|

Respectfully, | |

|

Brian McAndrews |

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant ý Filed by a Party other than the Registrant o | ||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

| Pandora Media, Inc. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): |

||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

Pandora Media, Inc.

2101 Webster Street, Suite 1650

Oakland, CA 94612

(510) 451-4100

Dear Stockholder:

We cordially invite you to attend the Pandora Media, Inc. Annual Meeting of Stockholders, which will be held on June 4, 2014 at Cathedral of Christ the Light Event Center, Conference Room C, 2121 Harrison St., Oakland, CA 94612 at 7:30 a.m. Pacific Time. Doors open at 7:00 a.m. Pacific Time. The attached Notice of Annual Meeting of Stockholders and Proxy Statement contain details of the business to be conducted at the Annual Meeting. At the Annual Meeting, stockholders will vote on a number of important matters.

Our 2014 Annual Report to Stockholders includes our audited financial statements for the eleven months ending December 31, 2013, along with a discussion and analysis of our financial results. Please take the time to review our 2014 Annual Report and to read carefully each of the proposals described in the attached Proxy Statement.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the meeting. Therefore, I urge you to promptly vote and submit your proxy via the Internet, or if you have elected to receive printed proxy materials, by phone or by signing, dating, and returning the enclosed proxy card in the enclosed envelope. If you decide to attend the Annual Meeting, you may vote in person. Please see the sections "If I am a stockholder of record of Pandora shares, how do I vote?" and "If I am the beneficial owner of Pandora shares held in street name, how do I vote?" in the Proxy Statement for additional instructions on how to vote your shares.

You may submit questions in advance of the Annual Meeting by email to shareholder@pandora.com, and we will respond to as many inquiries as time allows.

We will be using the "Notice and Access" method of providing proxy materials to stockholders via the Internet. This process will provide stockholders with a convenient and quick way to access the proxy materials and vote, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials. We will mail on or about April 22, 2014 to many of our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement and our 2014 Annual Report, including our Transition Report on Form 10-K, and vote electronically via the Internet. This notice will also contain instructions on how to receive a paper copy of your proxy materials. All stockholders who do not receive a notice will receive a paper copy of the proxy materials by mail or an electronic copy of the proxy materials by email.

We will provide a live webcast of the Annual Meeting from the Pandora Investor Relations website at http://investor.pandora.com. A transcript along with the audio of the entire Annual Meeting will be available on the Investor Relations website after the meeting. We hope this webcast will allow those of you who are unable to attend the Annual Meeting in person to hear Pandora executives discuss our results for the eleven months ending December 31, 2013. In addition, we make available at our Investor Relations website free of charge a variety of information for investors. Our goal is to maintain the Investor Relations website as a portal through which investors can easily find or navigate to pertinent information about us.

On behalf of the Board of Directors, thank you for your continued support and ownership of Pandora Media, Inc.

|

Respectfully, | |

|

Brian McAndrews |

Pandora Media, Inc.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 4, 2014

TO OUR STOCKHOLDERS:

The 2014 annual meeting of stockholders of Pandora Media, Inc. will be held on June 4, 2014, beginning at 7:30 a.m. Pacific Time, at Cathedral of Christ the Light Event Center, Conference Room C, 2121 Harrison St., Oakland, CA 94612, for the following purposes:

These items of business are more fully described in the proxy statement accompanying this notice. Our board of directors has fixed the close of business on April 8, 2014 as the record date for determination of the stockholders entitled to notice of, and to vote at, the annual meeting and any postponements or adjournments of the meeting.

We will mail to our stockholders of record and beneficial owners on or about April 22, 2014 a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and our 2014 Annual Report, including our Transition Report on Form 10-K for the eleven months ending December 31, 2013, via the Internet and vote online. The Notice of Internet Availability of Proxy Materials also contains instructions on how you can receive a paper copy of the proxy materials.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting To Be Held on June 4, 2014: This proxy statement, along with our 2014 Annual Report, including our Transition Report on Form 10-K for the eleven months ending December 31, 2013, are available on the following website: http://investor.pandora.com in the "Annual Report and Proxy" section.

All stockholders are cordially invited to attend the annual meeting in person. However, to assure your representation at the meeting, please vote as soon as possible.

By Order of the board of directors,

Delida

Costin

Senior Vice President, General Counsel and Secretary

Oakland,

California

April 22, 2014

2101 Webster Street, Suite 1650

Oakland, CA 94612

(510) 451-4100

PROXY STATEMENT FOR 2014 ANNUAL MEETING OF STOCKHOLDERS

The enclosed proxy is solicited on behalf of the board of directors of Pandora Media, Inc. ("Pandora") for use at our 2014 annual meeting of stockholders, or at any postponement or adjournment of the meeting.

These proxy solicitation materials are first being made available on or about April 22, 2014, together with our Transition Report on Form 10-K for the eleven months ending December 31, 2013 ("Annual Report"), to all stockholders of record at the close of business on April 8, 2014.

When and where is the meeting being held?

Our annual meeting of stockholders for 2014 is being held on June 4, 2014 beginning at 7:30 a.m. Pacific Time at Cathedral of Christ the Light Event Center, Conference Room C, 2121 Harrison St., Oakland, CA 94612.

What is the purpose of the annual meeting?

At our 2014 annual meeting, stockholders will act on the matters outlined in the notice of annual meeting on the cover page of this proxy statement, namely,

Who is entitled to notice of and to vote at the meeting?

You are entitled to receive notice of and to vote at our annual meeting (and any postponements or adjournments of the meeting) if our records indicate that you owned shares of our common stock at the close of business on April 8, 2014, the record date for the meeting. At the close of business on that date, 205,332,382 shares of our common stock were outstanding and entitled to vote. You are entitled to one vote for each share held and you may vote on each matter to come before the meeting.

Why did I receive a notice in the mail regarding Internet availability of proxy materials instead of a paper copy of printed materials?

We are permitted to furnish proxy materials, including this proxy statement and our Annual Report, to our stockholders by providing access to such documents on the Internet instead of mailing printed copies. On or about April 22, 2014, we will mail to our stockholders of record and beneficial owners a Notice of Internet Availability of Proxy Materials (the "Notice") containing instructions on how to access this proxy statement and our Annual Report via the Internet and vote online.

1

As a result, you will not receive a printed copy of the proxy materials in the mail unless you request a copy. All stockholders will have the ability to access the proxy materials on a website referred to in the Notice and may request a printed set of the proxy materials by mail or electronically from such website. If you would like to receive a printed or electronic copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice. By participating in the e-proxy process, we will save money on the cost of printing and mailing documents to you and reduce the impact of our annual stockholders' meetings on the environment.

What is the difference between holding shares as a stockholder of record and as a beneficial owner of shares held in "street name"?

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered the stockholder of record with respect to those shares, and the Notice will be sent directly to you. As our stockholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the annual meeting. We have enclosed a proxy card for your vote.

Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the beneficial owner of shares held in "street name," and the Notice will be forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct that organization on how to vote the shares held in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the annual meeting unless you request, complete and deliver the proper documentation provided by your broker, bank or other holder of record and bring it with you to the meeting.

What is "householding" and how does it affect me?

The Securities and Exchange Commission (the "SEC") has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as "householding," potentially means extra convenience for stockholders and cost savings for companies.

This year, a number of brokers with account holders who are Pandora stockholders may be "householding" our proxy materials. A single proxy statement may be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that it will be "householding" communications to your address, "householding" will continue until you are notified otherwise or until you notify your broker or us that you no longer wish to participate in "householding."

If, at any time, you no longer wish to participate in "householding" and would prefer to receive a separate proxy statement and annual report, you may (1) notify your broker, (2) direct your written request to: Pandora Media, Inc., 2101 Webster Street, Suite 1650, Oakland, California 94612, Attention: Investor Relations or (3) contact our Investor Relations department by telephone at (510) 842-6960. Stockholders who currently receive multiple copies of the proxy statement at their address and would like to request "householding" of their communications should contact their broker. In addition, we will promptly deliver, upon written or oral request to the address or telephone number above, a separate copy of the annual report and proxy statement to a stockholder at a shared address to which a single copy of the documents was delivered.

2

If I am a stockholder of record of Pandora shares, how do I vote?

If you are a stockholder of record, you may vote in person at the annual meeting or by proxy on the Internet, by telephone or by mail, all as described below. We recommend that you vote by proxy even if you plan to attend the annual meeting so that your vote will be counted even if you later decide not to attend the meeting. You can always change your vote at the meeting. The Internet and telephone voting procedures are designed to authenticate stockholders and to allow you to confirm that your instructions have been properly recorded. If you vote by telephone or on the Internet, you do not need to return a written proxy card by mail. The Internet and telephone voting facilities will close at 11:59 p.m., Eastern Time, on June 3, 2014.

By Internet: You may submit your proxy over the Internet by going to www.proxyvote.com and completing an electronic proxy card in accordance with the instructions provided on the proxy card.

By Telephone: If you have elected to receive printed proxy materials, you may submit your proxy by telephone in accordance with the instructions provided on the proxy card.

By Mail: If you have elected to receive printed proxy materials, you may choose to vote by mail by marking your proxy card, dating and signing it and returning it in the postage-paid envelope provided by following the instructions on the proxy card. If the envelope is missing, please mail your completed proxy card to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. Please allow sufficient time for mailing if you decide to vote by mail.

In Person: You may vote in person at the annual meeting. We will give you a ballot when you arrive.

If I am the beneficial owner of Pandora shares held in street name, how do I vote?

If you are a beneficial owner of shares held in street name, you may vote in person at the annual meeting or by proxy on the Internet, by telephone or by mail, by following the voting instructions you will receive from the holder of record, which is the brokerage firm, bank, broker dealer, or other similar organization holding your shares. You must follow these voting instructions to vote your shares. Since a beneficial owner is not the stockholder of record, you may not vote your shares in person at the annual meeting unless you obtain a "legal proxy" from the holder of record (your broker, bank, trustee, or nominee that holds your shares) giving you the right to vote the shares at the meeting.

Can I change my vote after I have voted?

You may revoke your proxy and change your vote at any time before the proxy is exercised at the meeting. If you are a stockholder of record of Pandora shares, you may change your vote by submitting another proxy on a later date on the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the meeting will be counted), or by signing and returning a new proxy card with a later date, or by attending the annual meeting and voting in person. Your attendance at the annual meeting will not automatically revoke your proxy unless you vote again at the meeting or specifically request in writing that your prior proxy be revoked by providing a written notice of revocation to our Corporate Secretary at Pandora Media, Inc., 2101 Webster Street, Suite 1650, Oakland, California 94612, Attention: Corporate Secretary. If you are a beneficial owner of Pandora shares, you may change your vote by submitting new voting instructions to the holder of record (your broker, bank, trustee, or nominee that holds your shares) following the instructions they provided or, if you have obtained a legal proxy from the holder of record (your broker, bank, trustee, or nominee that holds your shares) giving you the right to vote your shares, by attending the annual meeting and voting in person.

3

What if I don't give specific voting instructions?

Stockholders of Record: If you are a stockholder of record and you indicate that you wish to vote as recommended by our board of directors, or you return a signed proxy card but do not specify how you wish to vote, then your shares will be voted "FOR" all of the director nominees, "FOR" Proposal 2 and "FOR" Proposal 3. If you indicate a choice with respect to any matter to be acted upon on your proxy card, your shares will be voted in accordance with your instructions on such matter.

Beneficial Owner of Pandora Shares Held in Street Name: If you are a beneficial owner of Pandora shares held in street name and do not provide the organization that holds your shares with voting instructions, your broker, bank, trustee or other nominee will vote your shares only on those proposals on which it has discretion to vote; if your broker, bank, trustee or nominee does not have discretion to vote, your returned proxy will be considered a "broker non-vote." Broker non-votes will be considered as represented for purposes of determining a quorum but are not counted for purposes of determining the number of votes cast with respect to a particular proposal. Your broker, bank, trustee or nominee does not have discretion to vote your shares on the non-routine matters such as the election of directors (Proposal 1) or the approval of the 2014 Employee Stock Purchase Plan (Proposal 3). However, we believe your broker or nominee does have discretion to vote your shares on routine matters such as the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm (Proposal 2).

The meeting will be held if a majority of the shares of common stock issued and outstanding on the record date are present at the meeting, either in person or by proxy. This is called a quorum for the transaction of business. At the record date, there were 205,332,382 shares of common stock issued and outstanding. Accordingly, the presence of the holders of common stock representing at least 102,666,192 shares will be required to establish a quorum.

Your shares will be counted for purposes of determining if there is a quorum if you properly cast your vote in person at the meeting, electronically or telephonically, or a proxy card has been properly submitted by you or on your behalf. Votes "for" and "against," and proxies received but marked as "abstentions" and "broker non-votes" will each be counted as present for purposes of determining the presence of a quorum.

What vote is required to approve each item?

Proposal 1. Directors are elected by a plurality of votes cast. This means that the three nominees receiving the highest number of affirmative votes of the shares of common stock present in person or represented by proxy and entitled to vote on the item will be elected as the Class III directors.

Proposals 2 and 3. The affirmative vote of a majority of the shares of common stock present in person or represented by proxy and entitled to vote on the item will be required to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the current fiscal year (Proposal 2) and to approval the 2014 Employee Stock Purchase Plan (Proposal 3).

If any other matter is properly submitted to the stockholders at the annual meeting, its adoption generally will require the affirmative vote of a majority of the shares of common stock present in person or represented by proxy and entitled to vote on that matter.

How are abstentions and broker non-votes treated?

In accordance with Delaware law, only votes cast "for" a matter constitute affirmative votes. A properly executed proxy marked "abstain" with respect to any matter will not be voted, although it will

4

be counted for purposes of determining whether there is a quorum. Abstentions will have the same effect as negative votes for Proposal 2 and Proposal 3.

If you hold your shares in "street name" through a broker, bank, trustee or other nominee, your broker, bank, trustee or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon, including the election of directors (Proposal 1) and the approval of the 2014 Employee Stock Purchase Plan (Proposal 3). Thus, if you do not give your broker, bank, trustee or nominee specific instructions with respect to a non-discretionary matter, your shares will not be voted on such matter and will not be counted as shares entitled to vote on such matter. However, shares represented by such "broker non-votes" will be counted in determining whether there is a quorum. As "broker non-votes" are not considered entitled to vote on the item they will have no effect on the outcome other than reducing the number of shares present in person or by proxy and entitled to vote on the item from which a majority is calculated.

What are the recommendations of the board of directors?

Our board of directors recommends that you vote:

"FOR" the election of the three Class III director nominees;

"FOR" ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2014; and

"FOR" the approval of our 2014 Employee Stock Purchase Plan.

Broadridge Financial Solutions, Inc. will act as the inspector of elections and will tabulate the votes.

When will the voting results be announced?

Preliminary voting results will be announced at the annual meeting and final results will be published in a Current Report on Form 8-K filed within four business days after the annual meeting.

Is Pandora paying the cost of this proxy solicitation?

We will pay the costs of printing, mailing and distributing these proxy materials and soliciting votes. We may request banks, brokers other custodians, nominees and fiduciaries to solicit their customers who own our shares and we will reimburse them for their reasonable out-of-pocket expenses. Our employees, directors, officers and others may solicit proxies on our behalf, personally or by telephone, without additional compensation.

Is the annual meeting being webcast?

Yes. If you choose to listen to the webcast, go to the "Event Calendar" section of our Investor Relations website (http://investor.pandora.com) before the meeting time, and follow the instructions for downloading the webcast. If you miss the annual meeting, you can listen to a re-broadcast of the webcast through Friday, July 4, 2014.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE VOTE AS SOON AS POSSIBLE.

5

PROPOSAL NO. 1

ELECTION OF CLASS III DIRECTORS

Recommendation of the Board of Directors

The board of directors recommends that you vote "FOR" the election of each of the nominated directors as described below.

Our certificate of incorporation currently provides for a board of directors divided into three classes, designated Class I, Class II and Class III which currently consist of two, three and three directors, respectively. The three Class III directorships are up for election at the 2014 annual meeting of stockholders. Each person elected as a Class III director at the annual meeting of stockholders will serve a three-year term expiring on the date of the 2017 annual meeting of stockholders or until their respective successors have been duly elected and qualified.

Our board of directors has nominated Peter Chernin, Brian McAndrews and Tim Westergren for election at the 2014 annual meeting of stockholders.

The nominees were selected by the board of directors upon the recommendation of the nominating and corporate governance committee. Each of the nominees has a long record of integrity, a strong professional reputation and a record of entrepreneurial or managerial achievement. The specific experience, qualifications, attributes and skills of each nominee that led the board to conclude that the individual should serve as a director are described in each nominee's biography below.

Directors are elected by a plurality of the votes cast, and the three nominees who receive the most votes will be elected as Class III directors. Abstentions and broker non-votes will not be taken into account in determining the outcome of the election.

Nominees for Election as Class III Directors (Terms Expiring on the Date of the 2017 Annual Meeting of Stockholders)

| Peter Chernin | Director since January 2011 | |

| Brian McAndrews | Director since September 2013 | |

| Tim Westergren | Director since January 2000 |

Continuing Class I Directors (Terms Expiring on the Date of the 2015 Annual Meeting of Stockholders)

| Robert Kavner | Director since March 2004 | |

| David Sze | Director since May 2009 |

Continuing Class II Directors (Terms Expiring on the Date of the 2016 Annual Meeting of Stockholders)

| James M.P. Feuille | Director since October 2005 | |

| Peter Gotcher | Director since September 2005 | |

| Elizabeth A. Nelson | Director since July 2013 |

6

Set forth below is each director's and each director nominee's name and age as of the record date and his or her principal occupation, business history and public company directorships held during the past five years.

Peter Chernin, age 62, has served on our board of directors since January 2011. Mr. Chernin currently owns and runs Chernin Entertainment, which produces motion pictures and television programs, and The Chernin Group, which pursues strategic opportunities in media, technology and entertainment. From 1996 to 2009, Mr. Chernin held various positions at News Corporation, most recently as president and chief operating officer, and as chairman and chief executive officer of The Fox Group, a subsidiary of News Corporation, where he oversaw the global operations of the company's film, television, satellite, cable and digital media businesses. Prior to that, Mr. Chernin headed Twentieth Century Fox Filmed Entertainment and, earlier, the Fox Broadcasting Company. Prior to joining News Corporation, Mr. Chernin served as president and chief operating officer of Lorimar Film Entertainment, a television production company. Mr. Chernin currently serves on the board of directors of American Express, a diversified financial services company, and Twitter, a social media company, and has previously served on the boards of directors of various companies in the media industry and the tech industry, including News Corporation, Fox Entertainment Group, Gemstar-TV Guide International, E*Trade and DIRECTV. Mr. Chernin holds a Bachelor of Arts in English Literature from the University of California at Berkeley. We believe that Mr. Chernin is qualified to serve on our board of directors due to his operating and management experience at a global media corporation, his expertise in online and mobile markets and other new technologies, and his service on the boards of directors of a range of public and private companies.

James M. P. Feuille, age 56, has served on our board of directors since October 2005. Mr. Feuille currently serves as a general partner with Crosslink Capital, an investment and venture capital management company, where he focuses on investments in digital media, internet services, and software and business services. Mr. Feuille has been affiliated with Crosslink Capital since November 2002 and has been a general partner since January 2005. Prior to joining Crosslink Capital, Mr. Feuille served as global head of technology investment banking at UBS Warburg, a business group of a global financial services firm, chief operating officer at Volpe Brown Whelan & Company, and head of technology investment banking at Robertson Stephens & Company. Mr. Feuille currently serves on the boards of directors of a number of privately-held companies. Mr. Feuille holds a Bachelor of Arts degree in Chemistry from Dartmouth College and a Juris Doctor degree and a Master of Business Administration from Stanford University. We believe that Mr. Feuille is qualified to serve on our board of directors due to his experience with the venture capital industry and a wide variety of internet and technology companies, as well as the perspective he brings as an affiliate of one of our major stockholders.

Peter Gotcher, age 54, has served on our board of directors since September 2005. Mr. Gotcher is an independent private investor focusing on investments in digital media technology companies. Mr. Gotcher was a venture partner with Redpoint Ventures, a private investment firm from September 1999 to June 2002. Prior to that, Mr. Gotcher was a venture partner with Institutional Venture Partners, a private investment firm, from 1997 to September 1999. Mr. Gotcher founded Digidesign, a manufacturer of digital audio workstations, and served as its president, chief executive officer and chairman of the board of directors of from 1984 to 1995. Digidesign was acquired by Avid Technology, a media software company, in 1995 and Mr. Gotcher served as the general manager of Digidesign and executive vice president of Avid Technology from January 1995 to May 1996. Mr. Gotcher currently serves as Chairman of the board of directors of Dolby Laboratories and serves on the boards of directors of a number of privately-held companies. Mr. Gotcher holds a Bachelor of Arts degree in English literature from the University of California at Berkeley. We believe that Mr. Gotcher should serve on our board of directors due to his broad understanding of the operational, financial and

7

strategic issues facing public companies and his background providing guidance and counsel to companies in the digital media industry.

Robert Kavner, age 70, has served on our board of directors since March 2004 and as lead independent director since March 2010. Since 1995, Mr. Kavner has been an independent venture capital investor focusing on investments in technology companies. From January 1996 through December 1998, Mr. Kavner served as president and chief executive officer of On Command Corporation, a provider of on-demand video systems for the hospitality industry. From 1984 to 1994, Mr. Kavner held several senior management positions at AT&T, a provider of telecommunications services, including senior vice president, chief financial officer and chief executive officer of Multimedia Products and Services Group and chairman of AT&T Venture Capital Group. Mr. Kavner also served as a member of AT&T's executive committee. Mr. Kavner served on the board of directors of Earthlink, an internet service provider, from 2001 to 2008, and currently serves on the boards of directors of a number of privately-held companies. Prior to joining AT&T, Mr. Kavner was a partner of PricewaterhouseCoopers. Mr. Kavner received a Bachelor of Arts degree in business management from Adelphi University. We believe that Mr. Kavner is qualified to serve on our board of directors due to his extensive background in and experience with technology companies, his service on the boards of directors of a range of public and private companies and his background in public accounting.

Brian McAndrews, age 55, has served as our president and chief executive officer, as well as chairman of our board of directors, since September 2013. Previously, he served as a venture partner with Madrona Venture Group, LLC, a venture capital firm, from 2012 to September 2013 and as a managing director of Madrona from 2009 to 2011. From 2007 to 2008, Mr. McAndrews served as senior vice president of advertiser and publisher solutions at Microsoft Corporation, a provider of software, services and solutions. From 1997 to 2007, Mr. McAndrews served as chief executive officer of aQuantive, a leading digital marketing services and technology company which was acquired by Microsoft in 2007. Mr. McAndrews currently serves on the board of directors of The New York Times Company, a multimedia news and information company, and GrubHub Inc., an online and mobile food-ordering company. He previously served on the boards of directors of Fisher Communications, Inc. from 2006 to 2013 and Clearwire Corporation from 2009 to 2013. We believe that Mr. McAndrews is qualified to serve on our board of directors due to the perspective, experience and operational expertise he brings as our chief executive officer and his background in the internet and advertising industries.

Elizabeth A. Nelson, age 53, has served on our board of directors since 2013. Ms. Nelson currently serves on the boards of Nokia, a global leader in the mobile market, Brightcove, Inc., a provider of cloud-based solutions for publishing and distributing professional digital media, and several private companies. Ms. Nelson currently chairs the audit committee at Brightcove and serves on the audit committee at Nokia. From 1996 through 2005, Ms. Nelson served as the Executive Vice President and Chief Financial Officer at Macromedia, Inc., where she also served as a director from January 2005 to December 2005. Prior to joining Macromedia, Ms. Nelson held various roles in finance and corporate development at Hewlett-Packard Company, an information technology company. Ms. Nelson's public company board service includes serving as a director of Ancestry.com, an online family history company, from 2009 to 2012, of SuccessFactors Inc., a provider of human resources solutions, from 2007 to 2012, of Autodesk Inc., a design software company, from 2007 to 2010, and of CNET Networks, Inc., an Internet media company, from 2003 to 2008. Ms. Nelson holds an M.B.A. in Finance with distinction from the Wharton School at the University of Pennsylvania and a B.S. from Georgetown University. We believe that Ms. Nelson is qualified to serve on our board of directors due to her operating and management experience in the technology industry and her service on the boards of directors of a range of technology, internet and mobile companies.

David Sze, age 48, has served on our board of directors since May 2009. Mr. Sze currently serves as a partner with Greylock Partners, a private investment firm, where his investment focuses include

8

consumer internet and service, media convergence, wireless data and technology-assisted marketing services. Before joining Greylock in 2000, Mr. Sze was senior vice president of product strategy at Excite and then Excite@Home, an internet portal company. As an early employee at Excite, Mr. Sze also held roles as general manager of Excite.com and vice president of content and programming for the Excite Network. Prior to that, Mr. Sze was in product marketing and development at Electronic Arts and Crystal Dynamics, respectively. He started his career in management consulting for Marakon Associates and The Boston Consulting Group, and also spent time at HBO. Mr. Sze currently serves on the board of directors of LinkedIn Corporation, a professional social networking internet service, and serves on the boards of directors of several private companies. Mr. Sze holds a Bachelor of Arts degree from Yale University and a Master of Business Administration from Stanford University. Mr. Sze is also a Trustee of The Rockefeller University. We believe that Mr. Sze is qualified to serve as a director on our board of directors due to his extensive background and operational experience with internet and technology companies.

Tim Westergren, age 48, one of our founders, served as our chief creative officer and treasurer from February 2000 to May 2002, as our chief executive officer and president from May 2002 to July 2004, and as our chief strategy officer from July 2004 to February 2014. He has served as a member of our board of directors from the company's inception. Prior to founding our company, Mr. Westergren worked as an independent musician, composer and record producer and has over 20 years of experience in the music industry. Mr. Westergren holds a Bachelor of Arts degree from Stanford University, where he studied computer acoustics and recording technology. We believe that Mr. Westergren is qualified to serve on our board of directors based on his historic knowledge of our company as one of our founders, the continuity he provides on our board of directors, his strategic vision for Pandora and his background in technology and music.

9

Our business and affairs are managed under the direction of our board of directors. The current members of the board of directors are Brian McAndrews, Peter Chernin, James M. P. Feuille, Peter Gotcher, Robert Kavner, Elizabeth A. Nelson, David Sze and Tim Westergren.

Our board of directors is divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. Our directors are divided among the three classes as follows:

Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of our directors.

The board of directors held six meetings in the eleven months ending December 31, 2013 (an eleven month transition year as a result of the change in our fiscal year effective with the year ending December 31, 2013). Under our corporate governance guidelines, directors are expected to be active and engaged in discharging their duties and to keep themselves informed about our business and operations. Directors are expected to attend all meetings of the board of directors and the meetings of each committee on which they serve and to prepare themselves for those meetings. During the eleven months ending December 31, 2013, each of our directors attended at least 75% of the total number of meetings of the board of directors and the total number of meetings held by each committee on which such director served. In addition, under our corporate governance guidelines, directors are encouraged, but not required, to attend the annual meeting of stockholders.

Our board of directors currently has three standing committees: the audit committee, the compensation committee and the nominating and corporate governance committee. Each member of these committees is independent as defined by applicable NYSE and SEC rules and each of these committees has a written charter approved by the board of directors. Under our corporate governance guidelines, committee members are appointed by the board of directors based on the recommendation of the nominating and corporate governance committee, except that members of the nominating and

10

corporate governance committee are appointed by the independent members of the board of directors. The current members of the committees are as follows:

Director

|

Audit | Compensation | Nominating and Corporate Governance |

|||

|---|---|---|---|---|---|---|

| James M. P. Feuille | ü(Chair) | ü | ||||

| Peter Gotcher | ü | ü(Chair) | ||||

| Robert Kavner | ü | ü | ü | |||

| Elizabeth A. Nelson | ü(Chair) | |||||

| David Sze | ü |

Audit Committee. The primary functions of the audit committee are:

A detailed list of the audit committee's functions is included in its charter which is available on our Investor Relations website (http://investor.pandora.com) in the "Corporate Governance" section.

The audit committee currently consists of Mr. Kavner, Ms. Nelson and Mr. Sze with Ms. Nelson serving as the committee's chairperson. Barry McCarthy previously served as the audit committee's chairperson until his departure from our board of directors on June 5, 2013, and thereafter Mr. Kavner served as the committee's chairperson until December 11, 2013. Our board of directors has determined that each member of the committee is "independent" as defined under the NYSE listing standards, Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") and our corporate governance guidelines, and that each member of the audit committee meets the requirements for financial literacy under the applicable rules and regulations of the SEC and the NYSE. Our board of directors has determined that each member of the committee is an audit committee "financial expert," as that term is defined by the applicable rules of the SEC. The audit committee held four meetings during the eleven months ending December 31, 2013. The Audit Committee Report for the eleven months ending December 31, 2013 is included below.

Compensation Committee. The primary functions of the compensation committee are:

11

A detailed list of the compensation committee's functions is included in its charter which is available on our Investor Relations website (http://investor.pandora.com) in the "Corporate Governance" section.

The compensation committee currently consists of Messrs. Feuille, Gotcher and Kavner, with Mr. Feuille serving as the committee's chairperson. Our board of directors has determined that each member of the committee is "independent" within the meaning of the NYSE listing standards and our corporate governance guidelines. The compensation committee held five meetings during the eleven months ending December 31, 2013. The Compensation Committee Report for the eleven months ending December 31, 2013 is included below. The compensation committee has full authority to determine and approve executive officer compensation. It may delegate some of its authority to a sub-committee but may not delegate authority with respect to executive officer compensation except to an independent committee. For further information about the compensation committee's process for determining executive compensation, including the role of the compensation committee independent consultants, Frederic W Cook & Co. and Compensia, Inc., see "Compensation Discussion and Analysis" below.

Nominating and Corporate Governance Committee. The primary functions of the nominating and corporate governance committee are:

A detailed list of the nominating and corporate governance committee's functions is included in its charter which is available on our Investor Relations website (http://investor.pandora.com) in the "Corporate Governance" section.

The nominating and corporate governance committee currently consists of Messrs. Feuille, Gotcher and Kavner, with Mr. Gotcher serving as its chairperson. Our board of directors has determined that each member of the committee is "independent" within the meaning of the NYSE listing standards and our corporate governance guidelines. The nominating and corporate governance committee held five meetings during the eleven months ending December 31, 2013.

Cash Retainer. During the eleven months ending December 31, 2013, each of our non-employee directors received (a) an annual retainer of $40,000 for serving as a member of our board of directors

12

and (b) each of the applicable annual retainers set forth below for serving as a member or as a chair of one or more of the committees of our board of directors, or as our lead independent director.

Position

|

Annual Retainer ($) |

|||

|---|---|---|---|---|

Annual Committee Member Retainers: |

||||

Audit Committee |

12,500 | |||

Compensation Committee |

7,500 | |||

Nominating and Corporate Governance Committee |

5,000 | |||

Additional Annual Retainers for Committee Chairs: |

||||

Audit Committee |

12,500 | |||

Compensation Committee |

7,500 | |||

Nominating and Corporate Governance Committee |

5,000 | |||

Lead Independent Director |

20,000 | |||

Equity Awards. During the eleven months ending December 31, 2013, on the date of our annual stockholder meeting, each of our non-employee directors, other than Ms. Nelson, received a restricted stock unit award with the number of RSUs determined by dividing $200,000 by the closing price of our stock on such date. These equity awards become vested one year following grant or earlier upon a change in control. On July 15, 2013, upon joining our board of directors, Ms. Nelson received a pro-rated restricted stock unit award with the number of RSUs determined by dividing $175,000 by the closing price of our stock on such date. Ms. Nelson's equity award will vest in full on June 5, 2014 or earlier upon a change in control.

Director Compensation Table. The following table sets forth information concerning the compensation for our non-employee directors during the eleven months ending December 31, 2013. Messrs. McAndrews, Kennedy and Westergren, who served as executive officers, did not receive separate compensation for their service on the board of directors.

Name

|

Fees Earned or Paid in Cash ($) |

Stock Awards ($)(1)(2) |

Option Awards ($)(2) |

Total ($) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Peter Chernin |

34,167 | 199,993 | — | 234,160 | |||||||||

James M.P. Feuille |

52,500 | 199,993 | — | 252,493 | |||||||||

Peter Gotcher |

57,824 | 199,993 | — | 257,817 | |||||||||

Robert Kavner |

81,783 | 199,993 | — | 281,776 | |||||||||

Elizabeth A. Nelson |

25,363 | 174,986 | 200,349 | ||||||||||

David Sze |

45,625 | 199,993 | — | 245,618 | |||||||||

Barry McCarthy(3) |

20,109 | — | — | 20,109 | |||||||||

13

14

Corporate Governance Guidelines

Our board of directors has approved corporate governance guidelines for Pandora, which are available on our Investor Relations website (http://investor.pandora.com) in the "Corporate Governance" section. These corporate governance guidelines establish the practices of our board of directors with respect to:

The nominating and corporate governance committee is responsible for overseeing compliance with our corporate governance guidelines, reviewing and reassessing the adequacy of the guidelines at least annually and recommending any proposed changes to our board of directors.

Our board of directors is committed to strong, independent leadership and believes that objective oversight of management performance is a critical aspect of effective corporate governance. A substantial majority of our board members are independent directors, under NYSE listing standards, SEC rules and our corporate governance guidelines; our standing board committees (audit, compensation and nominating and corporate governance) are comprised solely of and chaired by independent directors; and, our independent directors meet in regularly scheduled executive sessions without management in connection with our regularly scheduled meetings of the board of directors.

Our board of directors is responsible for determining its leadership structure. Currently, the chairman of the board of directors, Mr. McAndrews, also serves as our chief executive officer and president. The board of directors believes that our company and our stockholders are best served by maintaining the flexibility to have any person serve as chairman of the board based on what is in the best interests of our company and our stockholders at a given point in time, and therefore the board of directors does not support placing restrictions on who may serve as its chairman. Our corporate governance guidelines provide that one of our independent directors should serve as a lead independent director at any time when the chief executive officer serves as the chairman of the board, or if the chairman of the board is not otherwise independent. Because Mr. McAndrews is our chairman, chief executive officer and president, the independent members of our board of directors have appointed Mr. Kavner as lead independent director to preside over periodic executive sessions of our independent directors, serve as a liaison between our chairman and the independent directors and perform such additional duties as set forth in our corporate governance guidelines and as our board of directors may otherwise determine and delegate. Mr. Kavner has served as our lead independent director since March 2010.

15

Our board of directors regularly deliberates and discusses its appropriate leadership structure and the role and responsibilities of the chairman of the board and the lead independent director based upon the needs of our company to provide effective, independent oversight of management performance.

Board's Role in Risk Oversight

While management is responsible for the day-to-day supervision of risks facing our company, the board of directors, as a whole and through its committees, has the ultimate responsibility for the oversight of risk management. The board of directors' oversight areas of focus include, but are not limited to succession planning with respect to our chief executive officer and other members of senior management, managing our long-term growth and strategic and operational planning.

The board of directors has delegated to certain committees oversight responsibility for those risks that are directly related to their areas of focus. For example, the audit committee coordinates the board of directors' oversight of our company's internal control over financial reporting and disclosure controls and procedures and periodically reports to the board of directors on any issues that arise with respect to the quality or integrity of our financial statements, our compliance with legal or regulatory requirements, the independence and performance of our independent auditor and the performance of the internal audit function. In addition, the compensation committee assists the board of directors in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation programs. The nominating and corporate governance committee assists the board in fulfilling its oversight responsibilities with respect to the management of risks associated with our overall governance practices and the leadership structure of the board of directors (as further described under "Corporate Governance-Board Leadership Structure"). Our board of directors is kept informed of each committee's risk oversights and other activities via regular reports of the committee chairs to the full board of directors.

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee during the eleven months ending December 31, 2013 has, at any time, been an officer or employee of Pandora. During the eleven months ending December 31, 2013, none of our executive officers served on the compensation committee or board of any other company whose executive officers serve as a member of our board or compensation committee, and no compensation committee member had any relationship requiring disclosure under Item 404 of Regulation S-K.

As required by the NYSE listing standards and our corporate governance guidelines, a majority of the board of directors is "independent" within the meaning of such standards and guidelines. The board of directors is required to make an affirmative determination at least annually as to the independence of each director. If the director nominees are elected at the 2014 annual meeting of stockholders, the board of directors will be composed of two management directors (Messrs. McAndrews and Westergren) and six independent directors. The board has determined that our former director, Mr.McCarthy, was independent (as defined by NYSE listing standards and our corporate governance guidelines) and that each of the following six directors is independent (as defined by NYSE listing standards and our corporate governance guidelines): Mr. Chernin, Mr. Feuille, Mr. Gotcher, Mr. Kavner, Ms. Nelson, and Mr. Sze; and that, therefore, all directors who served during the eleven months ending December 31, 2013 on the Audit, Compensation and Nominating and Corporate Governance Committees were independent under the NYSE listing standards.

16

Under our corporate governance guidelines, executive sessions of independent directors are held in connection with regularly scheduled meetings of the board of directors and at other times as necessary, and are chaired by the lead independent director. Our independent directors confer after each regularly scheduled meeting of the board of directors to discuss the need for executive sessions and held five executive sessions during the eleven months ending December 31, 2013.

General Criteria and Process

The nominating and corporate governance committee is responsible for identifying, reviewing and evaluating candidates to serve on our board of directors and reports to the board of directors regarding its conclusions and recommendations. In identifying and evaluating director nominees, the nominating and corporate governance committee will consider the membership criteria approved by the board of directors and described below, taking into account potential conflicts of interest, the enhanced independence, financial literacy and financial expertise standards that may be required under applicable SEC regulations, NYSE listing standards or our corporate governance guidelines, as well as the current challenges and needs of the board of directors. In evaluating director nominees, the nominating and corporate governance committee evaluates all candidates under consideration as it deems appropriate.

The nominating and corporate governance committee charter requires that the committee recommend, and that the board of directors approve, criteria for the selection of candidates to the board of directors and its committees. The nominating and corporate governance committee and the board of directors have established the following criteria for board of directors and committee membership:

The nominating and corporate governance committee does not assign specific weights to particular criteria. Rather, the board of directors believes that the backgrounds and qualifications of the directors, considered as a group, should provide a significant composite mix of judgment, diversity of skills and background, age, prior performance and experience that will allow the board of directors to fulfill its responsibilities.

Stockholder Nominations and Bylaw Procedures

Stockholders may nominate directors for election at our annual meeting of stockholders by following the provisions set forth in our bylaws, including giving timely notice to our Corporate Secretary at Pandora Media, Inc., 2101 Webster Street, Suite 1650, Oakland, California 94612, Attention: Corporate Secretary. The notice must include information specified in our bylaws, including information concerning the nominee that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Exchange Act, and information about the stockholder's ownership of and agreements related to our stock. The deadline for timely receiving stockholder nominations is disclosed elsewhere in this proxy statement under the caption "Deadline for Receipt of Stockholder Proposals."

17

At this time, our nominating and corporate governance committee does not have a formal policy with regard to the consideration of director candidates recommended by stockholders. The board of directors does not believe that a formal policy is merited because the evaluation of potential members of the board of directors is by its nature a case-by-case process based on the composition of the board of directors and the needs and status of our company at the time. Accordingly, the board of directors, or upon delegation, the nominating and corporate governance committee, would consider any such recommendations on a case-by-case basis in their discretion, and, if accepted for consideration, would evaluate any such nominee based on the membership criteria set forth under "Director Nominations-General Criteria and Process" above.

Communications with the Board of Directors

Stockholders and other parties interested in communicating directly with the board of directors or specific members of the board of directors may do so by writing to: Pandora Media, Inc., 2101 Webster St., Suite 1650, Oakland, CA 94612, Attn: General Counsel, noting the name and address of the stockholder on whose behalf the communication is sent and the number of shares of Pandora stock that are owned beneficially by such stockholder as of the date of the communication. Stockholders and other interested parties seeking to communicate directly and confidentially with our company's independent directors should indicate that the message is intended for the lead independent director.

Pursuant to our stockholder communications policy, a copy which is available on our Investor Relations website (http://investor.pandora.com) in the "Corporate Governance" section, the general counsel reviews all correspondence received by Pandora and addressed to members of the board of directors and submits to the appropriate members of the board of directors all correspondence that, in the opinion of the general counsel, warrants the members' attention. The general counsel also provides the board of directors a report on a quarterly basis of any stockholder communications received for which the general counsel has determined no response is necessary. The general counsel may also, where the nature of a communication warrants, determine, in his or her judgment, to obtain the more immediate attention of the appropriate committee of the board of directors, a director, an independent advisor or Pandora management.

Code of Business Conduct and Ethics

Our board of directors has adopted a code of business conduct and ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. The code of business conduct and ethics is available on our Investor Relations website (http://investor.pandora.com) in the "Corporate Governance" section. We expect that any amendments to the code, or any waivers of its requirements, will be disclosed on our website.

Transactions in Company Securities

We prohibit our directors and officers from trading equity derivatives such as options related to our stock and engaging in short sales or otherwise engaging in hedging or pledging transactions with respect to our securities.

18

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our common stock as of February 28, 2014 by:

In accordance with the rules of the SEC, beneficial ownership includes sole or shared voting or investment power with respect to securities and includes the shares issuable pursuant to stock options that are exercisable within 60 days of the determination date, which in the case of the following table is February 28, 2014. Shares issuable pursuant to stock options are deemed outstanding for computing the percentage of the person holding such options but are not outstanding for computing the percentage of any other person. The percentage of beneficial ownership is based on 202,343,712 shares of common stock outstanding as of February 28, 2014.

Unless otherwise indicated, the address for each listed stockholder is: c/o Pandora Media, Inc., 2101 Webster Street, Suite 1650, Oakland, California, 94612. To our knowledge, except as indicated in the footnotes to this table and pursuant to applicable community property laws, each person identified in the table possesses sole voting and investment power with respect to all shares of common stock shown as beneficially owned by the person.

| |

Common Stock | ||||||

|---|---|---|---|---|---|---|---|

Beneficial Owner

|

Amount and Nature of Beneficial Ownership(1) |

Percent of Class |

|||||

Greater than 5% Stockholders: |

|||||||

Entities affiliated with Crosslink Capital, Inc.(2) |

16,273,418 | 8.04 | % | ||||

Wellington Management Company, LLP(3) |

10,773,826 | 5.32 | % | ||||

Artisan Partners Limited Partnership(4) |

10,361,484 | 5.12 | % | ||||

Directors and Named Executive Officers: |

|||||||

Brian McAndrews |

— | — | |||||

Joseph Kennedy(5) |

4,677,738 | 2.30 | % | ||||

Michael Herring(6) |

117,491 | * | |||||

Thomas Conrad(7) |

1,524,827 | * | |||||

Delida Costin(8) |

77,083 | * | |||||

John Trimble(9) |

476,313 | * | |||||

Peter Chernin(10) |

270,323 | * | |||||

James M. P. Feuille(2)(11) |

16,510,131 | 8.16 | % | ||||

Peter Gotcher(12) |

978,679 | * | |||||

Robert Kavner(13) |

829,727 | * | |||||

Elizabeth A. Nelson |

— | — | |||||

David Sze |

639,748 | * | |||||

Tim Westergren(14) |

4,443,448 | 2.16 | % | ||||

Current Directors and Officers as a Group (12 persons)(15) |

24,350,464 | 11.78 | % | ||||

19

20

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers and directors and persons who beneficially own more than ten percent of our common stock to file with the SEC initial reports of beneficial ownership and reports of changes in beneficial ownership of common stock. Executive officers, directors and ten percent stockholders are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. As a matter of practice, we generally assist our executive officers and certain directors in preparing initial ownership reports and reporting ownership changes and we typically file these reports on their behalf. Based solely on our review of copies of any Section 16(a) forms received by us or written representations that no other reports were required, we believe that all of our executive officers, directors and ten percent stockholders complied during the eleven months ending December 31, 2013 with the reporting requirements of Section 16(a) of the Exchange Act except that a late Form 4 was filed on September 16, 2013 for the grant to Brian McAndrews of an option and RSU award and a late Form 4 was filed on April 17, 2013 for the grant to Thomas Conrad of an RSU award.

21

Our executive officers and their ages as of the record date and positions are as follows:

Name

|

Age | Position | |||

|---|---|---|---|---|---|

Brian McAndrews |

55 | Chief Executive Officer, President and Chairman of the Board | |||

Sara Clemens |

42 | Chief Strategy Officer | |||

Delida Costin |

44 | General Counsel, Senior Vice President and Secretary | |||

Simon Fleming-Wood |

45 | Chief Marketing Officer | |||

Michael Herring |

45 | Chief Financial Officer and Executive Vice President | |||

John Trimble |

50 | Chief Revenue Officer | |||

Tim Westergren |

48 | Founder and Director | |||

Brian McAndrews. See "Proposal No. 1 Election of Class III Directors."

Sara Clemens has served as our chief strategy officer since February 2014. Prior to joining Pandora, Ms. Clemens was an executive-in-residence at Greylock Partners, a venture capital firm, from September 2013 to February 2014. Ms. Clemens served as the vice president of corporate development at LinkedIn Corporation, a professional social networking internet service, from July 2012 to September 2013. Prior to that, from 2007 to 2012, she held a variety of leadership positions at Microsoft Corporation, a provider of software, services, and solutions, including serving as the general manager of strategy and development for Microsoft's interactive entertainment business from 2010 to 2012. Ms. Clemens holds a Bachelor of Arts degree and Master's degree with honors from the University of Canterbury in New Zealand.

Delida Costin has served as our senior vice president, general counsel and secretary since April 2010. From 2007 to 2010, Ms. Costin maintained a private legal practice, where she worked with public and private companies in the San Francisco Bay Area, including companies in the digital media space. During this period, Ms. Costin also served as an Axiom Attorney at Axiom Global. From 2000 to 2006, Ms. Costin served as assistant general counsel, and from 2006 to 2007 as vice president and assistant general counsel at CNET Networks, a media company, where she focused on legal issues relating to the digital media industry. Prior to that, Ms. Costin was an associate at the law firms of Goodwin Procter and Pillsbury Winthrop Shaw Pittman. During her years of legal practice, Ms. Costin has advised on issues related to compliance, securities law, digital media, privacy, data protection and online advertising. Ms. Costin holds a Juris Doctor degree from Boston University School of Law and a Bachelor of Arts degree from Northwestern University.

Simon Fleming-Wood has served as our chief marketing officer since October 2011. From 2009 to 2011, Mr. Fleming-Wood was the vice president of marketing for the consumer products group at Cisco Systems, a provider of communications and information technology products and services, where he oversaw the worldwide marketing organization for the company's consumer business and led the development and execution of all integrated marketing efforts. Mr. Fleming-Wood was the founding vice president of marketing at Pure Digital Technologies, a developer of digital imaging solutions, from 2001 to 2009, when Pure Digital Technologies was acquired by Cisco Systems. In that role, Mr. Fleming-Wood was responsible for the creation, development and introduction of the company's leading product line, Flip Video. Prior to that, Mr. Fleming-Wood held various senior marketing positions at Sega.com, The Learning Company/Mattel and The Clorox Company. Mr. Fleming-Wood holds a Bachelor of Arts in political science from Stanford University.

Michael Herring has served as our chief financial officer and executive vice president since February 2013. Prior to joining Pandora, Mr. Herring served as the vice president of operations at Adobe Systems Incorporated, a provider of digital marketing and digital media solutions, from 2009 to 2013. Mr. Herring served as the chief financial officer and executive vice president of Omniture, Inc., a provider of online business optimization software, from 2004 to 2009. Prior to Omniture, Mr. Herring

22

served as the chief financial officer of MyFamily.com (now Ancestry.com), having joined the company through the acquisition of Third Age Media in 2000. At Third Age Media, Mr. Herring served as vice president of finance. Prior to Third Age Media, he served as controller of Anergen Inc. Mr. Herring holds a Bachelor of Arts degree in economics and political science from the University of California at Los Angeles.

John Trimble has served as our chief revenue officer since March 2009. Prior to joining us, Mr. Trimble was the executive vice president of sales at Glam Media, a media company, from 2007 to 2009, where he was responsible for overseeing advertising sales to new audiences and markets. From 2002 to 2007, Mr. Trimble served as senior vice president of advertising sales for Fox Interactive Media, a provider of internet media management and content broadcasting services, where he was responsible for managing sales initiatives and driving advertising revenue for various Fox online media properties, including MySpace.com, IGN.com, FoxSports.com and AmericanIdol.com. Prior to that, Mr. Trimble also served as director of sales for the Sports Illustrated website, SI.com, and as vice president of sales for Phase2 Media, a men's vertical advertising network. Mr. Trimble holds a Bachelor of Arts degree in political science from St. Lawrence University.

Tim Westergren. See "Proposal No. 1 Election of Class III Directors."

23

Compensation Discussion and Analysis

This Compensation Discussion and Analysis provides compensation information for our current chief executive officer ("CEO"), our former chief executive officer, our chief financial officer ("CFO") and our next three most highly-compensated executive officers for our 11 month transitional fiscal year ended December 31, 2013 (which we refer to herein as "calendar 2013"). These individuals, to whom we refer collectively as our "named executive officers" or "NEOs" as determined under the SEC disclosure rules, are:

On March 18, 2014, Mr. Conrad resigned as our chief technology officer and executive vice president of product. Mr. Conrad is expected to continue full-time for three months and then transition to a part-time role advising our leadership team. Effective beginning with the period ending on December 31, 2013, we converted our fiscal year to the calendar 12 months ending December 31. As a result, our fiscal year was shortened from 12 months to an 11 month transition period from February 1, 2013 to December 31, 2013.

Executive Summary

This Executive Summary summarizes our financial and business highlights for calendar 2013, describes key features of our executive compensation program and provides an overview of factors that we believe are relevant to stockholders.

Business Highlights of Calendar 2013

Key strategic management transitions: Mr. McAndrews became our chief executive officer in September 2013, following the March 2013 announcement that Mr. Kennedy would be leaving Pandora after a search for his successor. In addition, Mr. Herring became our chief financial officer in February 2013.

24

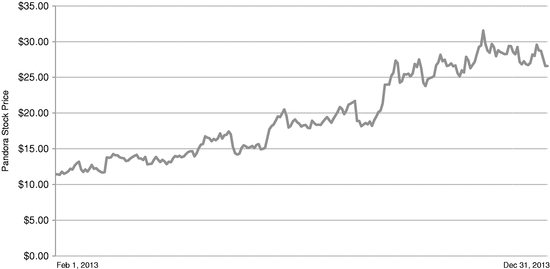

Stockholder value: Our stock price increased from $11.45 on February 1, 2013 to $26.60 on December 31, 2013, reflecting approximately a 132% increase, as shown in the following chart:

Business and financial results: We believe that to secure our long-term goals, the most important near-term objective is to strengthen our leadership position in the emerging internet radio market. We measure success in these efforts by our ability to grow listening hours, active listeners, market share in internet radio and overall U.S. radio listening, and revenues. In particular, for calendar 2013, we reported the following business performance results:

Monetization efforts: In addition to growing our reach through the expansion of listener hours, the other key driver of our long-term success is our ability to continue to monetize those hours through increased ad sales and subscriptions. For example:

25

Strengthening the balance sheet: With annual revenue of $600.2 million, and our philosophy of continuing to invest incremental gross margin to capitalize on our market opportunity, we concluded that increased balance sheet strength would be critical to allow us to continue growth both organically and potentially through acquisitions. In September 2013, we raised approximately $378.7 million, net of offering costs, in a registered offering of our common stock, which we believe will allow us to continue to focus on realizing the long-term potential of the business.

Features of Our Executive Compensation Program

Key features of our calendar 2013 executive compensation program align the interests of our NEOs with the long-term interests of our stockholders and help reduce the possibility of our NEOs making business decisions that promote short-term or individual compensation results as opposed to long-term stockholder value.

Objectives of Our Executive Compensation Program.

Hiring and retaining officers and other key employees has been critically important to ensuring continuity and stability, and in turn the growth, of our business. As a rapidly evolving and growing company in a highly competitive industry, we are managing our business for the achievement of long-term objectives rather than short-term performance. We recognize that our success is in large part dependent on our ability to attract and retain talented executives and other employees. Accordingly, our executive compensation and benefits philosophy is to attract, incentivize and retain a highly skilled and committed team of executive officers who share our vision and desire to work toward creating long-term stockholder value.

26

Management Recruitment and Transition

The recruitment of a highly qualified CEO and CFO were important aspects of our long-term business objectives for calendar 2013. The compensation packages were integral to attracting and retaining the talent we needed for these critical functions. In reaching the terms of the offer letters for Messrs. McAndrews and Herring described below, the compensation committee consulted with its independent compensation consultant and considered peer company data (including new hire data for technology companies), as well as each executive's experience and the compensation arrangements that each executive would have to give up at the executive's employer in accepting our offer of employment. The packages were the product of negotiations with the executives as well as the compensation committee's judgment as to competitive pay levels and components needed to attract the best candidates.

New CEO Recruitment. In its search for a new CEO, the board of directors sought a candidate who could build on Pandora's leading position in internet radio and accelerate its fast-growing advertising business. The board of directors believed that Mr. McAndrews' experience and understanding of the intersection of technology and advertising, as well as his proven abilities to set strategy, lead large teams and drive growth and innovation, afforded the combination of key attributes necessary to lead Pandora forward. As a result, the compensation committee and the board of directors approved a compensation package for Mr. McAndrews consisting of the following primary elements:

New CFO Recruitment. Mr. Herring became our chief financial officer on February 1, 2013. The board of directors believed that his track record of building global technology businesses and delivering long-term profitability and revenue growth were important to our business and our stockholders. As a result, the components of Mr. Herring's package were:

27

the upfront grant, his options are subject to a vesting schedule over a five-year period rather than the predominant market practice of three to four years.

Former CEO Transitional Arrangements. In March 2013, Mr. Kennedy announced that he would be leaving as our CEO after completion of a search for his successor following his nine-year tenure, during which he led the creation of Pandora internet radio, worked tirelessly to achieve a more sustainable music royalty structure for Pandora, oversaw Pandora's successful initial public offering in 2011 and helped position Pandora for long-term growth. Following our hiring of Mr. McAndrews, Mr. Kennedy remained employed by Pandora to assist in day-to-day royalty and licensing matters, which are important issues for our business, as well as to be available to support Mr. McAndrews' transition into the CEO role. Mr. Kennedy's employment ended in January 2014 at which time he forfeited a total of 1,181,250 unvested options. None of his options were accelerated. Because of his expertise in the areas of music royalties and licensing, we have further requested that Mr. Kennedy provide consulting services through December 2014 (subject to earlier termination by either party at any time) for a fee of $1,000 per month, but he will not vest in any stock options or receive an extension of his option exercise periods during his consulting service.

Executive Compensation Process