Exhibit 99.1

2015 Annual Stockholder Meeting

DISCLAIMER ON FORWARD - LOOKING STATEMENTS The guidance contained herein is based upon a number of assumptions and estimates that, while considered reasonable by us when taken as a whole, is inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control . In addition, the guidance is based upon specific assumptions with respect to future business conditions, some or all of which will change . The guidance, like any forecast, is necessarily speculative in nature and it can be expected that the assumptions upon which the guidance is based will not prove to be valid or will vary from actual results . Actual results will vary from the guidance and the variations may be material . Consequently, the guidance should not be regarded as a representation by us or any other person that the subscribers, revenue , adjusted EBITDA, and/or free cash flow will actually be achieved . You are cautioned not to place undue reliance on this information . This communication contains “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 . Such statements include, but are not limited to, statements about future financial and operating results, our plans, objectives, expectations and intentions with respect to future operations, products and services ; and other statements identified by words such as “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “believe,” “intend,” “plan,” “projection,” “outlook” or words of similar meaning . Such forward - looking statements are based upon the current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally beyond our control . Actual results may differ materially from the results anticipated in these forward - looking statements . 2

DISCLAIMER ON FORWARD - LOOKING STATEMENTS The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward - looking statements : • we face substantial competition and that competition is likely to increase over time ; our ability to attract and retain subscribers in the future is uncertain ; our business depends in large part upon the auto industry ; general economic conditions can affect our business ; consumer protection laws and their enforcement could damage our business ; if we fail to protect the security of personal information about our customers, we could be subject to costly government enforcement actions and private litigation and our reputation could suffer ; other existing or future government laws and regulations could harm our business ; failure of our satellites would significantly damage our business ; interruption or failure of our information technology and communications systems could negatively impact our results and our brand ; royalties for music rights have increased, there can be no assurance they will not continue to increase, and the market for music rights is changing and is subject to significant uncertainties ; the unfavorable outcome of pending or future litigation could have a material adverse effect ; we may not realize the benefits of acquisitions or other strategic initiatives ; rapid technological and industry changes could adversely impact our services ; failure of third parties to perform could adversely affect our business ; failure to comply with FCC requirements could damage our business ; we may from time to time modify our business plan, and these changes could adversely affect us and our financial condition ; we have a significant amount of indebtedness, and our revolving credit facility contains certain covenants that restrict our current and future operations ; our broadcast studios, terrestrial repeater networks, satellite uplink facilities or other ground facilities could be damaged by natural catastrophes or terrorist activities ; our principal stockholder has significant influence over our management and over actions requiring general stockholder approval and its interests may differ from the interests of other holders of our common stock ; we are a “controlled company” within the meaning of the NASDAQ listing rules and, as a result, qualify for, and rely on, exemptions from certain corporate governance requirements ; and our business may be impaired by third - party intellectual property rights . Additional factors that could cause our results to differ materially from those described in the forward - looking statements can be found in Sirius XM’s reports, including the most recent Form 10 - Q and Form 10 - K, filed with or furnished to the SEC and available at the SEC’s Internet site (http : //www . sec . gov) . The information set forth herein speaks only as of the date hereof, and we disclaim any intention or obligation to update any forward looking statements as a result of developments occurring after the date of this communication . 3

S IRIUS XM AT A GLANCE • A udio entertainment, traffic, weather, safety , security & convenience services to nearly 28 million subscribers • Over 150 channels of curated, commercial free music, talk, news and sports content • Satellite delivery provides seamless, nationwide coverage • Available over the internet and via apps for Android & iOS 4

• Growing subscriber base and high variable margins drive predictable cash flows • Factory installed in approximately 70% of new cars sold in U.S. • More than $5 billion of NOLs • Substantial capital return program UNIQUE VALUE DRIVERS 5

COMPELLING CONTENT 6

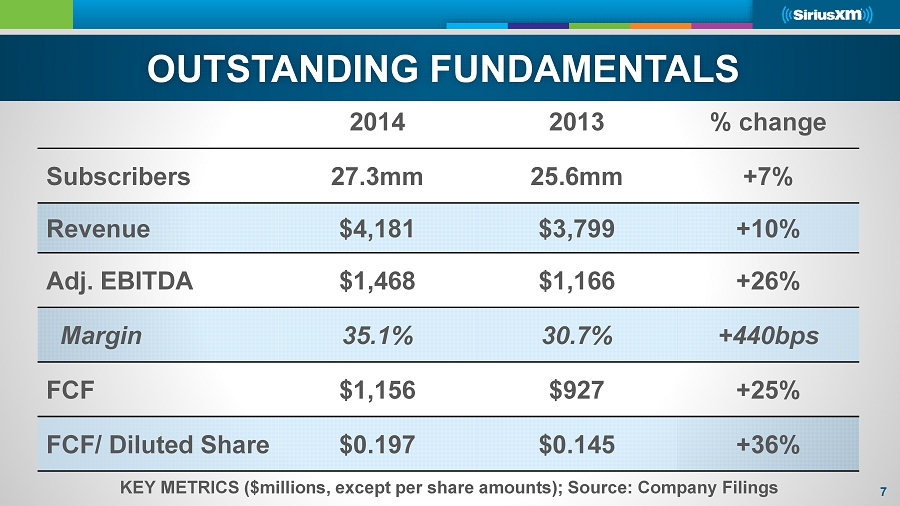

OUTSTANDING FUNDAMENTALS 2014 2013 % change Subscribers 27.3mm 25.6mm +7% Revenue $4,181 $3,799 +10% Adj. EBITDA $1,468 $1,166 +26% Margin 35.1% 30.7% +440bps FCF $1,156 $927 +25% FCF/ Diluted Share $0.197 $0.145 +36% KEY METRICS ($millions, except per share amounts); Source: Company Filings 7

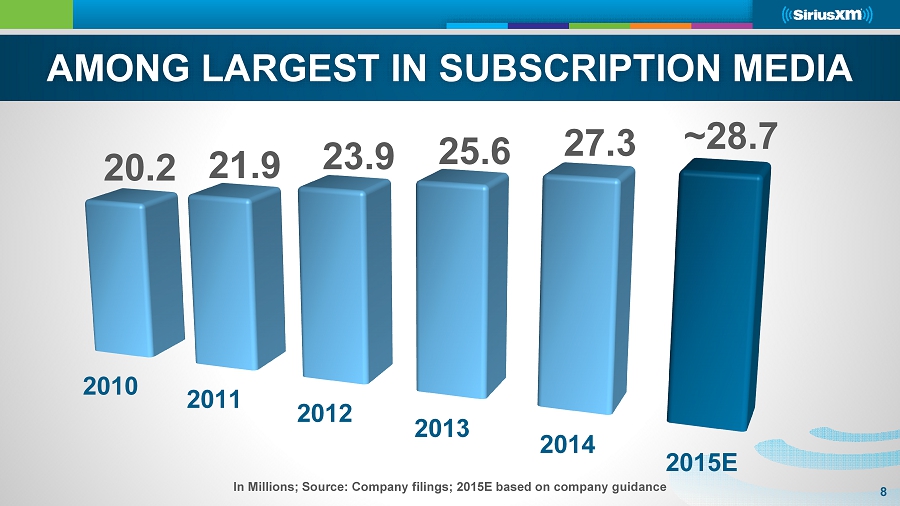

AMONG LARGEST IN SUBSCRIPTION MEDIA 2010 2011 2012 2013 2014 2015E 20.2 21.9 23.9 25.6 27.3 ~28.7 8 In Millions; Source: Company filings; 2015E based on company guidance

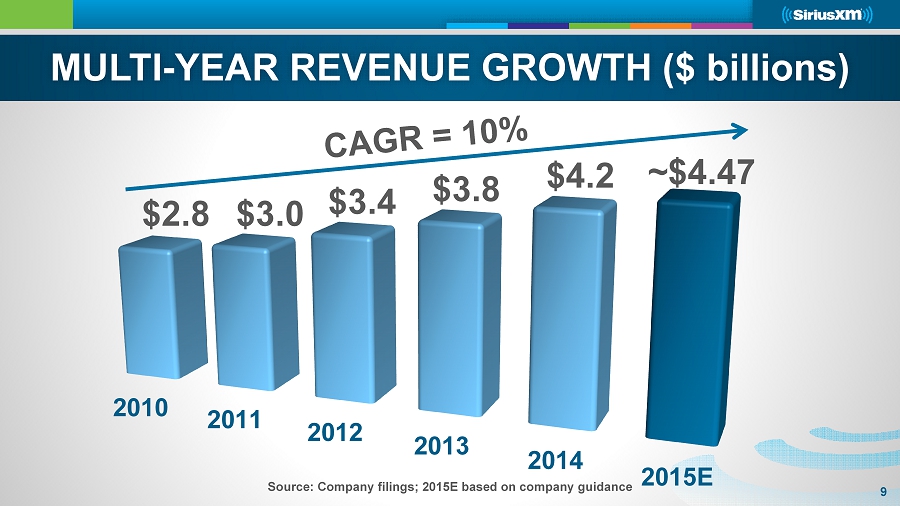

MULTI - YEAR REVENUE GROWTH ($ billions) 2010 2011 2012 2013 2014 2015E $2.8 $3.0 $3.4 $3.8 $4.2 ~$4.47 9 Source: Company filings; 2015E based on company guidance

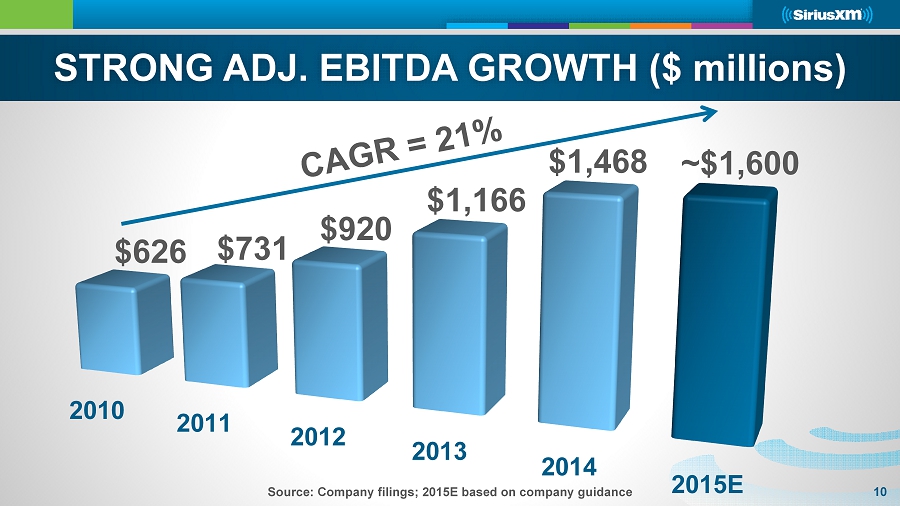

STRONG ADJ. EBITDA GROWTH ($ millions) 2010 2011 2012 2013 2014 2015E $626 $731 $920 $1,166 $1,468 ~$1,600 10 Source: Company filings; 2015E based on company guidance

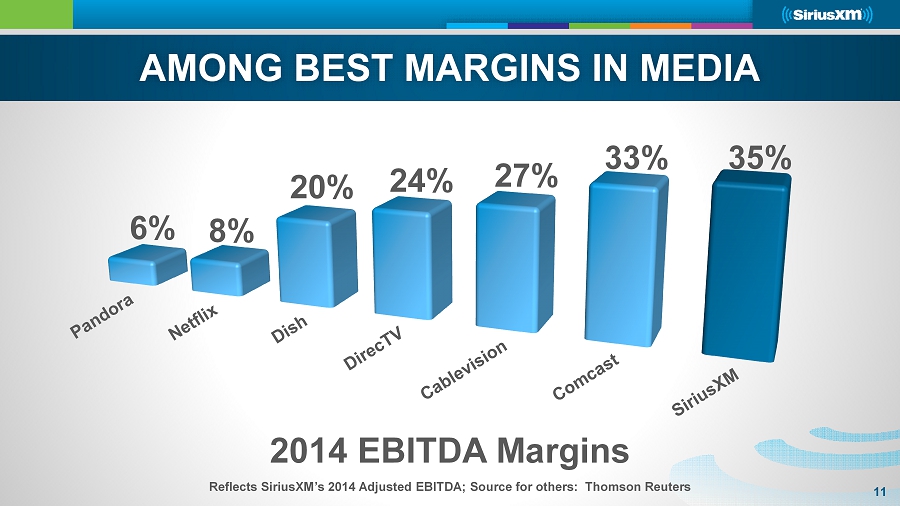

AMONG BEST MARGINS IN MEDIA 2014 EBITDA Margins Reflects SiriusXM’s 2014 Adjusted EBITDA; Source for others: Thomson Reuters 6% 8% 20% 24% 27% 33% 35% 11

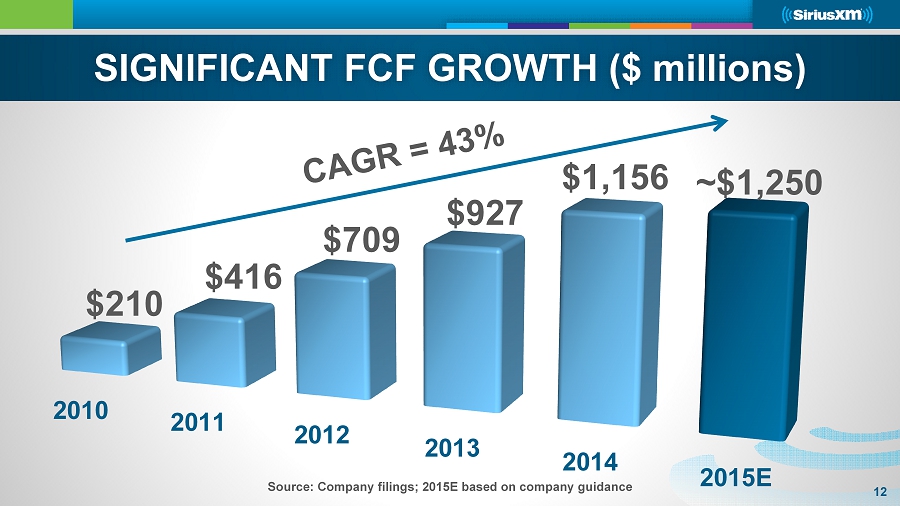

SIGNIFICANT FCF GROWTH ($ millions) 2010 2011 2012 2013 2014 2015E $210 $416 $709 $927 $1,156 ~$1,250 12 Source: Company filings; 2015E based on company guidance

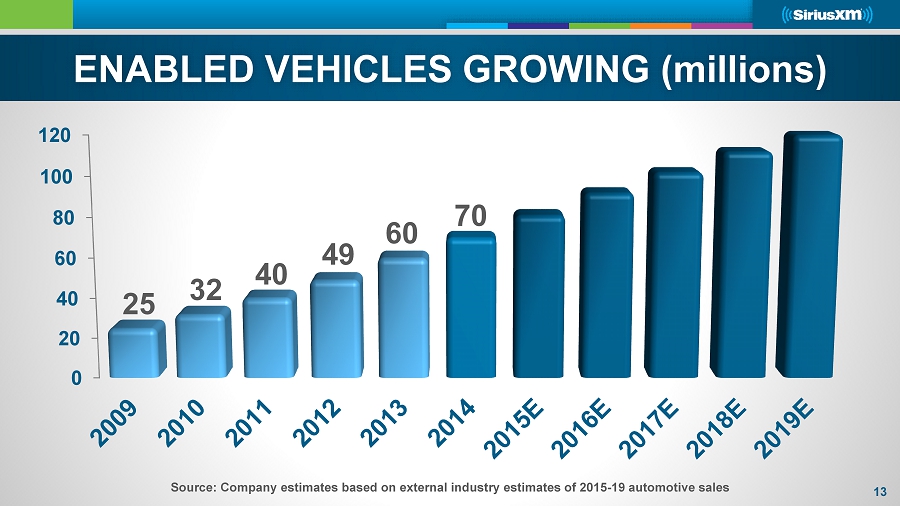

ENABLED VEHICLES GROWING (millions) Source: Company estimates based on external industry estimates of 2015 - 19 automotive sales 13 0 20 40 60 80 100 120 25 32 40 49 60 70

GROW SUBSEQUENT - OWNER ADDITIONS • The used car market is significantly larger than the new car market (nearly 3x) • Our used car penetration rate catches up with new car penetration (~70%) over time • Nearly 30% of self - pay additions now sourced from the subsequent owner market • Over 16,000 dealerships providing trials on sales • Expanding efforts to reach independent dealers & person - to - person sales 14

• Broad implementation in new vehicles will take many years • OEMs pursuing both tethered and embedded connectivity • SiriusXM has a clear strategy to maintain a dominant position in the connected car THE CONNECTED CAR IS HERE 15

• SiriusXM is a leading provider of connected vehicle services • Safety, security, & convenience features • Rapid adoption through existing OEM relationships expected to drive penetration and organic growth • Potential for new OEM relationships & global services CONNECTED CAR OPPORTUNITIES 16

• Leveraging satellite and mobile internet to create an unmatched in - vehicle experience • Enhanced consumer - facing features will provide on - demand content and customized music • Usage data will enable improved personalization, customer service, and marketing • The reason we are paid: winning value proposition and ease - of - use WHAT’S NEXT? SXM17 17

New Mobile App 18 • P ersonalized user experience • Better performance • I n - app social features • New search functions to discover more content

• Long - term growth prospects • Enabled vehicles 73m estimated 140m by 2022 • Strong business model • Unbeatable content + ease of use • Steady fixed costs • High variable margins • Low capex and taxes • Strong free cash flow BEST - IN - CLASS BUSINESS MODEL 19

CAPITAL RETURN PROGRAM • Supported by strong free cash flow generation • $ 6 billion common stock repurchase authorization • Since inception: • 1.4 billion shares repurchased for $ 5 billion through April 24, 2015 20

Appendix: Reconciliations

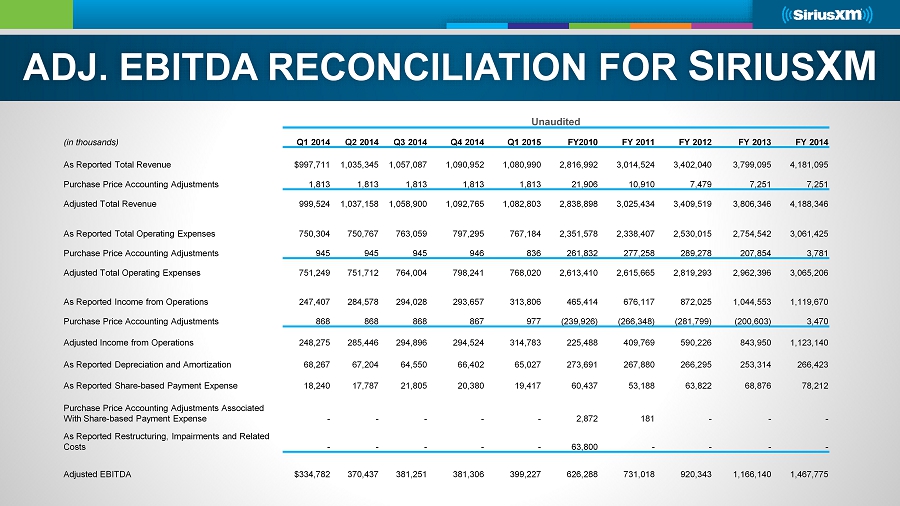

ADJ. EBITDA RECONCILIATION FOR S IRIUS XM Unaudited (in thousands) Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 FY2010 FY 2011 FY 2012 FY 2013 FY 2014 As Reported Total Revenue $997,711 1,035,345 1,057,087 1,090,952 1,080,990 2,816,992 3,014,524 3,402,040 3,799,095 4,181,095 Purchase Price Accounting Adjustments 1,813 1,813 1,813 1,813 1,813 21,906 10,910 7,479 7,251 7,251 Adjusted Total Revenue 999,524 1,037,158 1,058,900 1,092,765 1,082,803 2,838,898 3,025,434 3,409,519 3,806,346 4,188,346 As Reported Total Operating Expenses 750,304 750,767 763,059 797,295 767,184 2,351,578 2,338,407 2,530,015 2,754,542 3,061,425 Purchase Price Accounting Adjustments 945 945 945 946 836 261,832 277,258 289,278 207,854 3,781 Adjusted Total Operating Expenses 751,249 751,712 764,004 798,241 768,020 2,613,410 2,615,665 2,819,293 2,962,396 3,065,206 As Reported Income from Operations 247,407 284,578 294,028 293,657 313,806 465,414 676,117 872,025 1,044,553 1,119,670 Purchase Price Accounting Adjustments 868 868 868 867 977 (239,926) (266,348) (281,799) (200,603) 3,470 Adjusted Income from Operations 248,275 285,446 294,896 294,524 314,783 225,488 409,769 590,226 843,950 1,123,140 As Reported Depreciation and Amortization 68,267 67,204 64,550 66,402 65,027 273,691 267,880 266,295 253,314 266,423 As Reported Share - based Payment Expense 18,240 17,787 21,805 20,380 19,417 60,437 53,188 63,822 68,876 78,212 Purchase Price Accounting Adjustments Associated With Share - based Payment Expense - - - - - 2,872 181 - - - As Reported Restructuring, Impairments and Related Costs - - - - - 63,800 - - - - Adjusted EBITDA $334,782 370,437 381,251 381,306 399,227 626,288 731,018 920,343 1,166,140 1,467,775

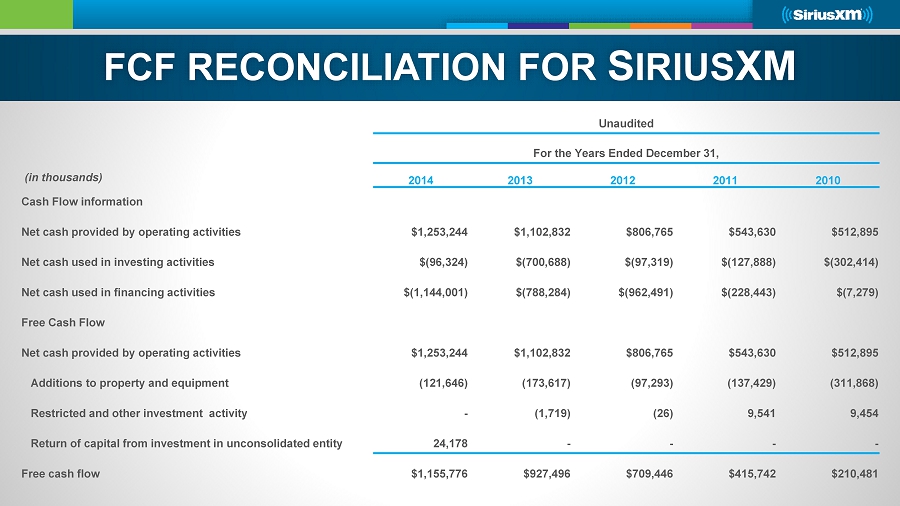

Unaudited For the Years Ended December 31, (in thousands) 2014 2013 2012 2011 2010 Cash Flow information Net cash provided by operating activities $1,253,244 $1,102,832 $806,765 $543,630 $512,895 Net cash used in investing activities $(96,324) $(700,688) $(97,319) $(127,888) $(302,414) Net cash used in financing activities $(1,144,001) $(788,284) $(962,491) $(228,443) $(7,279) Free Cash Flow Net cash provided by operating activities $1,253,244 $1,102,832 $806,765 $543,630 $512,895 Additions to property and equipment (121,646) (173,617) (97,293) (137,429) (311,868) Restricted and other investment activity - (1,719) (26) 9,541 9,454 Return of capital from investment in unconsolidated entity 24,178 - - - - Free cash flow $1,155,776 $927,496 $709,446 $415,742 $210,481 FCF RECONCILIATION FOR S IRIUS XM

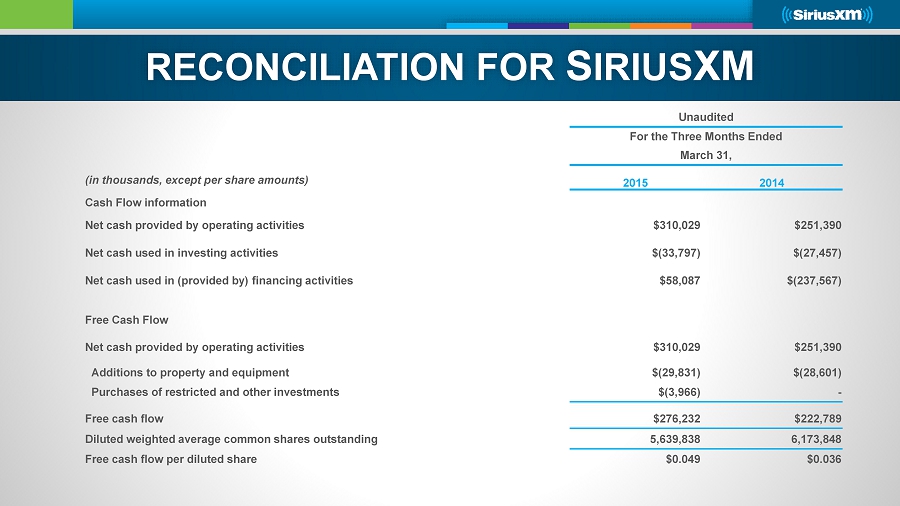

Unaudited For the Three Months Ended March 31, (in thousands, except per share amounts) 2015 2014 Cash Flow information Net cash provided by operating activities $310,029 $251,390 Net cash used in investing activities $(33,797) $(27,457) Net cash used in (provided by) financing activities $58,087 $(237,567) Free Cash Flow Net cash provided by operating activities $310,029 $251,390 Additions to property and equipment $(29,831) $(28,601) Purchases of restricted and other investments $(3,966) - Free cash flow $276,232 $222,789 Diluted weighted average common shares outstanding 5,639,838 6,173,848 Free cash flow per diluted share $0.049 $0.036 RECONCILIATION FOR S IRIUS XM