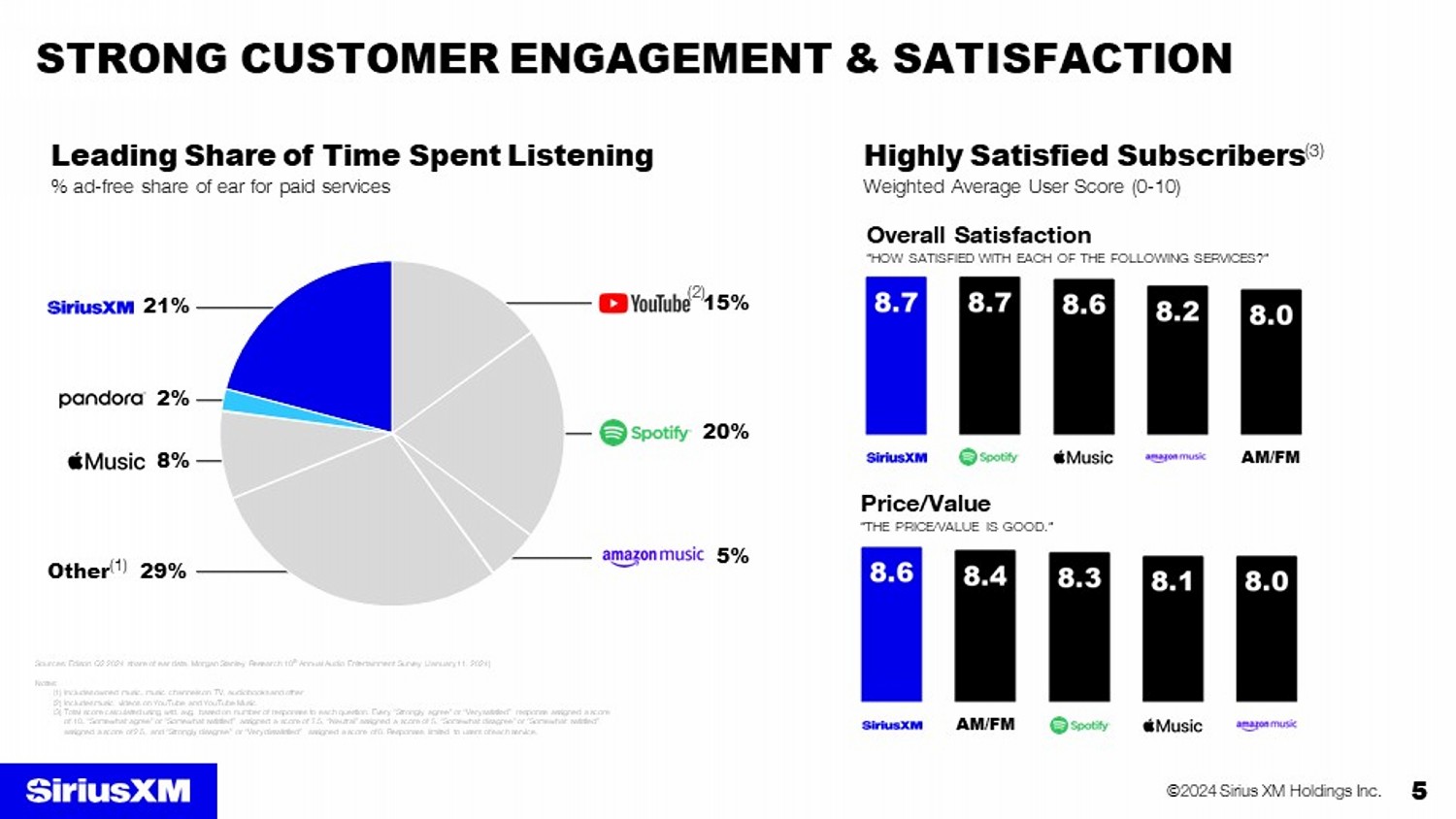

5 ©2024 Sirius XM Holdings Inc. STRONG CUSTOMER ENGAGEMENT & SATISFACTION Highly Satisfied Subscribers (3) Weighted Average User Score (0 - 10) AM/FM Price/Value “THE PRICE/VALUE IS GOOD.” AM/FM Overall Satisfaction “HOW SATISFIED WITH EACH OF THE FOLLOWING SERVICES?” Leading Share of Time Spent Listening % ad - free share of ear for paid services Sources: Edison Q2 2024 share of ear data, Morgan Stanley Research 10 th Annual Audio Entertainment Survey (January 11, 2024) Notes: (1) Includes owned music, music channels on TV, audiobooks and other (2) Includes music videos on YouTube and YouTube Music (3) Total score calculated using wtd. avg. based on number of responses to each question. Every “Strongly agree” or “Very satisfi ed” response assigned a score of 10, “Somewhat agree” or “Somewhat satisfied” assigned a score of 7.5, “Neutral” assigned a score of 5, “Somewhat disagree” or “Somewhat satisfied” assigned a score of 2.5, and “Strongly disagree” or “Very dissatisfied” assigned a score of 0. Responses limited to users of eac h service. 5% 20% 15% (2) Other (1) 29% 8% 21% 2%

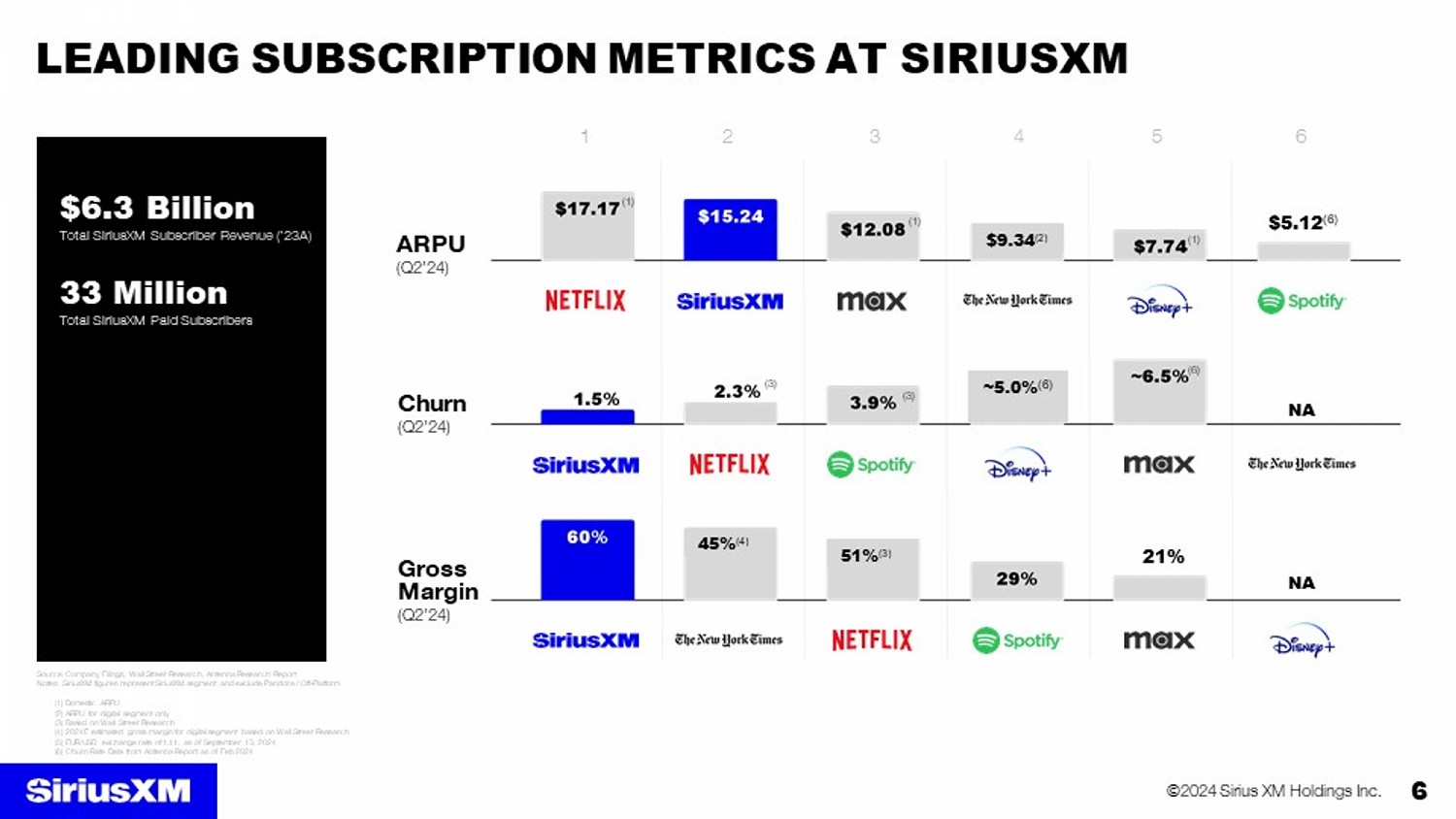

6 ©2024 Sirius XM Holdings Inc. LEADING SUBSCRIPTION METRICS AT SIRIUSXM 6 5 4 3 2 1 Source: Company Filings, Wall Street Research, Antenna Research Report Notes: SiriusXM figures represent SiriusXM segment and exclude Pandora / Off - Platform (1) Domestic ARPU (2) ARPU for digital segment only (3) Based on Wall Street Research (4) 2024E estimated gross margin for digital segment based on Wall Street Research (5) EUR/USD exchange rate of 1.11, as of September 13, 2024 (6) Churn Rate Data from Antenna Report as of Feb 2024 (1) (1) (2) (1) (6) ARPU (Q2’24) NA (3) (3) (4) (6) Churn (Q2’24) NA (5) Gross Margin (Q2’24) $6.3 Billion Total SiriusXM Subscriber Revenue (’23A) 33 Million Total SiriusXM Paid Subscribers $5.12 (6) 21% $9.34 (2) ~5.0% (6) 45% (4) 51% (3)

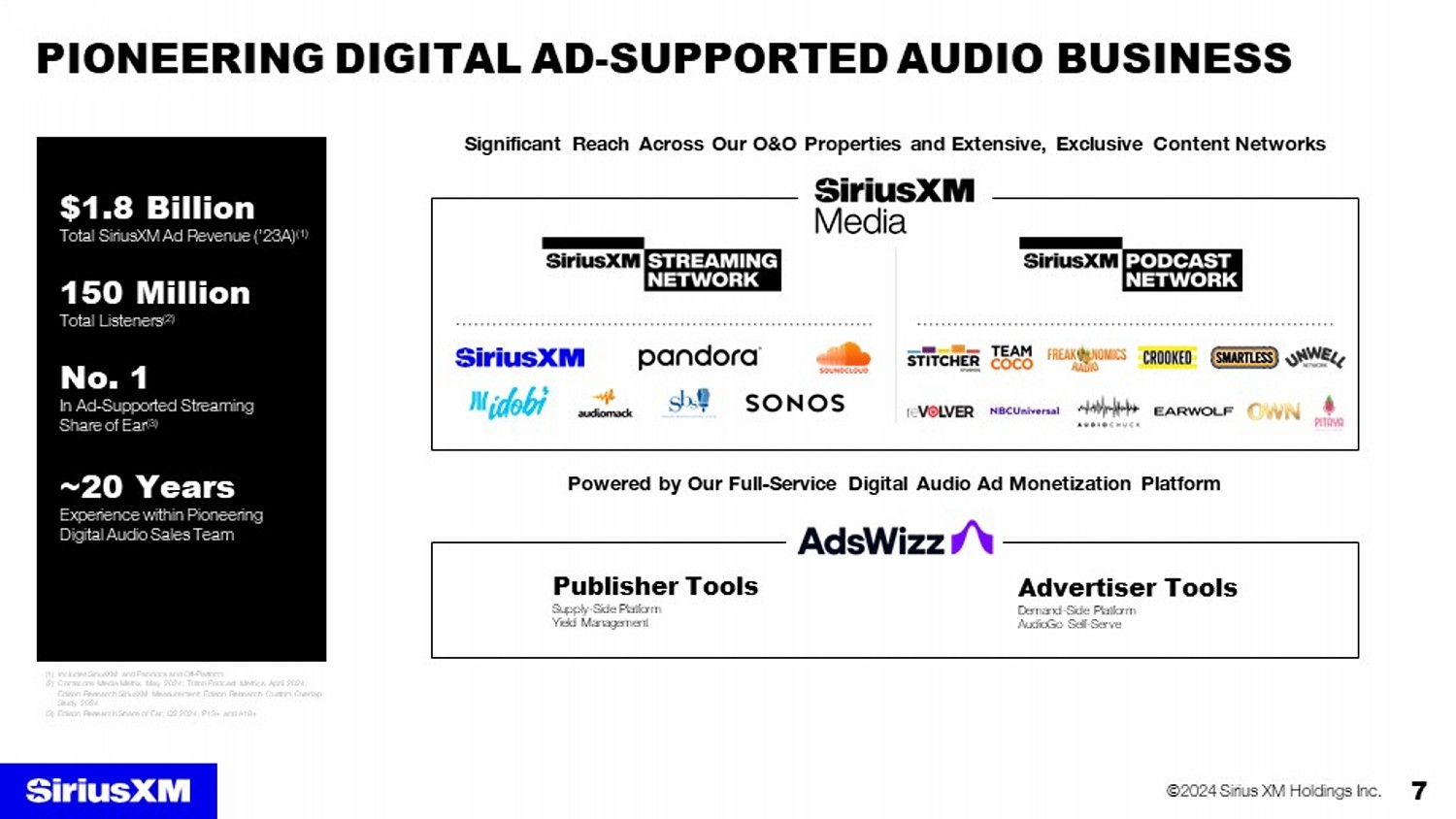

7 ©2024 Sirius XM Holdings Inc. PIONEERING DIGITAL AD - SUPPORTED AUDIO BUSINESS Significant Reach Across Our O&O Properties and Extensive, Exclusive Content Networks Powered by Our Full - Service Digital Audio Ad Monetization Platform Publisher Tools Supply - Side Platform Yield Management Advertiser Tools Demand - Side Platform AudioGo Self - Serve (1) Includes SiriusXM and Pandora and Off - Platform (2) Comscore Media Metrix, May 2024; Triton Podcast Metrics, April 2024; Edison Research SiriusXM Measurement; Edison Research Custom Overlap Study 2024 (3) Edison Research Share of Ear, Q2 2024, P13+ and A18+ $1.8 Billion Total SiriusXM Ad Revenue (’23A) (1) 150 Million Total Listeners (2) No. 1 In Ad - Supported Streaming Share of Ear (3) ~20 Years Experience within Pioneering Digital Audio Sales Team

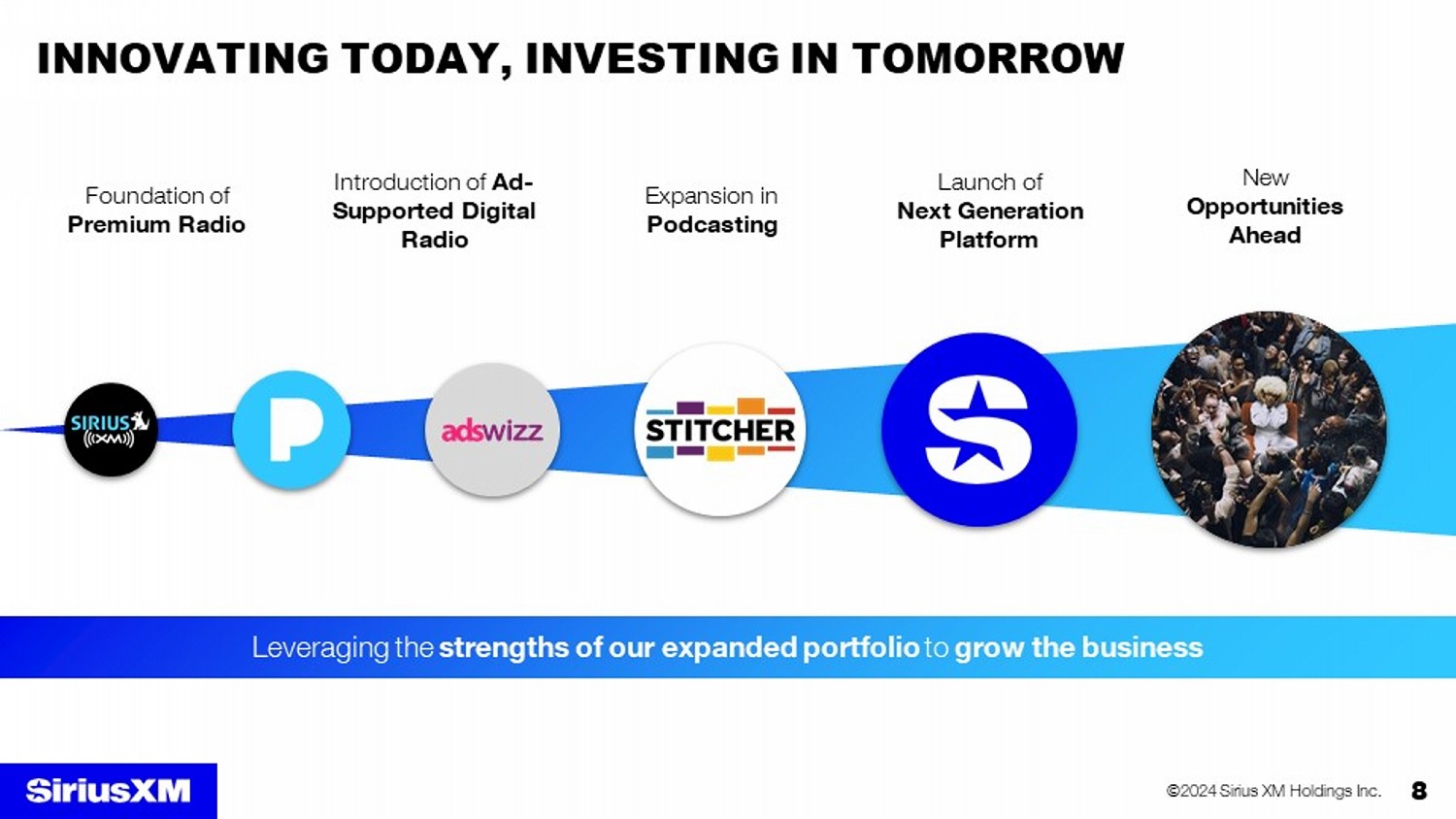

8 ©2024 Sirius XM Holdings Inc. INNOVATING TODAY, INVESTING IN TOMORROW Foundation of Premium Radio Introduction of Ad - Supported Digital Radio Expansion in Podcasting Launch of Next Generation Platform New Opportunities Ahead Leveraging the strengths of our expanded portfolio to grow the business

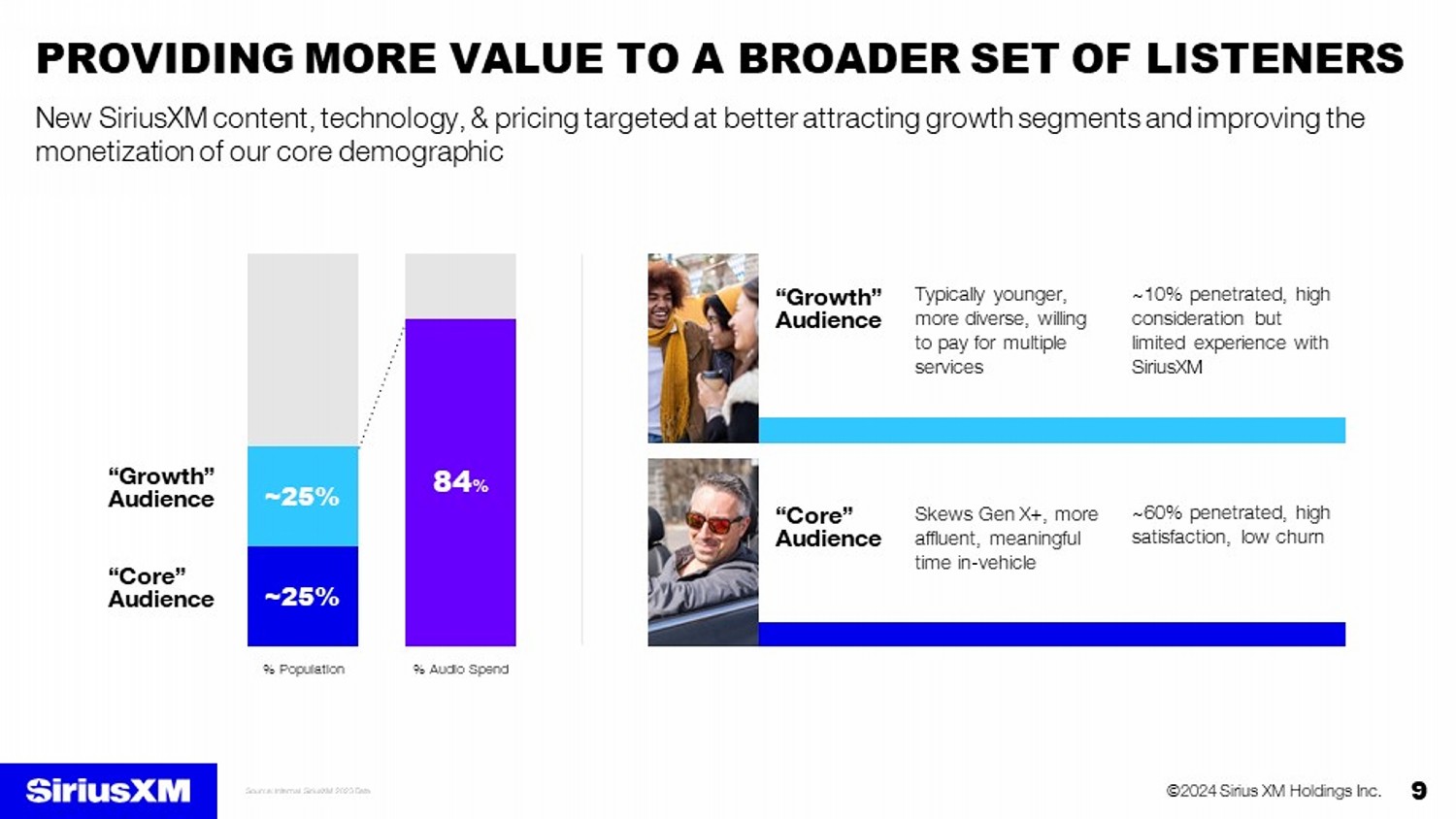

9 ©2024 Sirius XM Holdings Inc. “Growth” Audience “Core” Audience ~25% ~25% 84 % % Population % Audio Spend Skews Gen X+, more affluent, meaningful time in - vehicle ~60% penetrated, high satisfaction, low churn “Core” Audience Typically younger, more diverse, willing to pay for multiple services ~10% penetrated, high consideration but limited experience with SiriusXM “Growth” Audience PROVIDING MORE VALUE TO A BROADER SET OF LISTENERS New SiriusXM content, technology, & pricing targeted at better attracting growth segments and improving the monetization of our core demographic Source: Internal SiriusXM 2023 Data

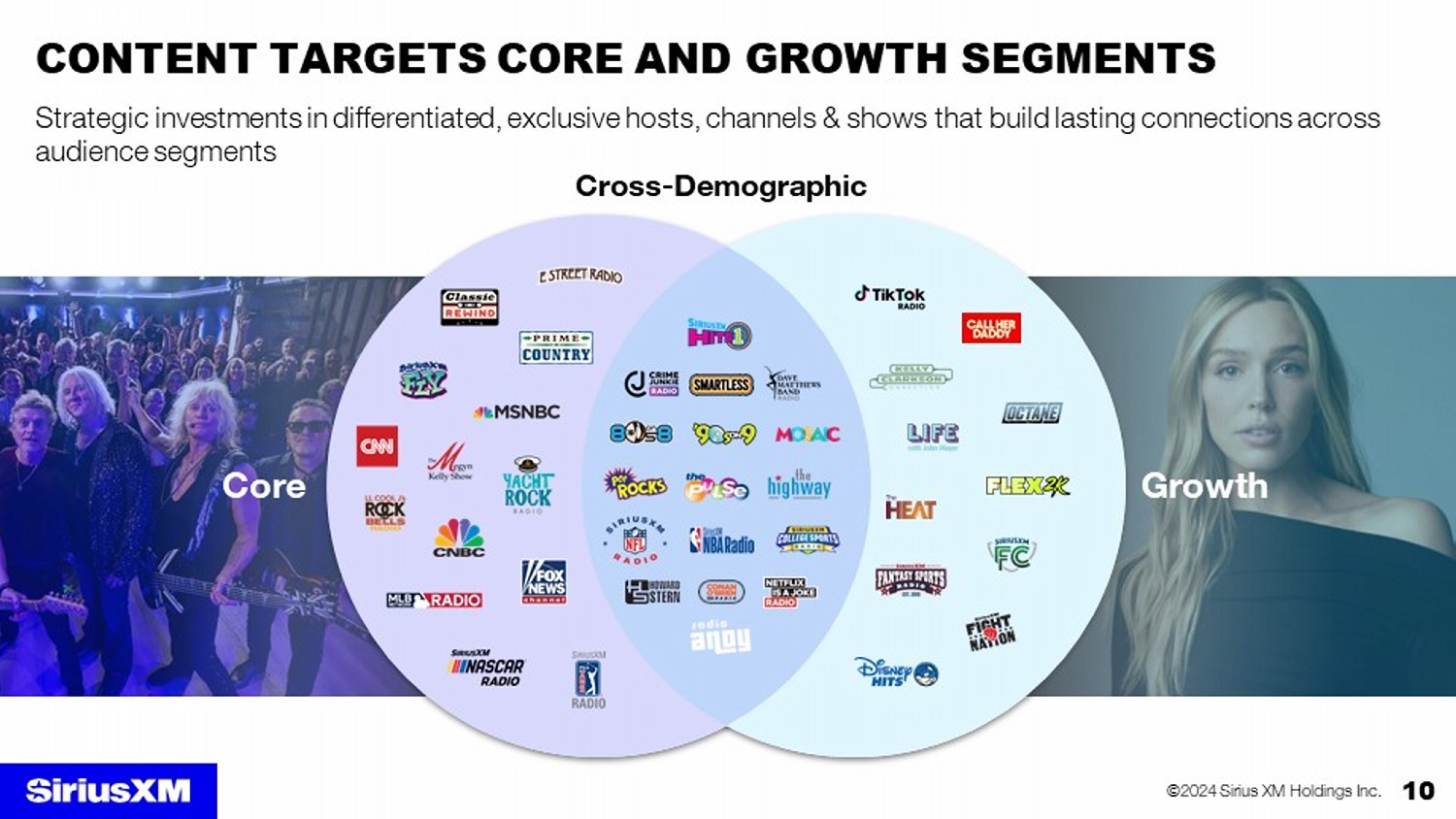

10 ©2024 Sirius XM Holdings Inc. CONTENT TARGETS CORE AND GROWTH SEGMENTS Strategic investments in differentiated, exclusive hosts, channels & shows that build lasting connections across audience segments Cross - Demographic Growth Core

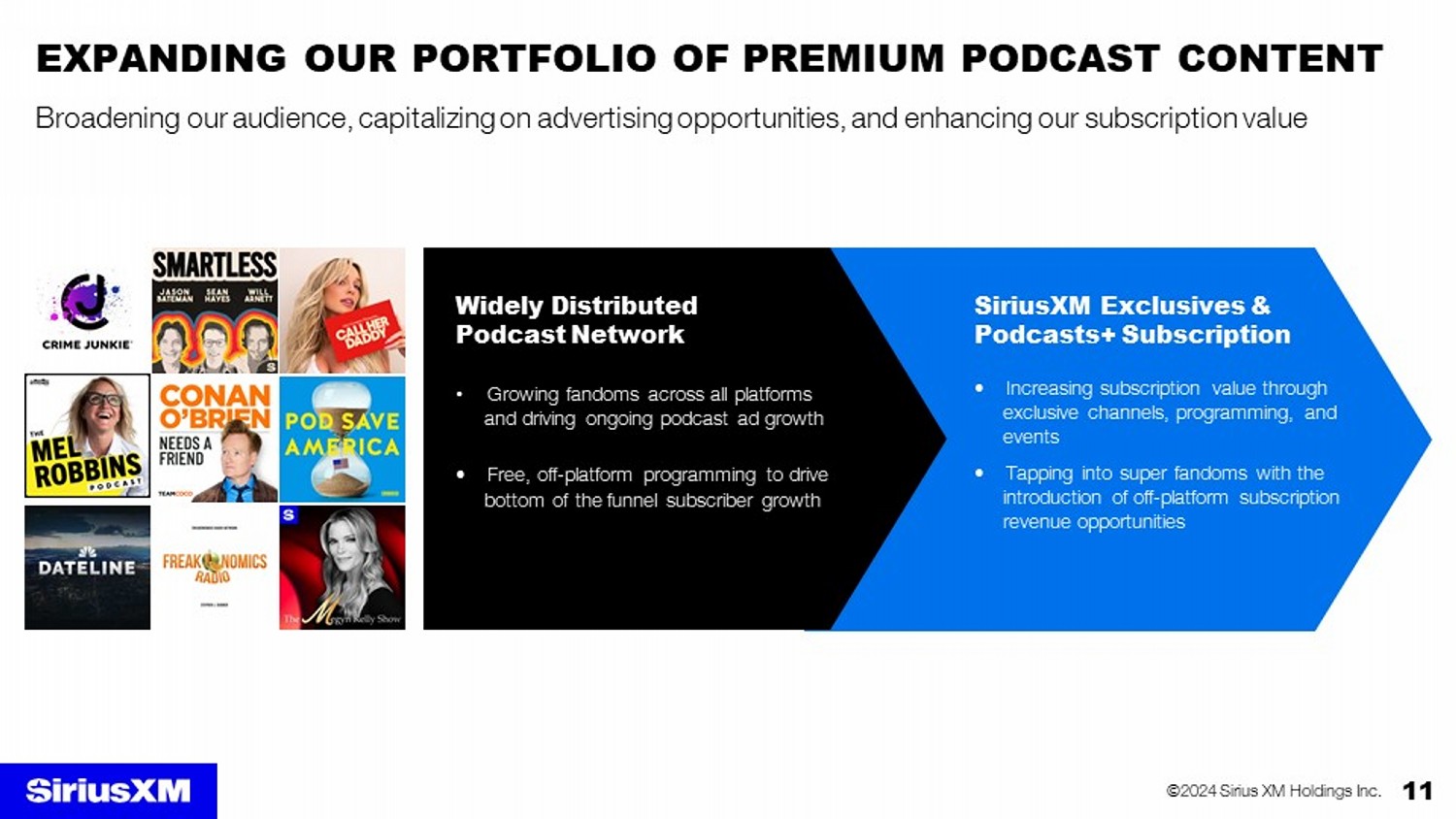

11 ©2024 Sirius XM Holdings Inc. SiriusXM Exclusives & Podcasts+ Subscription • Increasing subscription value through exclusive channels, programming, and events • Tapping into super fandoms with the introduction of off - platform subscription revenue opportunities EXPANDING OUR PORTFOLIO OF PREMIUM PODCAST CONTENT Broadening our audience, capitalizing on advertising opportunities, and enhancing our subscription value Widely Distributed Podcast Network • Growing fandoms across all platforms and driving ongoing podcast ad growth • Free, off - platform programming to drive bottom of the funnel subscriber growth

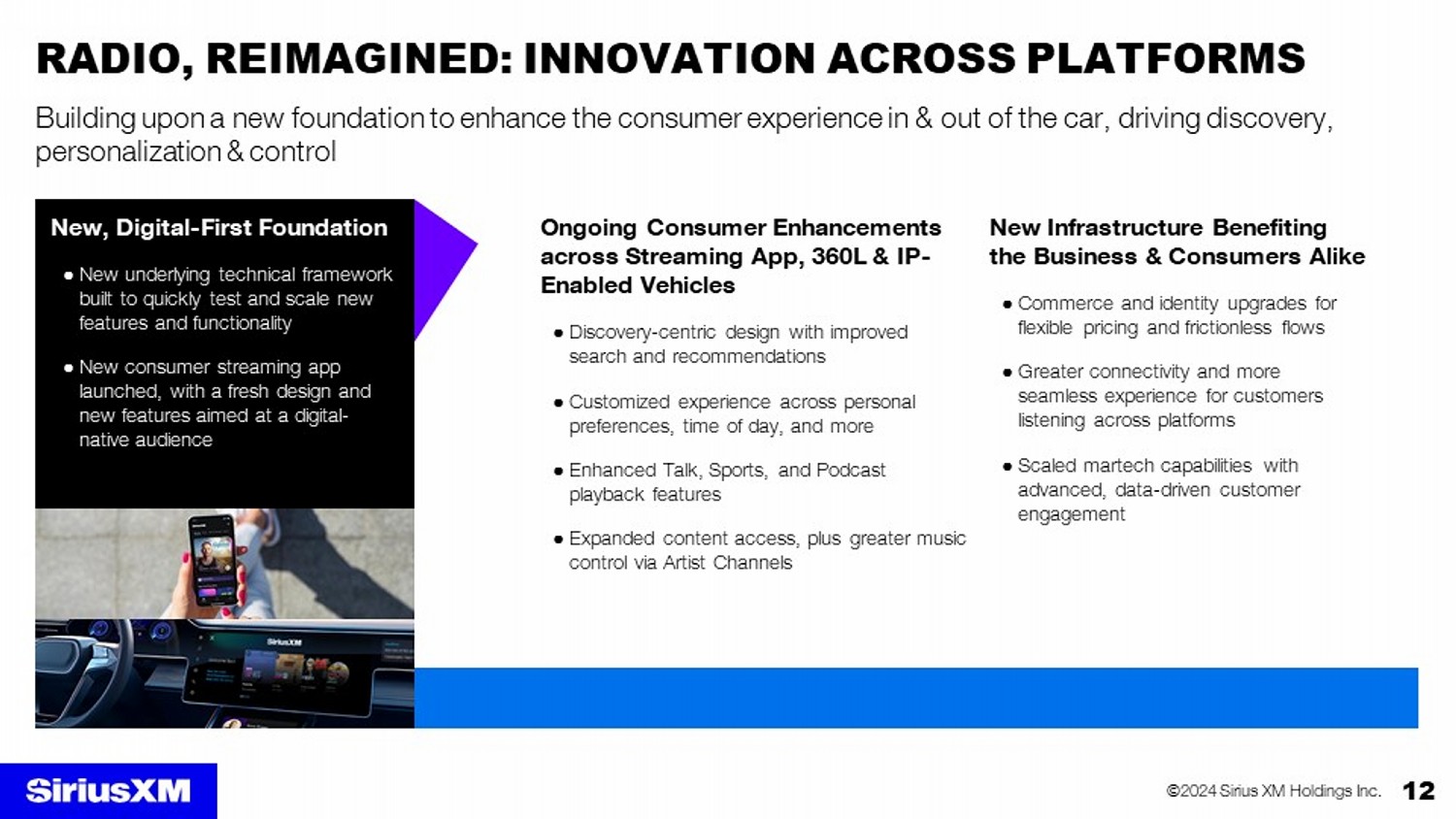

12 ©2024 Sirius XM Holdings Inc. RADIO, REIMAGINED: INNOVATION ACROSS PLATFORMS Building upon a new foundation to enhance the consumer experience in & out of the car, driving discovery, personalization & control Ongoing Consumer Enhancements across Streaming App, 360L & IP - Enabled Vehicles ● Discovery - centric design with improved search and recommendations ● Customized experience across personal preferences, time of day, and more ● Enhanced Talk, Sports, and Podcast playback features ● Expanded content access, plus greater music control via Artist Channels New Infrastructure Benefiting the Business & Consumers Alike ● Commerce and identity upgrades for flexible pricing and frictionless flows ● Greater connectivity and more seamless experience for customers listening across platforms ● Scaled martech capabilities with advanced, data - driven customer engagement New, Digital - First Foundation ● New underlying technical framework built to quickly test and scale new features and functionality ● New consumer streaming app launched, with a fresh design and new features aimed at a digital - native audience

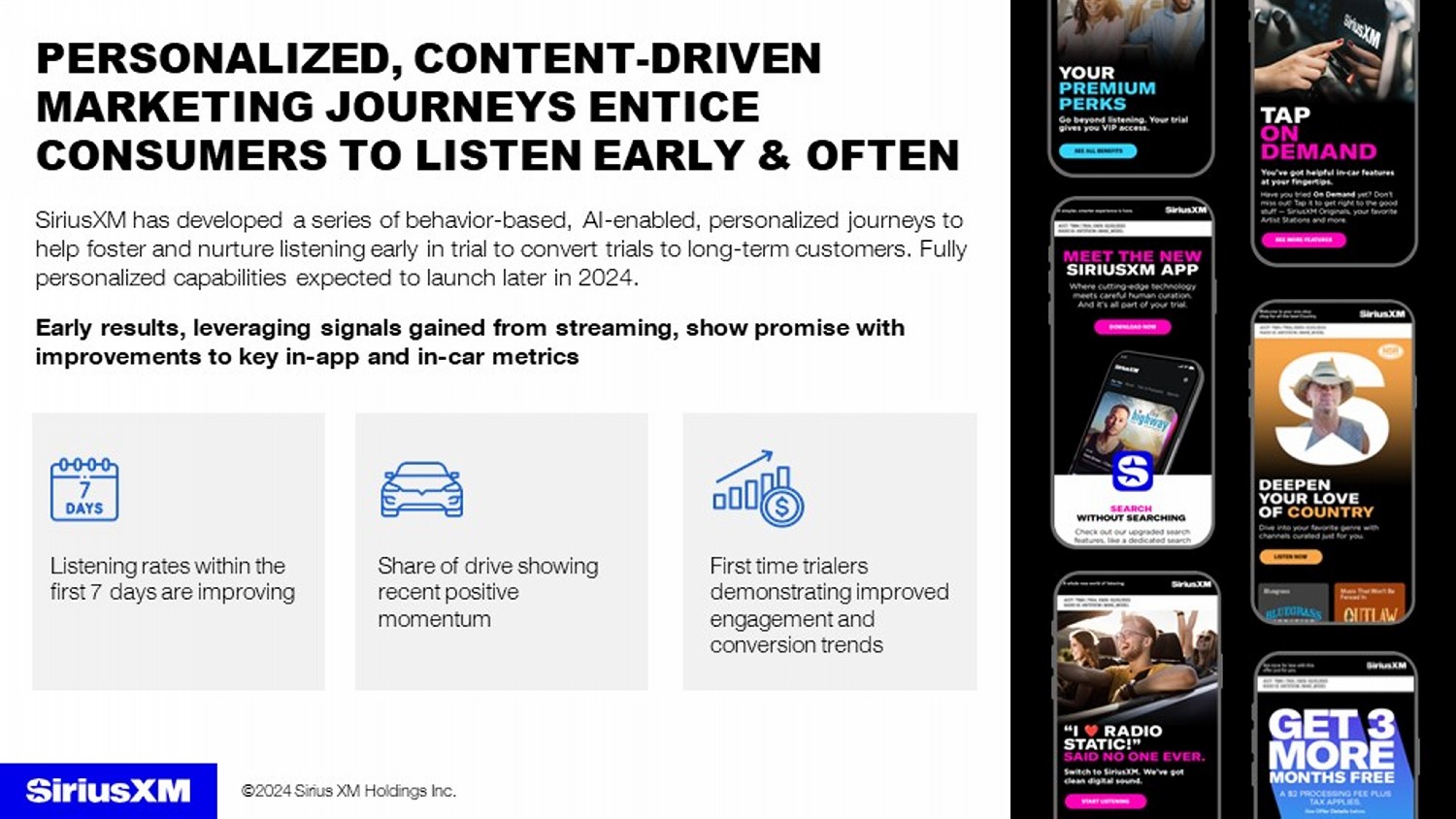

©2024 Sirius XM Holdings Inc. SiriusXM has developed a series of behavior - based, AI - enabled, personalized journeys to help foster and nurture listening early in trial to convert trials to long - term customers. Fully personalized capabilities expected to launch later in 2024. Early results, leveraging signals gained from streaming, show promise with improvements to key in - app and in - car metrics PERSONALIZED, CONTENT - DRIVEN MARKETING JOURNEYS ENTICE CONSUMERS TO LISTEN EARLY & OFTEN Listening rates within the first 7 days are improving Share of drive showing recent positive momentum First time trialers demonstrating improved engagement and conversion trends

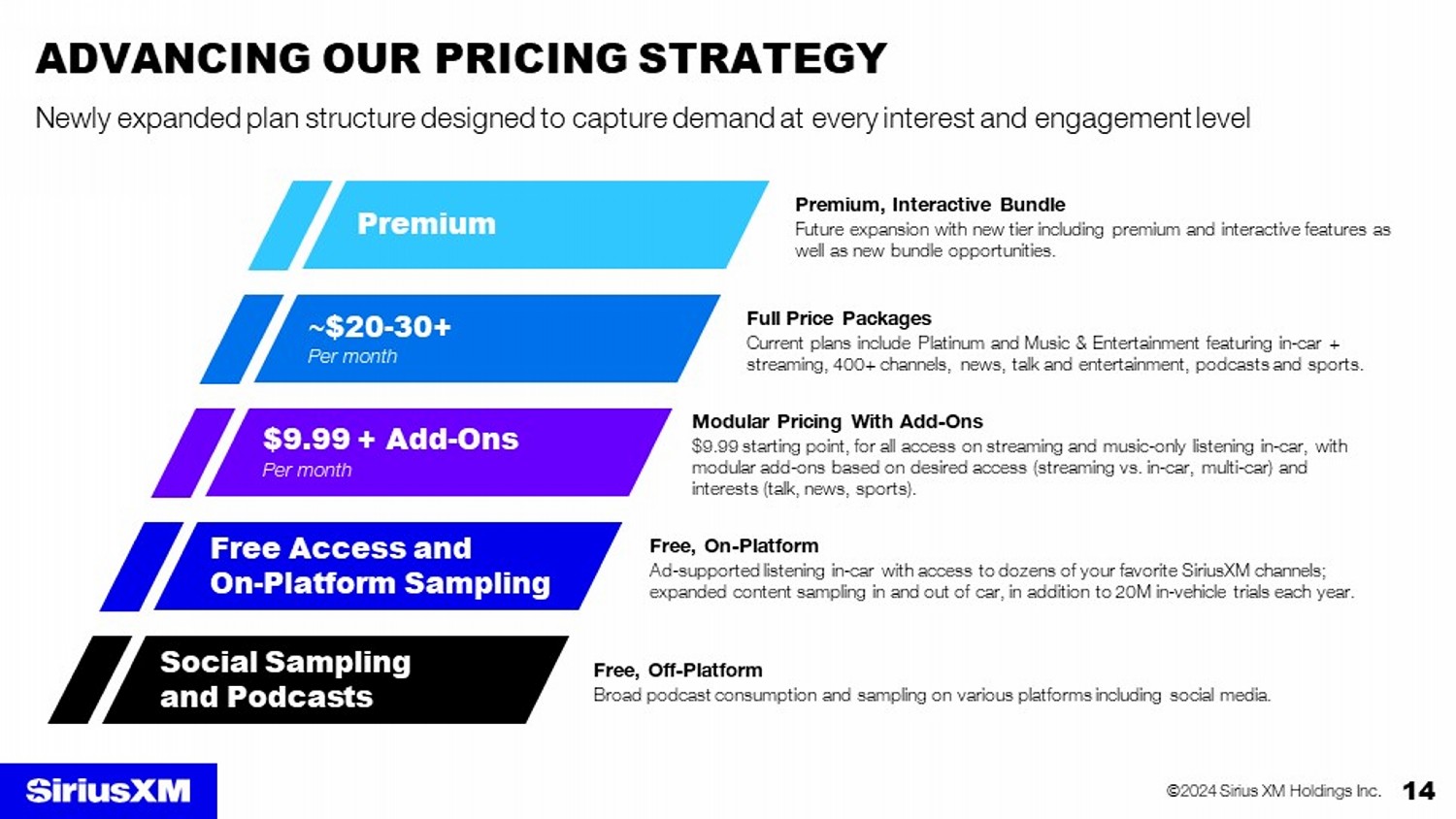

14 ©2024 Sirius XM Holdings Inc. ADVANCING OUR PRICING STRATEGY Newly expanded plan structure designed to capture demand at every interest and engagement level Full Price Packages Current plans include Platinum and Music & Entertainment featuring in - car + streaming, 400+ channels, news, talk and entertainment, podcasts and sports. Modular Pricing With Add - Ons $9.99 starting point, for all access on streaming and music - only listening in - car, with modular add - ons based on desired access (streaming vs. in - car, multi - car) and interests (talk, news, sports). Free, On - Platform Ad - supported listening in - car with access to dozens of your favorite SiriusXM channels; expanded content sampling in and out of car, in addition to 20M in - vehicle trials each year. Free, Off - Platform Broad podcast consumption and sampling on various platforms including social media. Premium, Interactive Bundle Future expansion with new tier including premium and interactive features as well as new bundle opportunities. ~ $20 - 30+ Per month $9.99 + Add - Ons Per month Free Access and On - Platform Sampling Social Sampling and Podcasts Premium

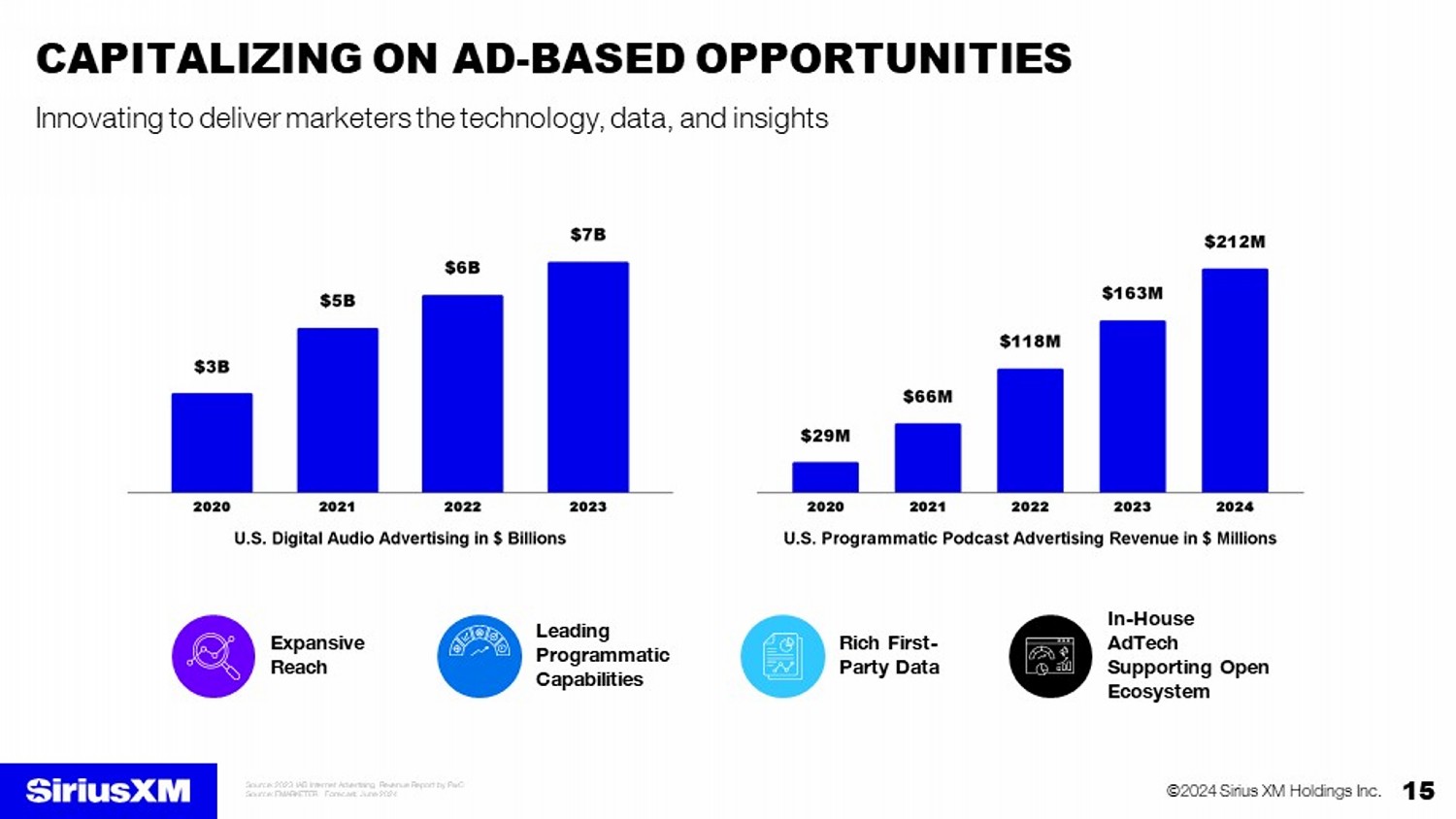

15 ©2024 Sirius XM Holdings Inc. Source: 2023 IAB Internet Advertising Revenue Report by PwC Source: EMARKETER Forecast, June 2024 CAPITALIZING ON AD - BASED OPPORTUNITIES Innovating to deliver marketers the technology, data, and insights Expansive Reach Leading Programmatic Capabilities Rich First - Party Data In - House AdTech Supporting Open Ecosystem

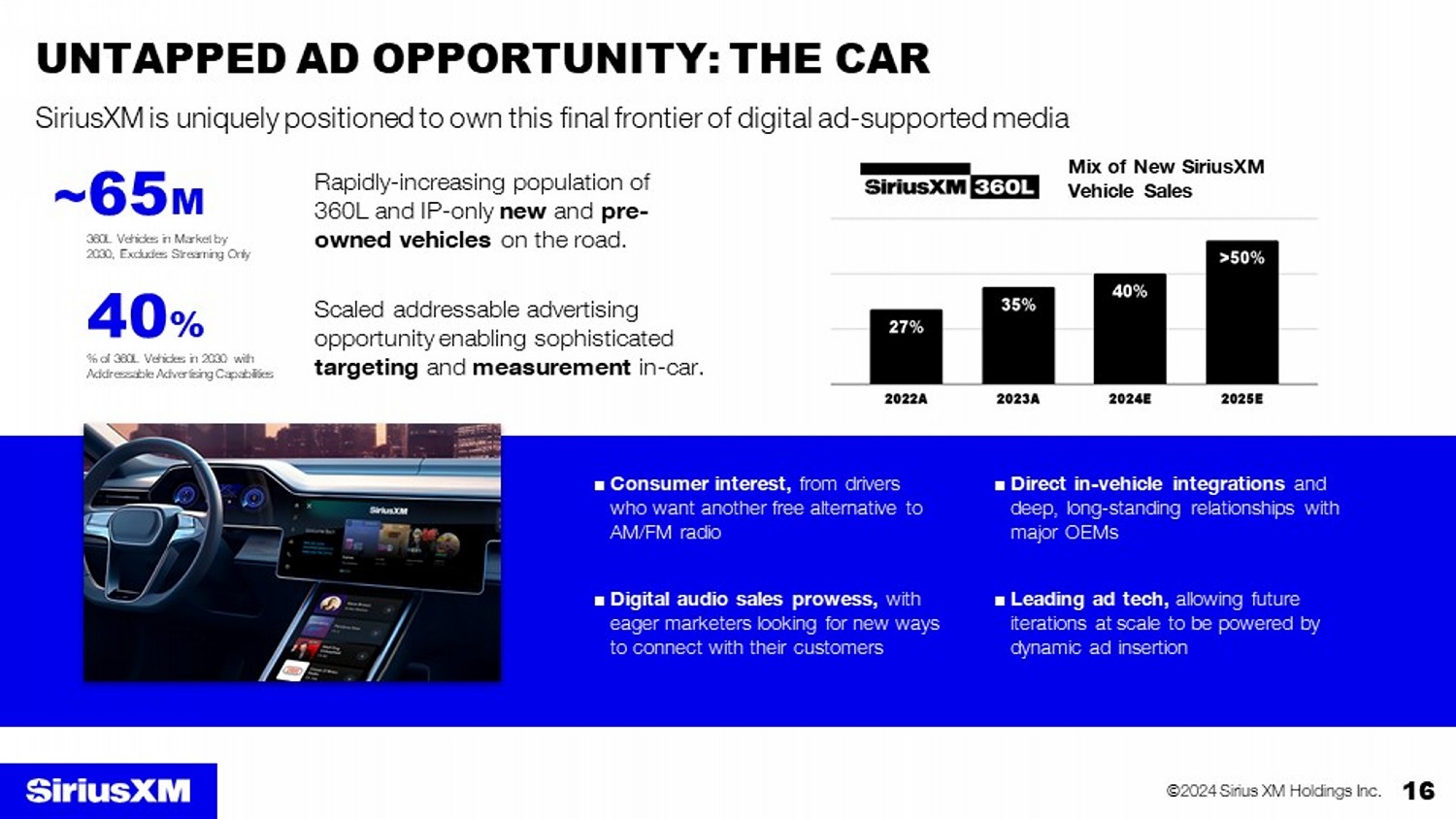

16 ©2024 Sirius XM Holdings Inc. UNTAPPED AD OPPORTUNITY: THE CAR SiriusXM is uniquely positioned to own this final frontier of digital ad - supported media Mix of New SiriusXM Vehicle Sales Rapidly - increasing population of 360L and IP - only new and pre - owned vehicles on the road. ~ 65 M 360L Vehicles in Market by 2030, Excludes Streaming Only ■ Consumer interest, from drivers who want another free alternative to AM/FM radio ■ Direct in - vehicle integrations and deep, long - standing relationships with major OEMs ■ Digital audio sales prowess, with eager marketers looking for new ways to connect with their customers ■ Leading ad tech, allowing future iterations at scale to be powered by dynamic ad insertion Scaled addressable advertising opportunity enabling sophisticated targeting and measurement in - car. 40 % % of 360L Vehicles in 2030 with Addressable Advertising Capabilities

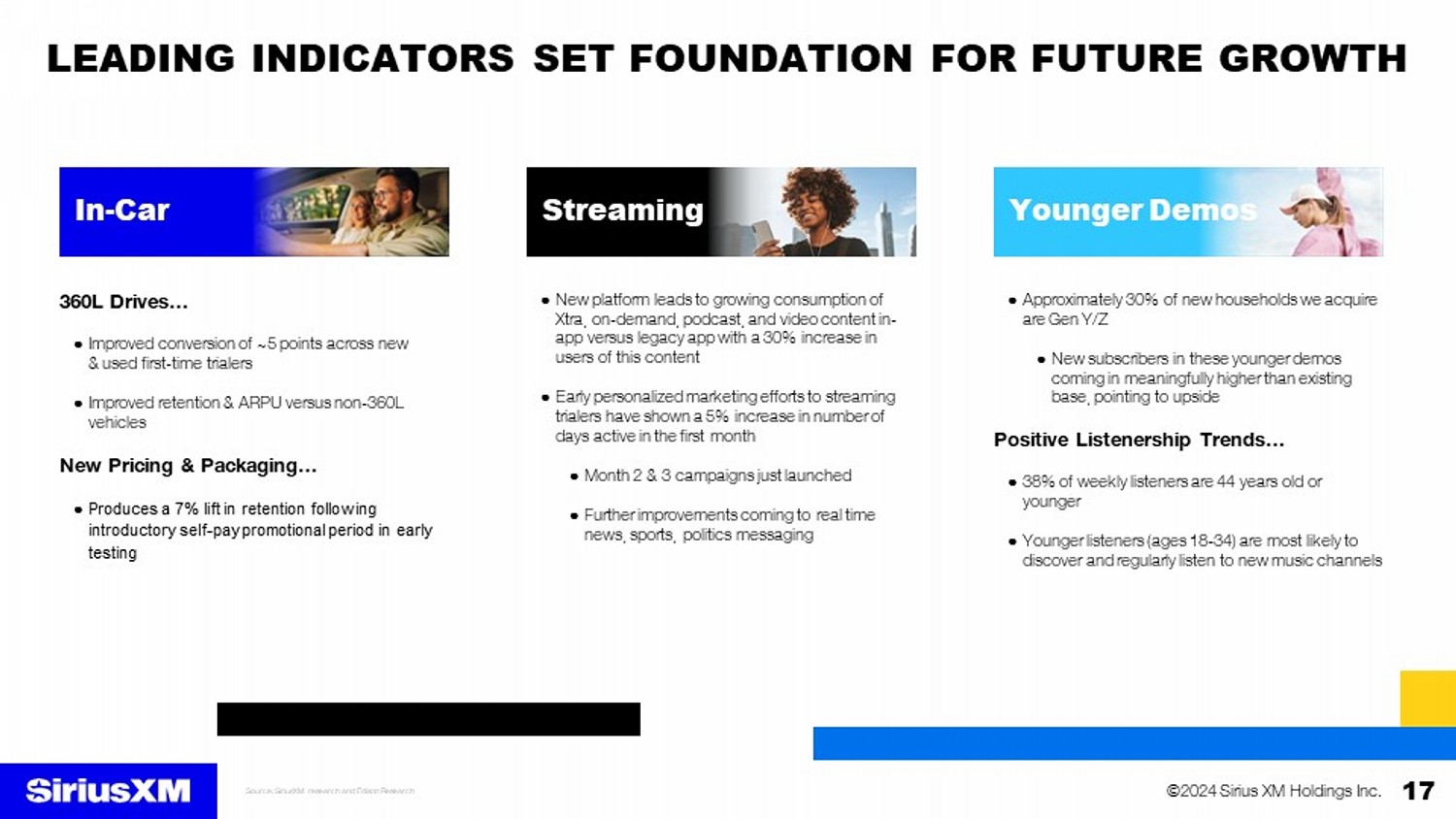

17 ©2024 Sirius XM Holdings Inc. LEADING INDICATORS SET FOUNDATION FOR FUTURE GROWTH Source: SiriusXM research and Edison Research 360L Drives… ● Improved conversion of ~5 points across new & used first - time trialers ● Improved retention & ARPU versus non - 360L vehicles New Pricing & Packaging… ● Produces a 7% lift in retention following introductory self - pay promotional period in early testing In - Car ● Approximately 30% of new households we acquire are Gen Y/Z ● New subscribers in these younger demos coming in meaningfully higher than existing base, pointing to upside Positive Listenership Trends… ● 38% of weekly listeners are 44 years old or younger ● Younger listeners (ages 18 - 34) are most likely to discover and regularly listen to new music channels Younger Demos ● New platform leads to growing consumption of Xtra, on - demand, podcast, and video content in - app versus legacy app with a 30% increase in users of this content ● Early personalized marketing efforts to streaming trialers have shown a 5% increase in number of days active in the first month ● Month 2 & 3 campaigns just launched ● Further improvements coming to real time news, sports, politics messaging Streaming

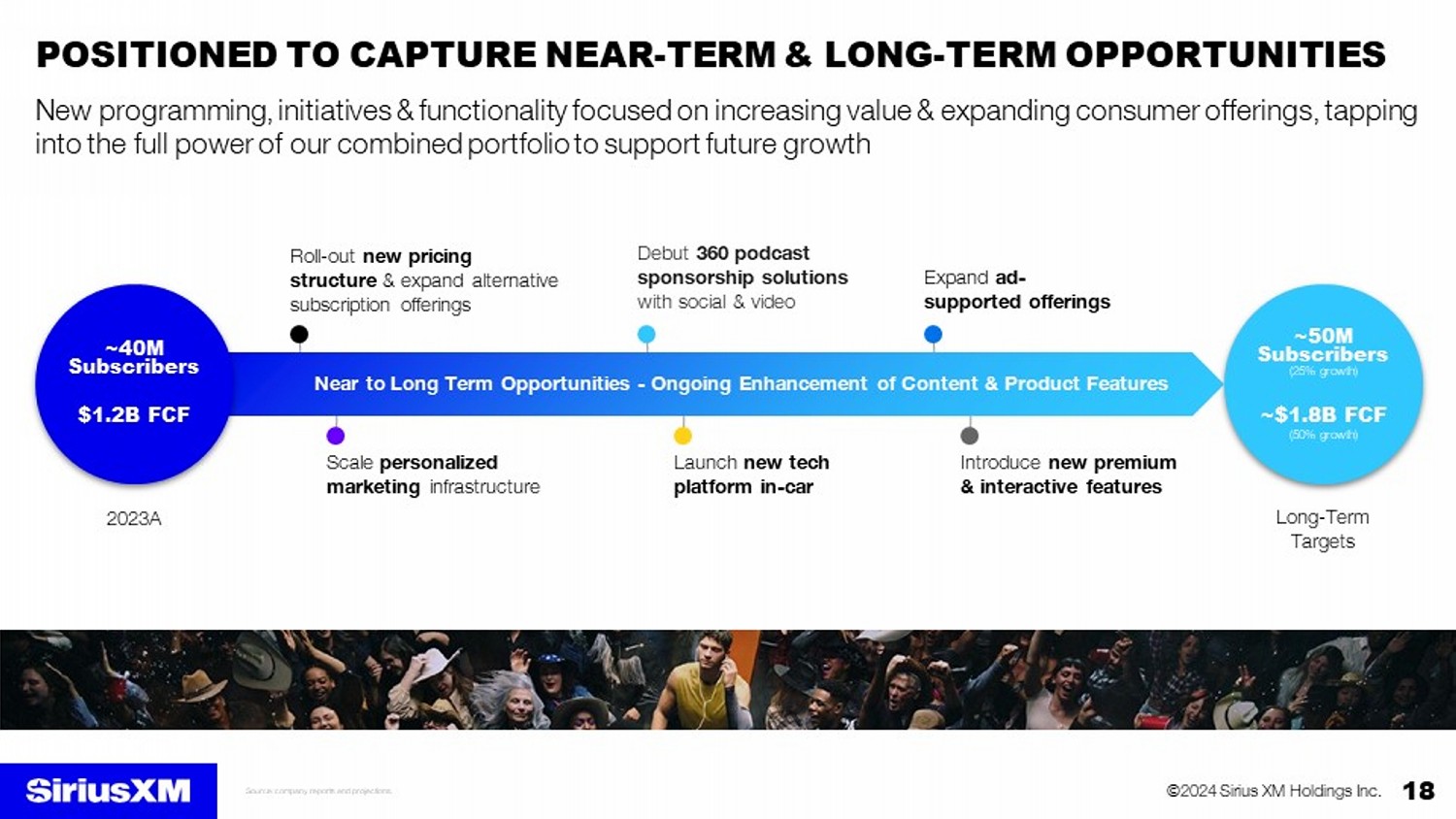

18 ©2024 Sirius XM Holdings Inc. ~50M Subscribers (25% growth) ~$1.8B FCF (50% growth) Long - Term Targets Roll - out new pricing structure & expand alternative subscription offerings Introduce new premium & interactive features Scale personalized marketing infrastructure Expand ad - supported offerings Debut 360 podcast sponsorship solutions with social & video Launch new tech platform in - car Near to Long Term Opportunities - Ongoing Enhancement of Content & Product Features POSITIONED TO CAPTURE NEAR - TERM & LONG - TERM OPPORTUNITIES New programming, initiatives & functionality focused on increasing value & expanding consumer offerings, tapping into the full power of our combined portfolio to support future growth ~40M Subscribers $1.2B FCF 2023A Source: company reports and projections.

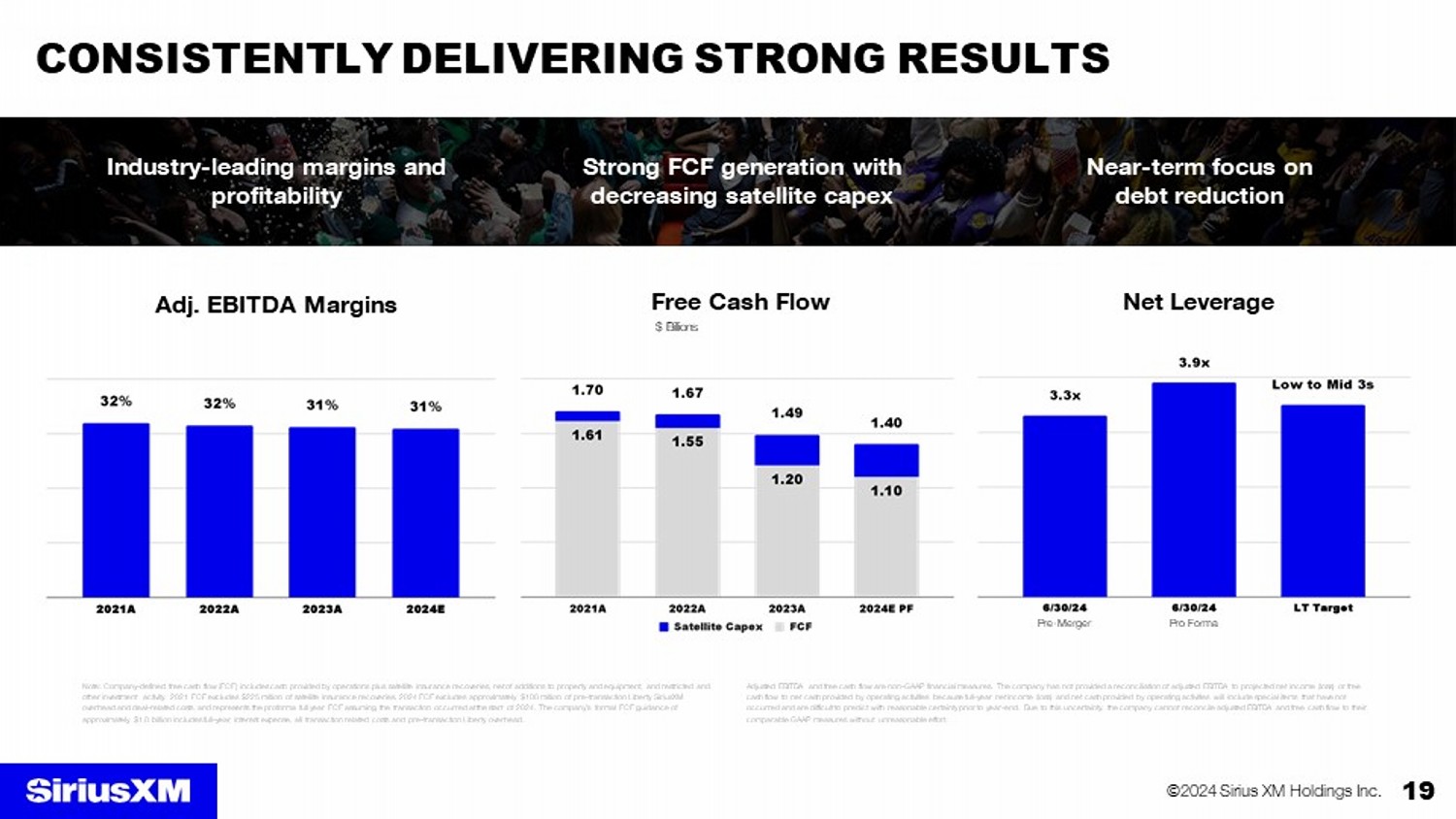

19 ©2024 Sirius XM Holdings Inc. Note: Company - defined free cash flow (FCF) includes cash provided by operations plus satellite insurance recoveries, net of addi tions to property and equipment, and restricted and other investment activity. 2021 FCF excludes $225 million of satellite insurance recoveries. 2024 FCF excludes approximately $10 0 million of pre - transaction Liberty SiriusXM overhead and deal - related costs and represents the proforma full year FCF assuming the transaction occurred at the start of 2024 . The company’s formal FCF guidance of approximately $1.0 billion includes full - year interest expense, all transaction related costs and pre - transaction Liberty overhe ad. CONSISTENTLY DELIVERING STRONG RESULTS Industry - leading margins and profitability Adj. EBITDA Margins Strong FCF generation with decreasing satellite capex Free Cash Flow $ Billions Near - term focus on debt reduction Net Leverage Pre - Merger Pro Forma Adjusted EBITDA and free cash flow are non - GAAP financial measures. The company has not provided a reconciliation of adjusted EB ITDA to projected net income (loss) or free cash flow to net cash provided by operating activities because full - year net income (loss) and net cash provided by operating ac tivities will include special items that have not occurred and are difficult to predict with reasonable certainty prior to year - end. Due to this uncertainty, the company cannot reconcile adjusted EBITDA and free cash flow to their comparable GAAP measures without unreasonable effort.

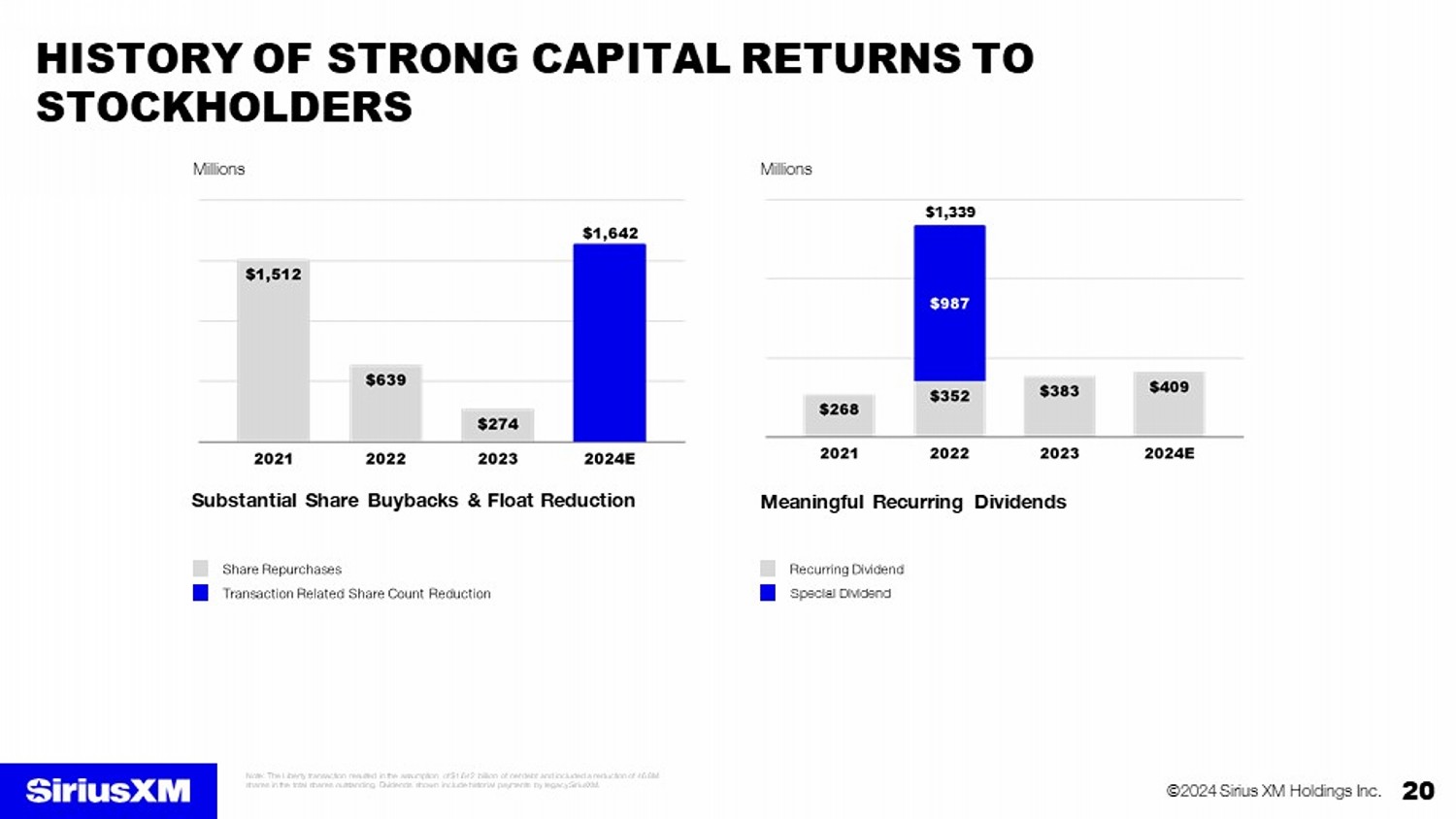

20 ©2024 Sirius XM Holdings Inc. Substantial Share Buybacks & Float Reduction Meaningful Recurring Dividends $1,339 HISTORY OF STRONG CAPITAL RETURNS TO STOCKHOLDERS Note: The Liberty transaction resulted in the assumption of $1.642 billion of net debt and included a reduction of 46.8M shares in the total shares outstanding. Dividends shown include historial payments by legacy SiriusXM. Special Dividend Millions Millions

THANK YOU

APPENDIX

23 ©2024 Sirius XM Holdings Inc. COMPELLING TRANSACTION BENEFITS The transaction offered every stockholder the opportunity to share in the long - term, profitable growth potential of a leading and unparalleled audio - entertainment company ■ Simplified Equity Structure ■ Enhanced Trading Liquidity and Float Broadened potential investor base Eliminated multi - class structure ■ Greater Strategic Flexibility with Majority Independent Board ■ Expanded Potential Index Inclusion ■ Addressed Discount to Net Asset Value at LSXM

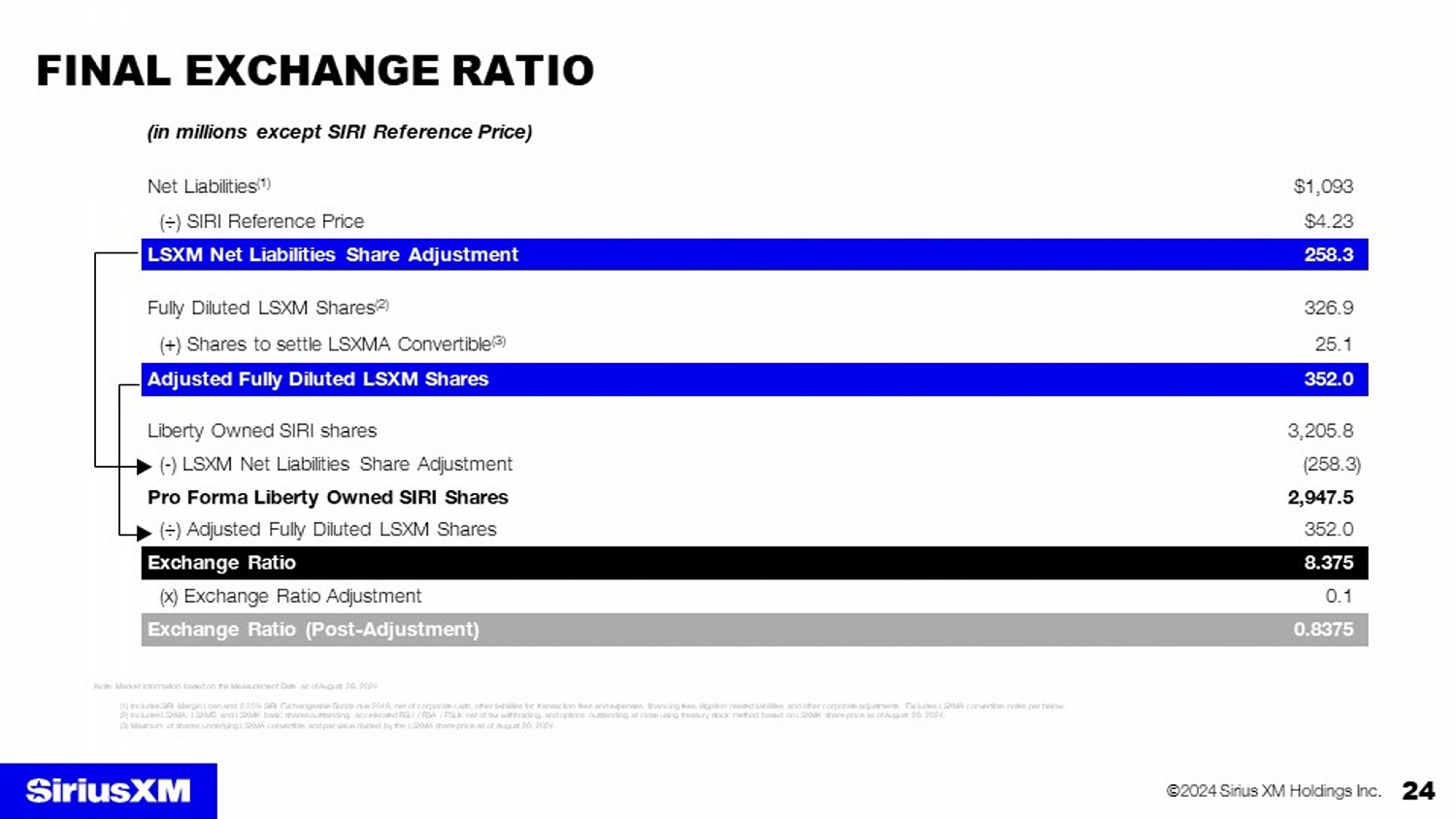

24 ©2024 Sirius XM Holdings Inc. FINAL EXCHANGE RATIO Note: Market information based on the Measurement Date as of August 28, 2024 (1) Includes SIRI Margin Loan and 2.75% SIRI Exchangeable Bonds due 2049, net of corporate cash, other liabilities for transactio n f ees and expenses, financing fees, litigation related liabilities and other corporate adjustments. Excludes LSXMA convertible not es per below. (2) Includes LSXMA, LSXMB and LSXMK basic shares outstanding, accelerated RSU / RSA / PSUs net of tax withholding, and options ou tst anding at close using treasury stock method based on LSXMK share price as of August 28, 2024. (3) Maximum of shares underlying LSXMA convertible and par value divided by the LSXMA share price as of August 28, 2024. (in millions except SIRI Reference Price) $1,093 Net Liabilities (1) $4.23 ( ÷ ) SIRI Reference Price 258.3 LSXM Net Liabilities Share Adjustment 326.9 Fully Diluted LSXM Shares (2) 25.1 (+) Shares to settle LSXMA Convertible (3) 352.0 Adjusted Fully Diluted LSXM Shares 3,205.8 Liberty Owned SIRI shares (258.3) ( - ) LSXM Net Liabilities Share Adjustment 2,947.5 Pro Forma Liberty Owned SIRI Shares 352.0 ( ÷ ) Adjusted Fully Diluted LSXM Shares 8.375 Exchange Ratio 0.1 (x) Exchange Ratio Adjustment 0.8375 Exchange Ratio (Post - Adjustment)

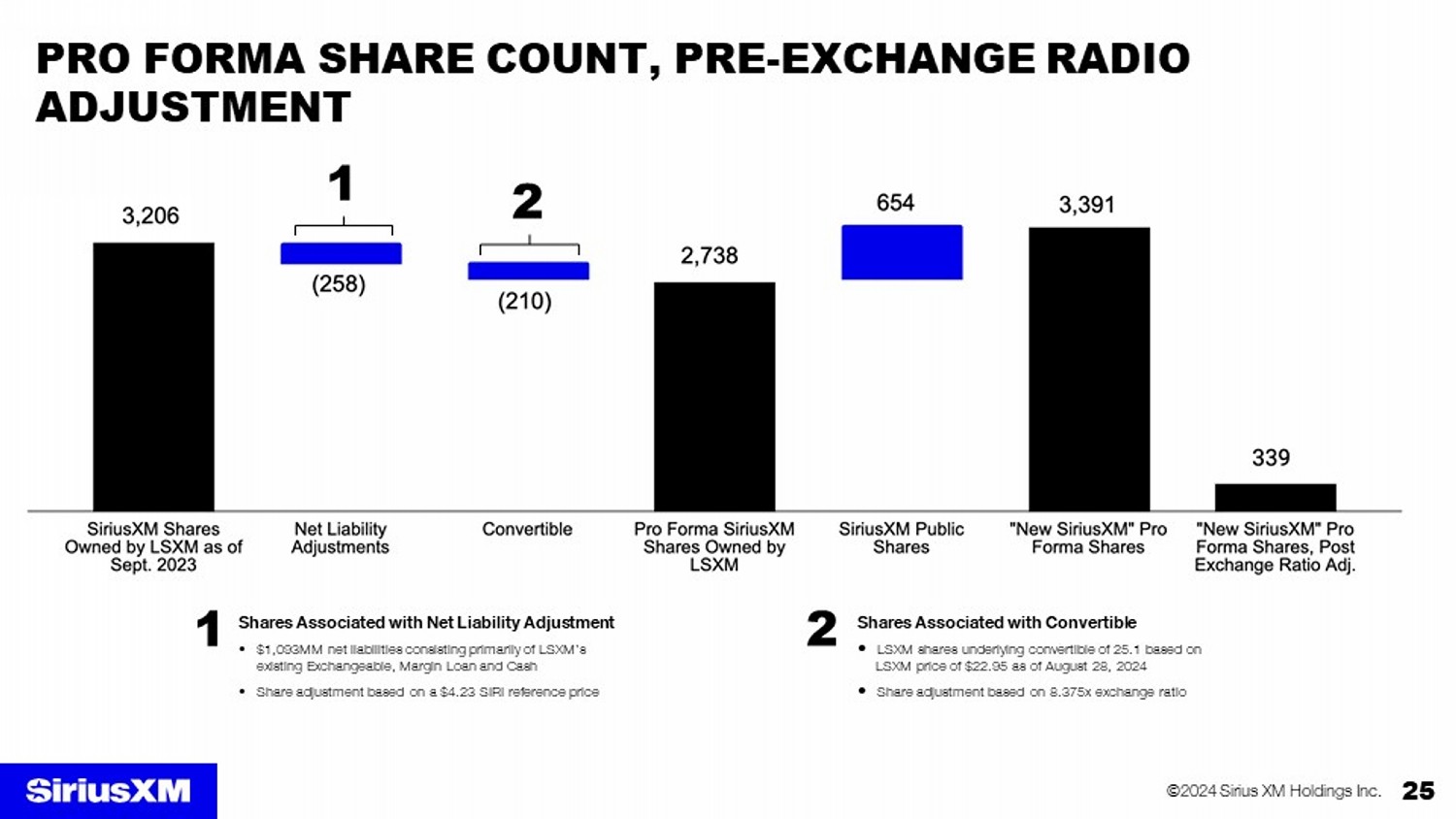

25 ©2024 Sirius XM Holdings Inc. PRO FORMA SHARE COUNT, PRE - EXCHANGE RADIO ADJUSTMENT 1 2 Shares Associated with Net Liability Adjustment • $1,093MM net liabilities consisting primarily of LSXM’s existing Exchangeable, Margin Loan and Cash • Share adjustment based on a $4.23 SIRI reference price 1 Shares Associated with Convertible • LSXM shares underlying convertible of 25.1 based on LSXM price of $22.95 as of August 28, 2024 • Share adjustment based on 8.375x exchange ratio 2

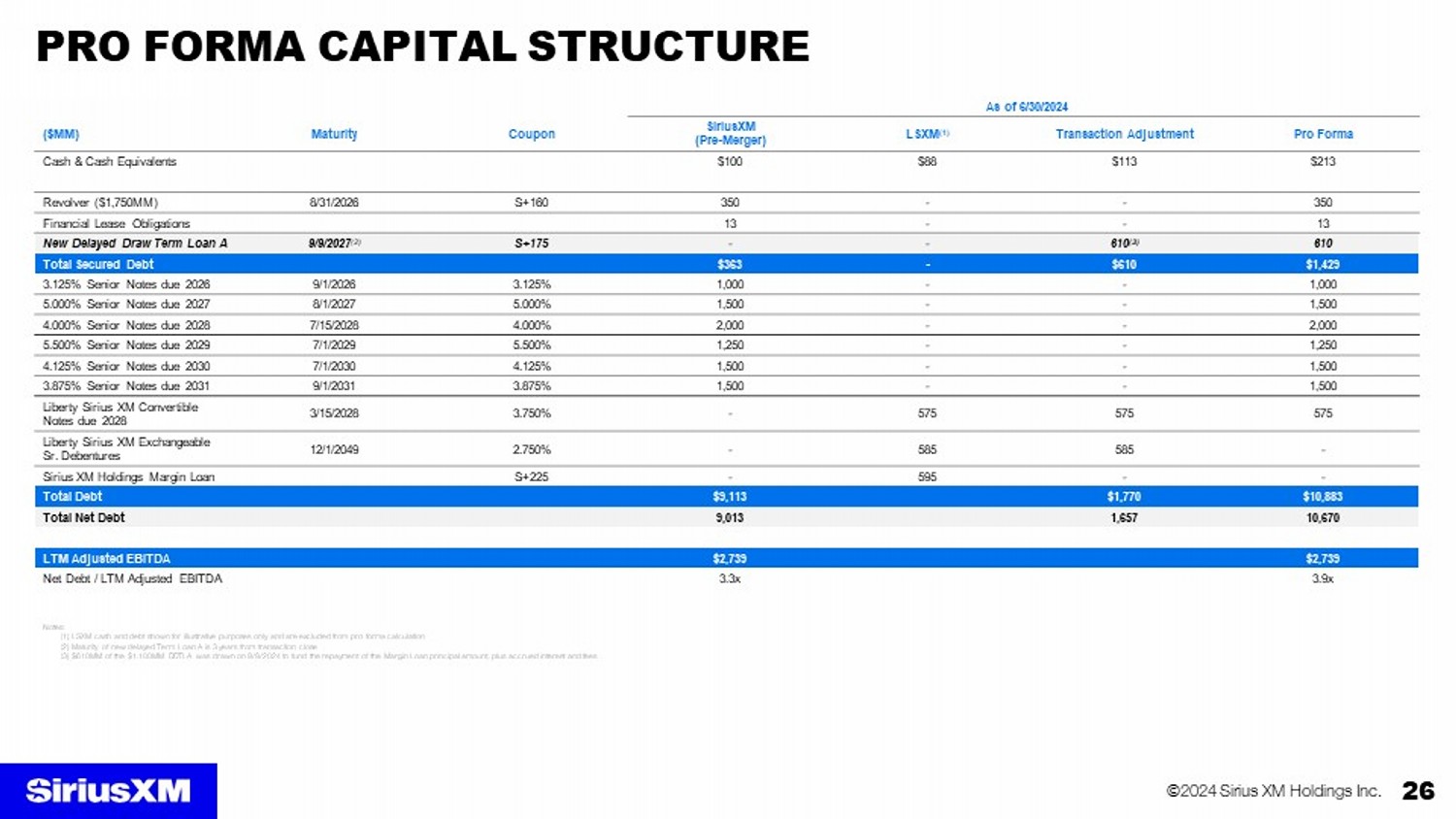

26 ©2024 Sirius XM Holdings Inc. PRO FORMA CAPITAL STRUCTURE As of 6/30/2024 Pro Forma Transaction Adjustment LSXM (1) SiriusXM (Pre - Merger) Coupon Maturity ($MM) $213 $113 $88 $100 Cash & Cash Equivalents 350 - - 350 S+160 8/31/2026 Revolver ($1,750MM) 13 - - 13 Financial Lease Obligations 610 610 (3) - - S+175 9/9/2027 (2) New Delayed Draw Term Loan A $1,429 $610 - $363 Total Secured Debt 1,000 - - 1,000 3.125% 9/1/2026 3.125% Senior Notes due 2026 1,500 - - 1,500 5.000% 8/1/2027 5.000% Senior Notes due 2027 2,000 - - 2,000 4.000% 7/15/2028 4.000% Senior Notes due 2028 1,250 - - 1,250 5.500% 7/1/2029 5.500% Senior Notes due 2029 1,500 - - 1,500 4.125% 7/1/2030 4.125% Senior Notes due 2030 1,500 - - 1,500 3.875% 9/1/2031 3.875% Senior Notes due 2031 575 575 575 - 3.750% 3/15/2028 Liberty Sirius XM Convertible Notes due 2028 - 585 585 - 2.750% 12/1/2049 Liberty Sirius XM Exchangeable Sr. Debentures - - 595 - S+225 Sirius XM Holdings Margin Loan $10,883 $1,770 $9,113 Total Debt 10,670 1,657 9,013 Total Net Debt $2,739 $2,739 LTM Adjusted EBITDA 3.9x 3.3x Net Debt / LTM Adjusted EBITDA Notes: (1) LSXM cash and debt shown for illustrative purposes only and are excluded from pro forma calculation (2) Maturity of new delayed Term Loan A is 3 years from transaction close (3) $610MM of the $1.100MM DDTLA was drawn on 9/9/2024 to fund the repayment of the Margin Loan principal amount, plus accrued in ter est and fees