Annual Meeting of Stockholders

MAY 27, 2009

Disclaimer on forward-looking statements

The guidance contained herein are based upon a number of assumptions and estimates that, while considered reasonable by us when taken as a whole, are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, the guidance is based upon specific assumptions with respect to future business conditions, some or all of which will change. The guidance, like any forecast, is necessarily speculative in nature and it can be expected that the assumptions upon which the guidance is based will not prove to be valid or will vary from actual results. Actual results will vary from the guidance and the variations may be material. Consequently, the guidance should not be regarded as a representation by us or any other person that the subscribers, synergies, revenue, and adjusted EBITDA will actually be achieved. You are cautioned not to place undue reliance on this information.

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about the benefits of the business combination transaction involving SIRIUS and XM, including potential synergies and cost savings and the timing thereof, future financial and operating results, the combined company’s plans, objectives, expectations and intentions with respect to future operations, products and services; and other statements identified by word such as “will likely result,” “are expected to,” “anticipate,” “believe,” “plan,” “estimate,” “intend,” “will,” “should,” “may,” or words of similar meaning. Such forward-looking statements are based upon the current beliefs and expectations of SIRIUS’ and XM’s management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally beyond the control of SIRIUS and XM. Actual results may differ materially from the results anticipated in these forward-looking statements.

The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statement: our substantial indebtedness; the businesses of SIRIUS and XM may not be combined successfully, or such combination may take longer, be more difficult, time-consuming or costly to accomplish than expected; the useful life of our satellites; our dependence upon automakers and other third parties; our competitive position versus other forms of audio and video entertainment; and general economic conditions. Additional factors that could cause SIRIUS’ and XM’s results to differ materially from those described in the forward-looking statements can be found in SIRIUS’ Annual Report on Form 10-K for the year ended December 31, 2008 and XM’s Annual Report on Form 10-K for the year ended December 31, 2008, which are filed with the Securities and Exchange Commission (the “SEC”) and available at the SEC’s internet site (http://www.sec.gov). The information set forth herein speaks only as the date hereof, and SIRIUS and XM disclaim any intention or obligation to update any forward looking statements as a result of developments occurring after the date of this communication.

Corporate Priorities

Obtain license

1990-1997

< 1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009 >

Corporate Priorities

Develop radio chipsets

and launch satellites

2000-2001

< 1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009 >

Corporate Priorities

Develop content and

auto arrangements

2000-2004

< 1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009 >

Corporate Priorities

Rapidly build subscriber base

2003-2007

< 1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009 >

Corporate Priorities

Complete merger

February 2007 - July 2008

< 1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009 >

Corporate Priorities

Cut costs

2008-2009

< 1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009 >

Corporate Priorities

Focus on cash flow

2009 and beyond

< 1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009 >

Complete Diverse Programming

Over 85 Channels of Commercial-Free Music

Live Coverage of Every Major Sport

The Best in News, Talk and Entertainment

Social Media to Drive

Subscriber Growth and Interaction

Twitter, MySpace, YouTube, Facebook

Tiered Selling Began Seven Months Ago

No price alternatives prior to merger

No base price increase before August 2011

“Best of Package”

SIRIUS

XM

Total

$9.99 packages

A la carte

544 k

204 k

748 k

97 k

4 k

Source: Company reports as of 5/17/09

Operating Costs Improve Across the Board

Programming and content

Satellite and transmission

General and administrative

10%

23%

32%

Source: Company reports

Operating Costs Improve Across the Board

Sales and marketing

Engineering, Design

& Development

Subscriber acquisition

costs

36%

48%

48%

Source: Company reports

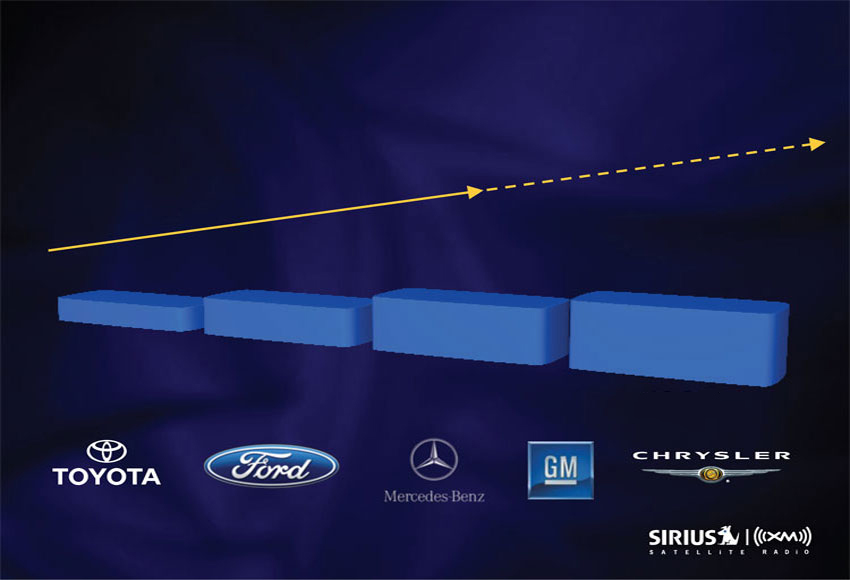

Penetration Gains at Every Major Automaker

Combined OEM penetration as

a percentage of U.S. auto sales

22%

33%

45%

53%

2006

2007

2008

1Q09

Source: Company reports

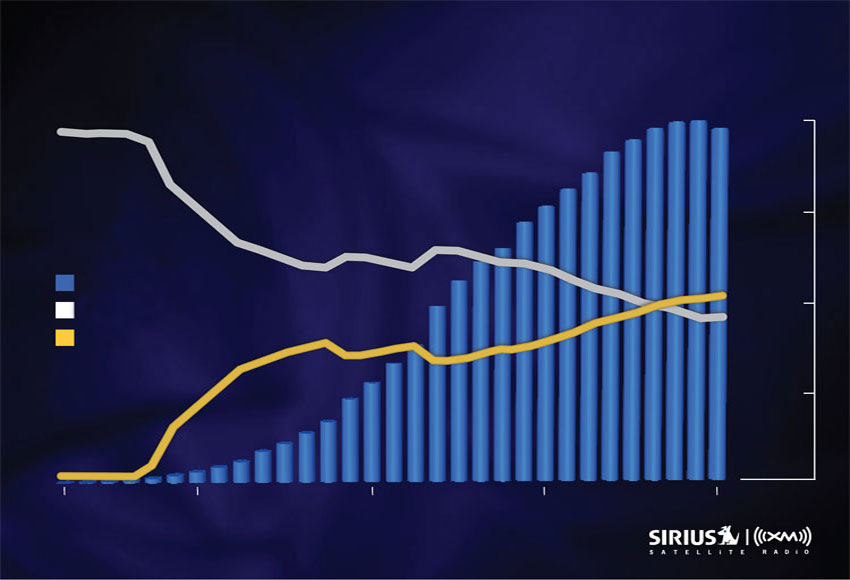

Subscriber Growth Shifts to OEM

100%

19

mm

15

mm

10

mm

5

mm

79%

61%

55%

54%

45%

46%

39%

21%

Subscribers

% Retail

% OEM

0%

2001

2002

2004

2007

2009

Source: Company reports

Portable Radios + MP3

Portable Stiletto 2

Portable XMp3

Introduced Interoperable and a la Carte Radios

MiRGE Radio

Starmate 5

Dock & Play Radio

Certified Preowned Program (CPO)

Launched with Honda, GM, Acura, Volvo,

Porsche, Volkswagen and Ford (regional)

4 additional programs to be launched soon

Low subscriber acquisition costs

Launching Apple iPhone/iPod Touch and

Smart Phone Applications

Focus on EBITDA / FCF

Will Impact Subscriber Growth

Streaming now $2.99 / month vs. free

Family plan now $8.99 / month vs. $6.99 / month

Content cost control

Improved OEM & Retail contracts

OEM penetration adjustments

Channel rationalization

Focus on Profitable Growth

Sample High

Sample Low

Converting Vehicle Converting Vehicle

Conversion Rate

70%

30%

SAC payback months

12

29

Source: SIRIUS XM estimates based on select sample data

Focus on Churn Management

4 - 5%

4.20%

2.20%

1.83%

1.33%

HBO/

Showtime/

Starz

Netflix

SIRIUS|XM

Dish

DTV

Source: Company reports and estimates

Growth Statistics and Improvements

PF 1Q08

PF 1Q09

% Improvement

Adjusted EBITDA

($70) mm

$109 mm

NMF

Subscribers

Revenue

Cash operating

expenses

17.9 mm

$579 mm

$649 mm

18.6 mm

$606 mm

$497 mm

(23%)

5%

3%

Source: Most recent Sirius XM 10Q filing. Figures are pro forma

SIRIUS XM is Now a Cash Flow Growth Story

($61) mm

($37) mm

$32 mm

$109 mm

2Q08

3Q08

4Q08

1Q09

Pro Forma Adj. EBITDA

Source: Company reports

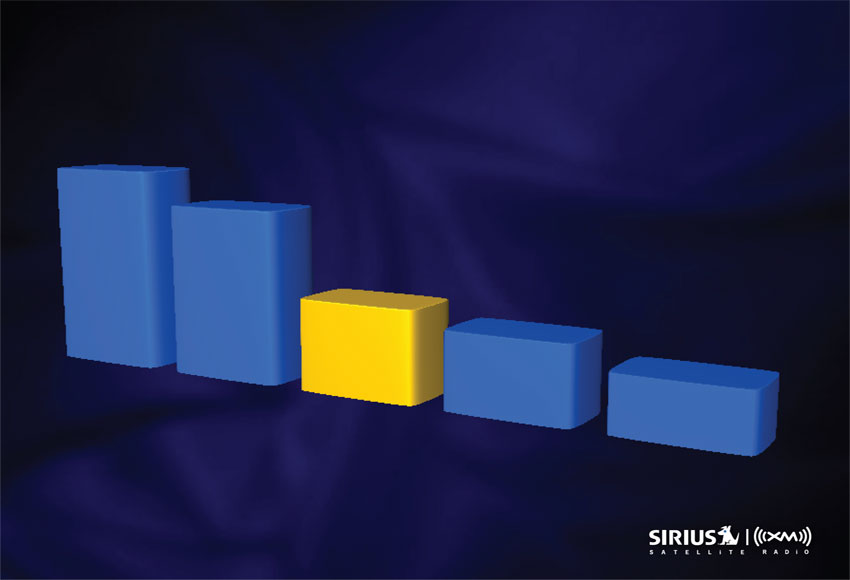

SIRIUS XM is Now the Largest Radio

Company based on First Quarter Revenue

(-24%)

$55

(-21%)

$75

(-23%)

$76

(-23%)

$159

(-29%)

$260

(-22%)

$604

(+5%)

$606

Cumulus

Entercom

Cox Radio

Citadel

CBS Radio

Clear Channel

SIRIUS|XM

1Q09 Radio Revenue (% change versus 1Q08)

Source: Company reports

Adjusted EBITDA: Change in First Quarter

Versus Year Ago

($11)

Cumulus

($14)

Entercom

($17)

Cox Radio

($25)

Citadel

($70)

CBS Radio

($136)

Clear Channel

$179

SIRIUS|XM

Source: Company reports

Internet Radio Searches for Business Model

$2.4 B

<$25 M

<$100 M

<$100 M

$161 M

Pandora

lastFM.com

Slacker

Rhapsody/

RadioPass

SIRIUS XM

|

2008 Revenue

Source: Company reports and estimates

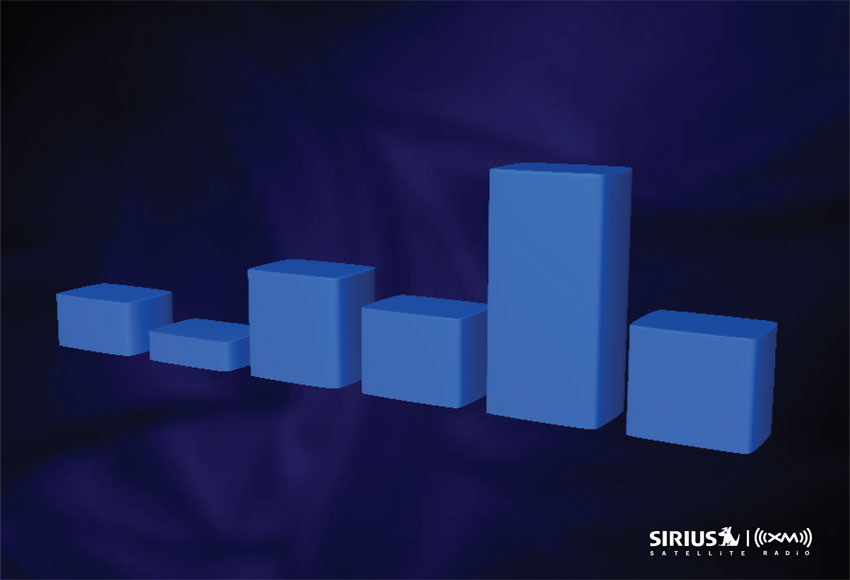

Pro Forma Adjusted EBITDA: Now Expecting

More than $350 mm in 2009

Above

$350 mm

($136) mm

($679) mm ($566) mm

($971) mm

2005

2006

2007

2008

2009

Guidance increased from more than $300 mm

Source: Company reports

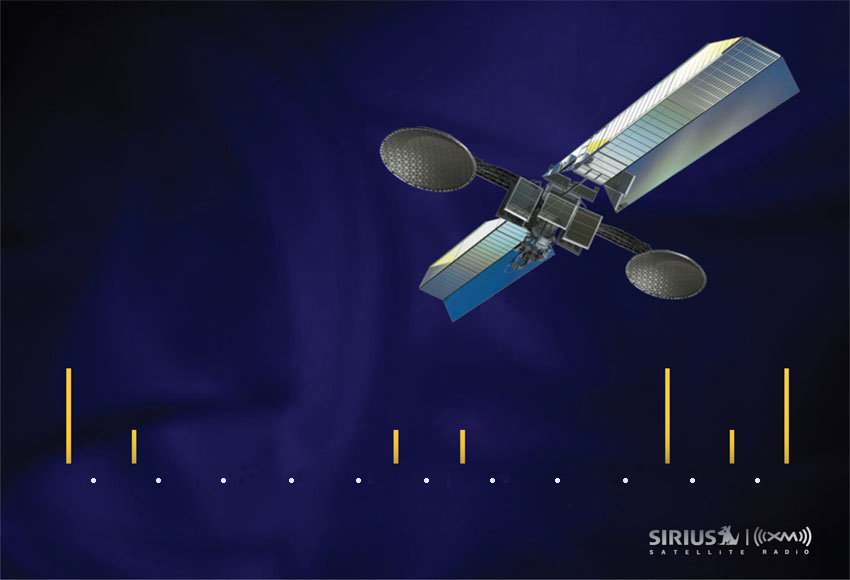

Satellite Expenditures

Sharply Reduced After 2011

SIRIUS

1, 2, & 3

XM

1 & 2

XM

3

XM

4

SIRIUS

5

SIRIUS

6

XM

5

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

LAUNCH DATE

Completed Refinancing

Firm plan to meet all 2009 / 2010 maturities

Liberty Media committed to $530 mm,

received a 40% equity stake

Bank debt renewed and extended

Debt Maturities ($ millions)

$339

$180

$632

$485

$1,279

$555

2009

2010

2011

2012

2013

2014

Source: Company reports

Strong Market Value

SIRIUS|XM is the 140th most valuable

company on NASDAQ (out of nearly

3,000 companies)

Other companies with similar valuations:

DreamWorks and Netflix

Source: NASDAQ as of May 20, 2009

Improved Market Value

$457 Million

12/18/08

$2.3 Billion

Up 393%

5/22/09

Source: NASDAQ and company reports

Highlights of the Past Year

Closed merger (17 months)

Refinanced $2.2 billion of $3.3 billion debt

Seamless integration

Achieved more synergies

Introduced and successfully marketed

tiered pricing

Highlights of the Past Year continued

Initiated preowned certified programs

Achieved first positive Pro Forma Adj.

EBITDA quarter in 4Q08: +$32 m vs.

($224) m in 4Q07

Strong Pro Forma Adj. EBITDA Growth

in 1Q09 to $109 m vs. ($70) m in 1Q08

Near Term Concerns

U.S. auto sales

Churn

Debt

Management Priorities

Grow revenue

Manage churn

Continue cost reductions

Position for auto rebound

Expand new platforms

Manage balance sheet

Cash flow growth

Everything Worth Listening To

Is Now On

We refer to net loss before interest and investment income, interest expense net of amounts capitalized, income tax expense, loss from redemption of debt, loss on investments, other expense (income), restructuring and related cost, depreciation and amortization, and share related payment expense as adjusted EBITDA. Adjusted EBITDA is not a measure of financial performance under U.S. GAAP. We believe adjusted EBITDA is a useful measure of our operating performance. We use adjusted EBITDA for budgetary and planning purposes; to assess the relative profitability and on-going performance of our consolidated operations; to compare our performance from period-to-period; and to compare our performance to that of our competitors. We also believe adjusted EBITDA is useful to investors to compare our operating performance to the performance of other communications, entertainment and media companies. We believe that investors use current and projected adjusted EBITDA to estimate our current or prospective enterprise value and to make investment decisions.

Because we fund and build-out our satellite radio system through the periodic raising and expenditure of large amounts of capital, our results of operations reflect significant charges for interest and depreciation expense. We believe adjusted EBITDA provides useful information about the operating performance of our business apart from the costs associated with our capital structure and physical plant. The exclusion of interest and depreciation and amortization expense is useful given fluctuations in interest rates and significant variation in depreciation and amortization expense that can result from the amount and timing of capital expenditures and potential variations in estimated useful lives, all of which can vary widely across different industries or among companies within the same industry. We believe the exclusion of taxes is appropriate for comparability purposes as the tax positions of companies can vary because of their differing abilities to take advantage of tax benefits and because of the tax policies of the various jurisdictions in which they operate. We believe the exclusion of restructuring and related costs is useful given the non-recurring nature of these transactions. We also believe the exclusion of share-based payment expense is useful given the significant variation in expense that can result from changes in the fair market value of our common stock. To compensate for the exclusion of taxes, other income (expense), depreciation and amortization and share-based payment expense, we separately measure and budget for these items.

There are material limitations associated with the use of adjusted EBITDA in evaluating our company compared with net loss, which reflects overall financial performance, including the effects of taxes, other income (expense), depreciation and amortization, restructuring and related costs, and share-based payment expense. We use adjusted EBITDA to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. Investors that wish to compare and evaluate our operating results after giving effect for these costs, should refer to net loss as disclosed in our unaudited condensed consolidated statements of operations. Since adjusted EBITDA is a non-GAAP financial measure, our calculation of adjusted EBITDA may be susceptible to varying calculations; may not be comparable to other similarly titled measures of other companies; and should not be considered in isolation, as a substitute for, or superior to measures of financial performance prepared in accordance with GAAP. Please see our most recent filings on Form 10-Q and Form 10-K for additional information.

The following tables reconcile our GAAP income (loss) from operations to our non-GAAP pro forma unadjusted income (loss) from operations.

As Reported

Income (Loss)

from Operations

Predecessor

Financials

Purchase Price

Accounting

Adjustments

Pro Forma

Income (Loss)

from Operations

As Reported

Income (Loss)

from Operations

Predecessor

Financials

Purchase Price

Accounting

Adjustments

Pro Forma

Income (Loss)

from Operations

2005

(829)

(556)

-

(1,385)

2006

(1,068)

(403)

-

(1,471)

2007

(513)

(512)

-

(1,025)

2008

(5,037)

(231)

4,750

(517)

4Q07

(150)

(202)

-

(352)

1Q08

(89)

(93)

-

(182)

2Q08

(68)

(83)

-

(151)

3Q08

(4,827)

(54)

4,743

(138)

4Q08

(53)

-

7

(46)

1Q09

41

-

(6)

35